Xinjiang Bitcoin Mining Crackdown Claims Fall Short of Hashrate Data

Reports of a renewed crackdown on Bitcoin mining in China’s Xinjiang region triggered concern across crypto markets this week. Early claims warned of severe hashrate losses and widespread shutdowns. Mining data reviewed after the initial reaction suggests, however, that the impact was brief and far smaller than first reported.

In brief

- Bitcoin hashrate fell briefly after Xinjiang reports, but data shows losses were far smaller and recovery across major pools was quick.

- Net hashrate declined by nearly 20 EH/s, well below early claims of 100 EH/s tied to a major China mining shutdown.

- North American pools, led by Foundry USA, saw the sharpest drops, pointing to U.S. power curtailments as a major factor.

- Despite China’s 2021 ban, mining activity linked to Xinjiang persists due to cheap energy and unused data center capacity.

Bitcoin Hashrate Dip Far Smaller Than Early Xinjiang Claims, Data Shows

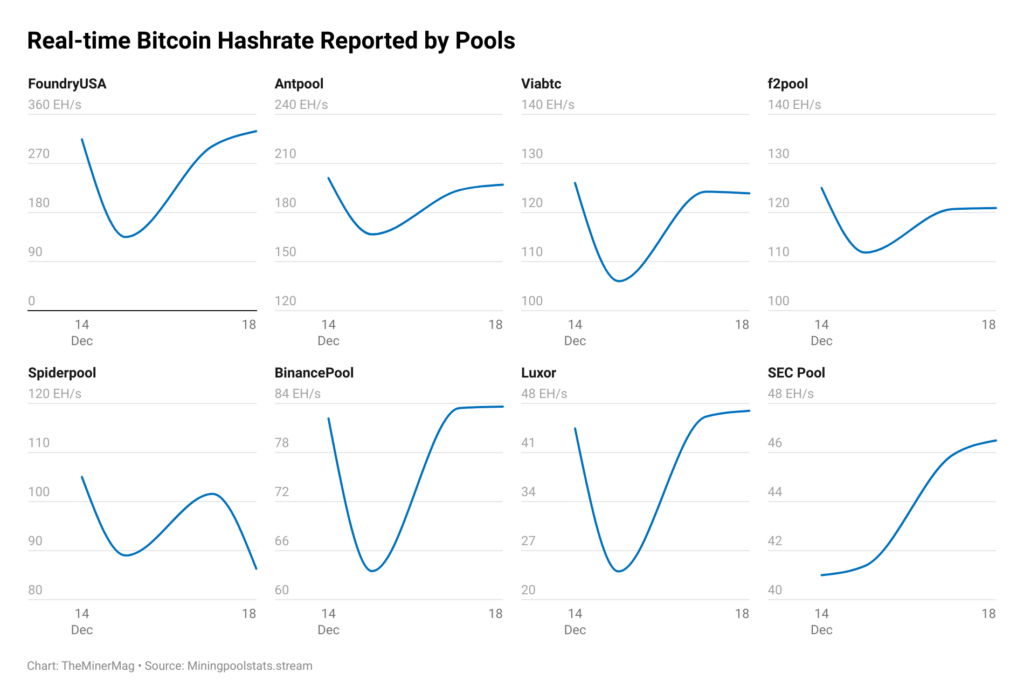

Data from TheMinerMag shows that while Bitcoin’s hashrate did dip, early claims overstated both the scale and the cause. Initial reactions centered on Xinjiang, while later evidence pointed to a mix of factors, including temporary power limits in the United States.

In its latest Miner Weekly report, TheMinerMag noted that Bitcoin’s total hashrate fell shortly after reports of shutdowns in Xinjiang surfaced. The drop fueled fears of a major regional disruption. Recovery followed quickly, with most large mining pools returning close to previous levels within days.

Rather than the widely cited 100 exahashes per second (EH/s) loss, the data points to a net decline of around 20 EH/s. This pattern indicates a short-lived interruption rather than a sustained, region-specific shutdown. And for Bitcoin, the difference matters. Prolonged declines in hashrate can slow block production and affect mining difficulty, while brief dips typically have a limited effect.

Mining Data Shows Fast Recovery After Brief Global Hashrate Dip

Pool-level data adds another layer of context to the Xinjiang-focused narrative. North American pools recorded the steepest losses during the same period. Foundry USA alone reported an estimated 180 EH/s drop, pointing to power curtailments outside China as a key factor.

Chinese-origin pools did register combined declines of about 100 EH/s. Even so, analysts caution against attributing all of that to Xinjiang. Activity shifted unevenly across pools, making a single-cause explanation unlikely.

Key takeaways from the hashrate data include:

- A short-term hashrate dip followed by a fast recovery.

- A net loss closer to 20 EH/s, not 100 EH/s.

- The largest pool-level declines occurred in North America.

- Chinese pools recorded mixed and uneven reductions.

- No evidence of a sustained, nationwide shutdown.

Questions about China’s role resurfaced after Jianping Kong, a former Canaan executive, said some Xinjiang operations had stopped. Crypto commentator Kevin Zhang estimated that roughly 2 gigawatts of mining capacity went offline.

Early social media posts suggested that as many as 500,000 machines were affected, but later analysis pointed to narrower compliance or operational issues rather than broad enforcement.

Bitcoin mining activity linked to China has gradually returned since the 2021 nationwide ban. Data from CryptoQuant suggest China may now account for 15% to 20% of global mining activity, making it the world’s third-largest Bitcoin miner.

Xinjiang remains attractive due to low-cost energy and large data center investments. Some local facilities reportedly lease unused capacity to miners to offset demand swings from other computing services. Together, these factors help explain why mining activity in the region persists despite periodic disruptions and renewed scrutiny.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.