Bitcoin’s $125K Milestone: ETFs, Not Corporates, Lead the Charge

Bitcoin (BTC) surged to a new all-time high of $125,559 on Saturday, marking another milestone for the digital asset. The record followed a week of heavy accumulation by both institutional investors and corporate holders. Yet, according to analysts, the true engine behind this price rally was not company buying but the flood of money moving into BTC exchange-traded funds (ETFs).

In brief

- Analysts say ETF inflows were the main driver behind Bitcoin’s surge to a new record, overshadowing corporate buying as the key catalyst of the rally..

- Spot BTC ETFs saw net inflows of $3.24 billion during the week, matching levels last seen in late 2024 and reflecting renewed institutional appetite.

- ETFs now hold over 1.5 million BTC while corporate treasuries own about 1.4 million, highlighting the expanding role of institutions in Bitcoin’s supply.

Treasury Purchases Support Demand, but ETFs Steer the Surge

Bitcoin treasury firms added more than 6,700 BTC to their holdings last week, investing roughly $1.2 billion. The bulk of that came from the Japanese investment company Metaplanet, whose midweek purchase of 5,258 BTC made it the largest corporate buyer for the period and reflected growing confidence among companies treating Bitcoin as a long-term reserve asset.

However, while these purchases helped support demand, analysts noted that the main force behind Bitcoin’s price rise came from ETF inflows. Bloomberg analyst Eric Balchunas stated that spot Bitcoin ETFs recorded a net inflow of around $3.3 billion for the week, bringing total inflows to roughly $24 billion for the year. The weekly figure was close to levels seen in November 2024, indicating that institutional interest in Bitcoin may be strengthening again.

ETF Inflows Emerge as the Main Catalyst Behind Bitcoin’s Rally

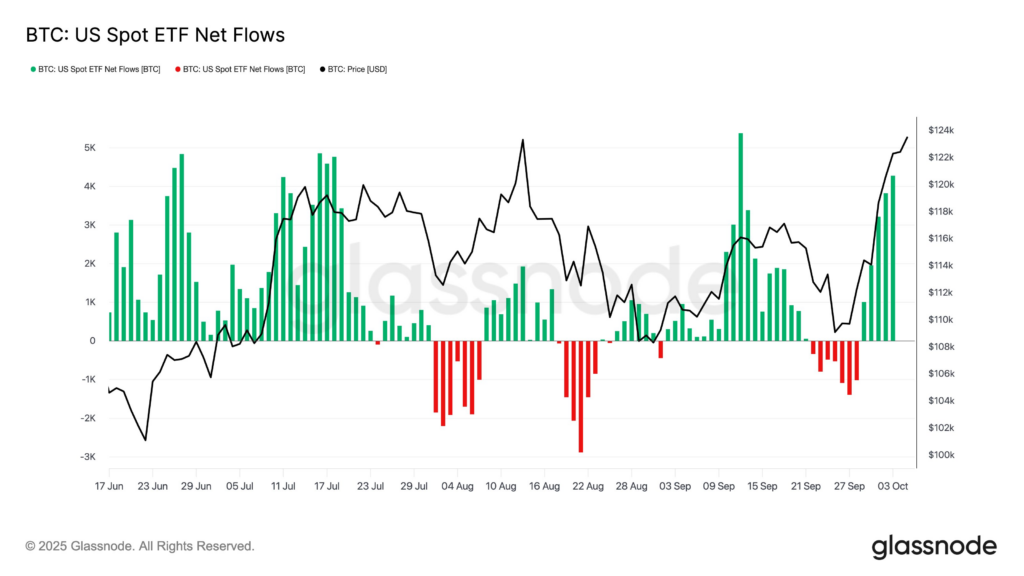

Market analysts largely agreed that ETF activity played the biggest role in Bitcoin’s latest rally. Glassnode, a blockchain analytics firm, reported that ETF flows had turned strongly positive after several weeks of withdrawals. The firm said this renewed wave of institutional demand was strengthening market momentum and helping to build firmer structural support as the market heads into the final quarter of the year.

Crypto market analyst Will Clemente III shared a similar assessment. He explained that this rally stood out because it wasn’t fueled by speculative traders or corporate treasuries but by institutional investors buying through spot ETFs. Clemente described this as a sign that large portfolio managers and funds now view Bitcoin as a viable alternative to assets such as commodities and small-cap equities.

A similar view came from Vincent Liu, Chief Investment Officer at Kronos Research, who pointed to ETF inflows as the main force behind Bitcoin’s price rise. He explained that broader market pressures—including “tight exchange supply, a weaker dollar, and macro uncertainty”—also helped sustain the rally, supported by strong institutional demand and steady market momentum.

Institutions Deepen Their Hold on Bitcoin

The scale of institutional involvement in Bitcoin is becoming increasingly clear, and here is what the figures are showing

- ETFs hold over 1.5 million BTC valued at around $188 billion, accounting for about 7.2% of the total supply.

- Corporate treasuries collectively own 1.4 million BTC worth more than $166 billion, representing 6.3% of all circulating Bitcoin.

- Notably, institutional demand is outpacing miner supply, with miners generating around 900 BTC per day while businesses and ETFs are buying about 1,755 BTC and 1,430 BTC per day on average this year.

Looking forward, Liu anticipates that Bitcoin’s fourth-quarter performance will be influenced by market fundamentals and broader macro conditions. He noted that Bitcoin’s role as a hedge against currency depreciation could provide extra support and that thinner liquidity alongside ETF inflows is likely to drive both rallies and volatility. He added that future gains will depend on institutional and economic factors, including ongoing adoption, clear regulations, limited supply, and favorable market conditions.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.