Ethereum Pulls Back, But ETFs See Record Inflows

The euphoria around Ethereum had regained momentum: the $4,200 mark was crossed, quickly followed by an attempt towards $4,300. Facing this rebound, the crypto market was again shaken by fierce volatility. Yet, behind the turmoil, a strong trend emerges: institutional investors are flocking to spot ETFs, rekindling interest in ETH and reviving hope for a lasting recovery.

In brief

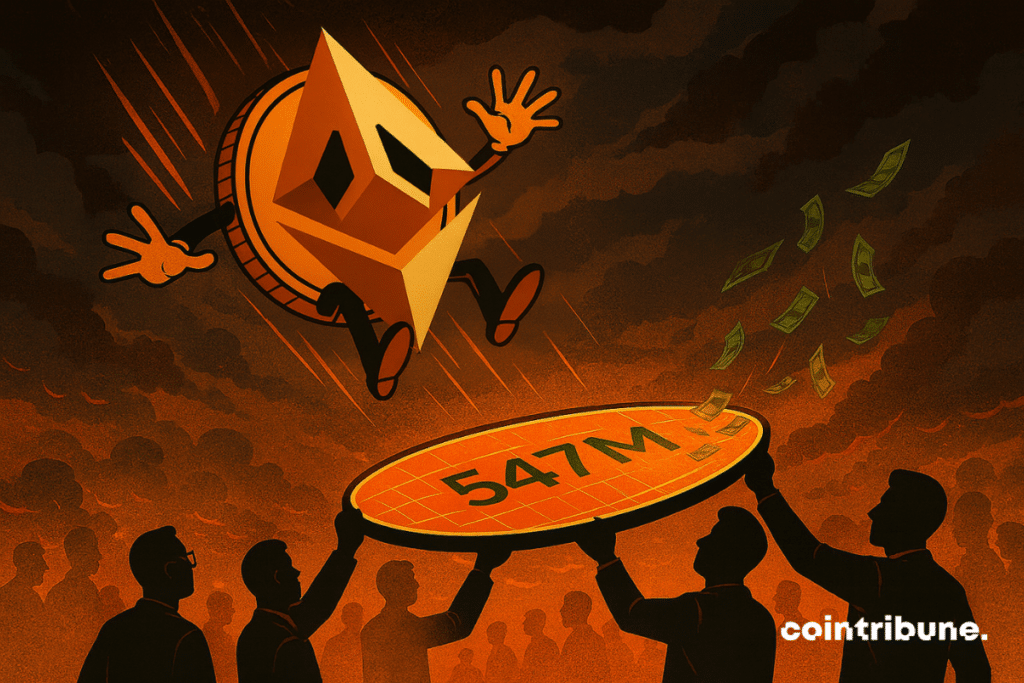

- 547 million dollars injected into Ethereum ETFs in a single day of active trading.

- BitMine Immersion holds $10.6 billion in ETH aiming for 5% of the supply.

- ETH nears $4,350, a critical threshold that could liquidate $1 billion of short positions.

- On-chain activity falls by 16%, while spot purchases remain strategically high.

The institutional awakening: $547M in spot ETFs for Ethereum

On Monday, the crypto market was marked by a flood of capital: $547 million poured into spot ETH products, overturning several days of successive withdrawals. This surge confirms that professionalization is taking root in the Ether universe. Among the players, BitMine Immersion added 234,800 ETH to its reserves, now holding $10.6 billion in assets, a serious bet on a future share of the total supply.

This movement is accompanied by a structural sentiment: companies are reviewing their treasury strategies, some analytical funds anticipating that this institutional shift could bring Ethereum closer to $4,800 or more, if momentum confirms. Moreover, the nature of these flows suggests a preference for spot accumulation, less risky than leveraged speculation.

$4,275 – $4,350: a technical and psychological ceiling

Ethereum sings, but hits a wall. The levels of $4,275 to $4,350 currently act as a barrier: crossing these thresholds could trigger the liquidation of about $1 billion in short positions, according to CoinGlass data. Conversely, if ETH fails again, the pressure could bring the price back to support zones like $4,100.

The technical setup reveals a downward trendline inherited from September peaks, which Ethereum struggles to break. At the same time, market sentiment shows a certain duality: spot ETF flows reflect institutional capital confidence, but caution still dominates derivative markets, with futures showing more measured accumulation.

The SWIFT–Consensys connection acts as a moral lever: although no direct transfer strengthens ETH, it legitimizes the idea of a bridge between traditional finance and crypto. If even a fraction of SWIFT’s 53 million daily messages passed through Ethereum infrastructure, the symbolic impact would be colossal. Such a prospect, combined with the paradox of decreased on-chain activity (–12% fees, –16% transactions over 30 days), makes the challenge fascinating: reclaim resistance while rebuilding support.

When networks and accumulation coexist between paradoxes and signals

The Ethereum visible in its figures hides a paradox: crypto investors flock to ETFs, while momentum on the chains wanes. The network shows –12% fees and –16% transactions in one month, contrasting with the strength of spot ETH accumulated outside exchanges. The crypto market faces a double narrative: strategic accumulation against usage weakening.

To frame this contrast, here are 5 key figures to remember:

- $547 million in net inflows into Ethereum spot ETFs in one day;

- $10.6 billion held by BitMine Immersion in ETH;

- $1 billion of risky short positions if the ETH price exceeds $4,350;

- –12% Ethereum fees over 30 days (economic erosion);

- –16% transactions on the network over the same period.

Several signals indicate that the crypto market is entering a new phase. Institutional crypto investors gradually replace impulsive speculators. The narrative is no longer just about a token, but about a financial infrastructure in transition. The act of buying a dip transforms into a bet on Ethereum’s technological and macroeconomic future.

The end of this test period will not go unnoticed by seasoned observers. And while Bitcoin and Ethereum face pressure, Eric Trump himself took center stage, urging the crypto market to buy the dips. Experts have a keen eye; the vulture watches the pullbacks in this volatile dance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.