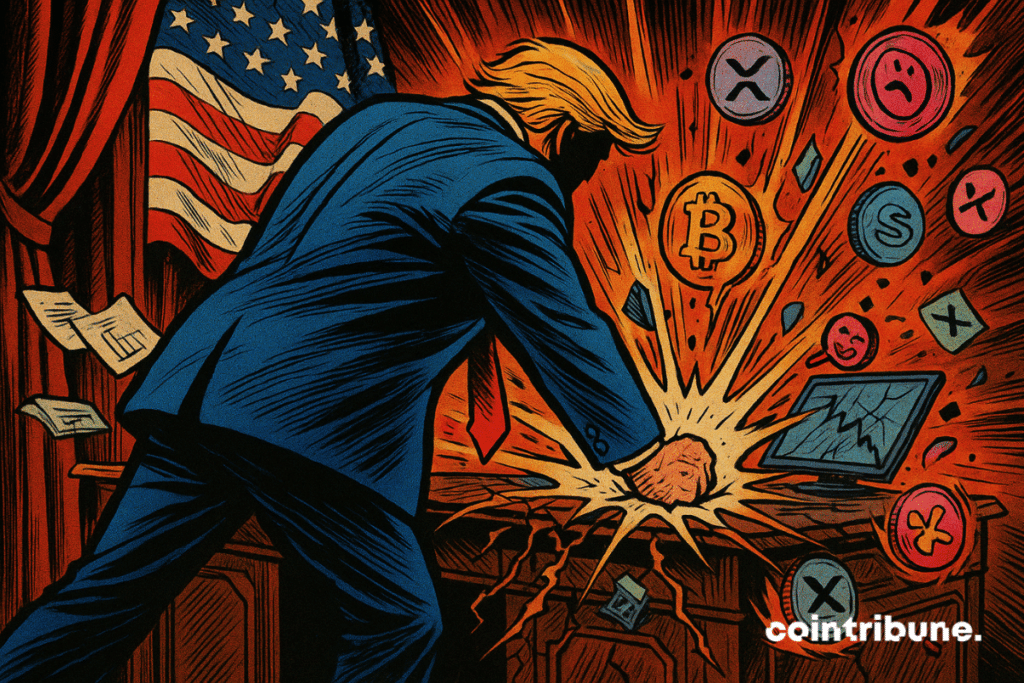

Trump’s China Software Tariffs Hit Crypto Markets Hard

On October 10, a radical decision by Donald Trump, 100 % tariffs on Chinese software, triggered an unprecedented storm. Within hours, bitcoin collapsed, more than 16 billion dollars evaporated, and 1.6 million traders liquidated positions.

In brief

- On October 10, Donald Trump announces 100 % tariffs on Chinese software, triggering an immediate shockwave.

- The crypto market collapses, Bitcoin down 8.4 %, more than 16 billion dollars of positions liquidated.

- 1.6 million traders are affected, and some platforms record record losses in a few hours.

- Rumors mention an anonymous trader who earned $88M just before the crash, fueling manipulation suspicions.

A political announcement, billions vanished

President Donald Trump triggered a real financial earthquake this Friday by announcing new 100 % tariffs on imports of critical Chinese software.

“Starting November 1, we are imposing 100% tariffs on all imports of critical software from China”, he declared. The announcement comes amid rising tensions over rare earths and strategic technologies, with the United States responding to Chinese restrictions on technology exports. This message, broadcast at a time of heavy stock market activity, immediately triggered a domino effect on global financial markets.

The reaction in the crypto market was brutal and almost instantaneous. Within hours, the entire ecosystem was swept away by a wave of forced liquidations of historic scale. Here are the important facts of this rout :

- Bitcoin dropped 8.4 %, settling at $104,782, just days after an all-time high ;

- Altcoins recorded losses between 20 % and 40 % in a single trading day ;

- More than 16 billion dollars of long positions were liquidated ;

- Nearly 1.6 million traders were hit by liquidations across all platforms ;

- On Hyperliquid, one of the most active derivatives exchanges, 6,300 wallets were affected, causing $1.2 billion in losses.

A U.S. trade policy announcement had never caused such an effect in the crypto sector. The speed of the fall, combined with the leverage widely used by investors, turned a macroeconomic event into a technical carnage. The market, overheated by bitcoin’s recent rise, collapsed, revealing once again the structural fragility of an ecosystem still heavily dependent on emotions and political decisions.

The shadow of manipulation hangs over the crash

Suspicions arise on social media and in several crypto analysis circles. According to some information, an anonymous trader made 88 million dollars in less than 30 minutes thanks to bitcoin just before Trump’s announcement.

Other, more speculative rumors mention a whale that doubled its short position half an hour before the presidential statement, potentially cashing in more than 200 million dollars in gains. For now, no formal evidence identifies the entity behind these moves or confirms any insider trading. The analyzed on-chain data remains incomplete and open to interpretation.

Beyond these accusations, some analysts propose less sensational structural explanations. According to several specialists, the movement could have been amplified by high-frequency trading algorithms, triggering automatic orders at the first corrections. The snowball effect, combined with reduced liquidity in some markets, then caused a chain of forced liquidations, without the need to resort to manipulation theories. Early warning signals on derivatives markets were minimal and did not clearly indicate the magnitude of the forthcoming shock.

This October 10 shock, which led to a drop in bitcoin price, reveals the extreme sensitivity of the crypto market to geopolitical instabilities. While some see a healthy purge, others denounce a panic amplified by algorithms and leverage effects. In the absence of evidence of manipulation, the episode leaves room for uncertainty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.