VanEck Sees Q1 2026 Turning Point for Risk Assets as Policy Clarity Returns

Investment firm VanEck expects the first quarter of 2026 to favor risk assets, citing clearer fiscal policy, steadier monetary signals, and renewed interest across several major investment themes. After years of uncertainty, improved visibility is shaping how investors position their portfolios heading into the new year.

In brief

- VanEck says clearer fiscal policy and steadier rate signals are restoring investor confidence across crypto, AI, gold, and credit.

- AI assets look more attractive after 2025 pullbacks, with selective exposure favored as infrastructure demand reshapes risk dynamics.

- Gold demand remains strong amid central bank buying, while India stands out as a long-term growth opportunity driven by reforms.

- Bitcoin’s cycle appears less predictable after 2025, though long-term projections remain bullish despite near-term volatility.

Clearer Fiscal Signals and Rate Stability Boost Investor Confidence, Says VanEck

In a post on X, VanEck said markets are operating with a level of clarity not seen in years. Analysts pointed to more defined government spending plans, fewer policy surprises, and increasingly predictable interest-rate expectations. Together, these factors are allowing investors to reassess opportunities across artificial intelligence, private credit, gold, India, and cryptocurrency.

Following a sharp pullback late in 2025, AI-related assets now appear more attractive. VanEck mentioned that sector-wide corrections have created better entry points for medium-term investors. Interest in AI infrastructure—particularly areas such as nuclear power—has intensified. And as such, this has shifted the risk-reward balance toward selective exposure rather than broad-based speculation.

Improving U.S. government finances have also supported market sentiment. VanEck referenced Treasury Secretary Scott Bessent’s description of current interest rates as “normal”, a signal that abrupt policy shifts may be less likely in 2026. More moderate policy changes and lower volatility are helping markets price risk more confidently.

Private credit has also regained investor attention after a difficult 2025, especially within business development companies. While yields remain elevated, much of the sector’s credit risk is already reflected in valuations. As a result, VanEck views private credit as more attractive than it was a year ago.

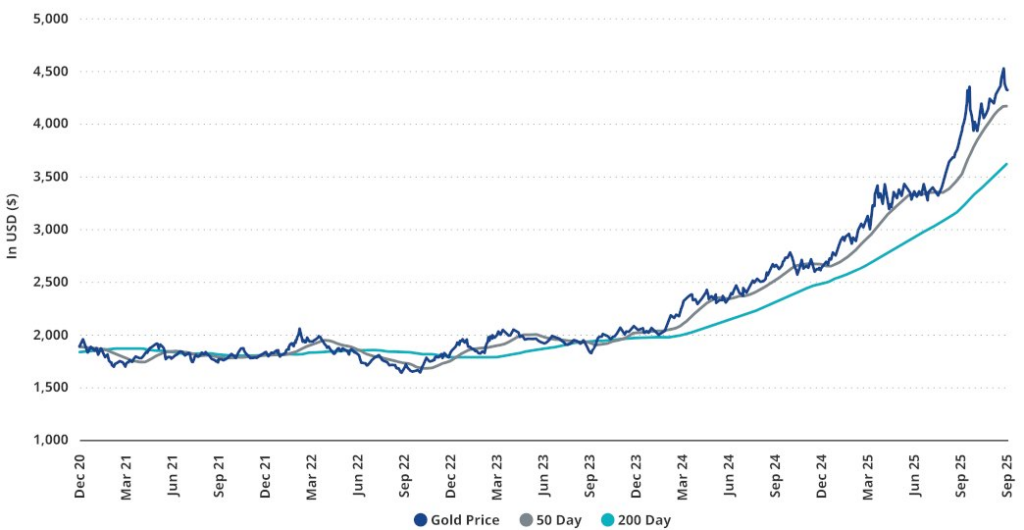

Gold Pullbacks Attract Buyers as Bitcoin Adjusts to New Market Cycle

Gold continues to strengthen its role as a reserve asset. Sustained central bank demand and a gradual move away from reliance on the U.S. dollar have reinforced gold’s appeal as a global store of value.

Although some technical indicators suggest overextension, price pullbacks continue to attract buyers. India was also highlighted as a high-conviction, long-term opportunity, supported by structural reforms, favorable demographics, and steady economic growth.

VanEck’s key investment themes include:

- A risk-on environment supported by clearer fiscal and monetary policy.

- AI and related infrastructure following a valuation reset.

- Private credit offering attractive yields after market corrections.

- Gold benefiting from central bank demand and declining dollar dominance.

- India positioned for sustained long-term growth through reforms.

Despite the optimistic outlook, opinions on Bitcoin remain divided within the firm. Analysts cautioned that the traditional four-year Bitcoin cycle appeared to break down in 2025, making short-term signals less reliable. VanEck expects choppier price action over the next three to six months as market dynamics adjust.

Some executives take a more constructive view. Matthew Sigel and David Schassler were cited as having greater confidence in Bitcoin’s near-term cycle, even as others remain cautious. VanEck also noted that Bitcoin has recently decoupled from equities and gold following a major deleveraging event in October.

VanEck Says Bitcoin Could Reach $2.9M by 2050 as Adoption Expands

Earlier research from the firm remains bullish over the long term. VanEck has previously projected that Bitcoin could reach $2.9 million by 2050 if it captures a meaningful share of global trade settlements and central bank reserves.

External analysts echoed a more measured, medium-term perspective. Justin d’Anethan of Arctic Digital explained that recent price action reflects healthier market conditions. And gains are forming in a low-leverage environment. He noted that last year’s excess speculation has largely faded, leading to more grounded expectations across the market.

While geopolitical tensions and potential friction with U.S. policymakers could have weighed on assets, broader risk appetite has helped crypto regain momentum. Tim Sun of HashKey Group noted that adjustments made in late 2025 have created a clearer path into early 2026, positioning Bitcoin and other cryptocurrencies to benefit. Crypto investor Will Clemente added that the current environment closely aligns with Bitcoin’s original purpose.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.