Crypto: Santiment warns of dangerous frenzy after Powell's speech

Crypto markets pulse to the beat of the Federal Reserve. As Jerome Powell mentions a possible rate cut in September, Santiment sounds the alarm. Could the current euphoria be hiding a trap for investors?

En bref

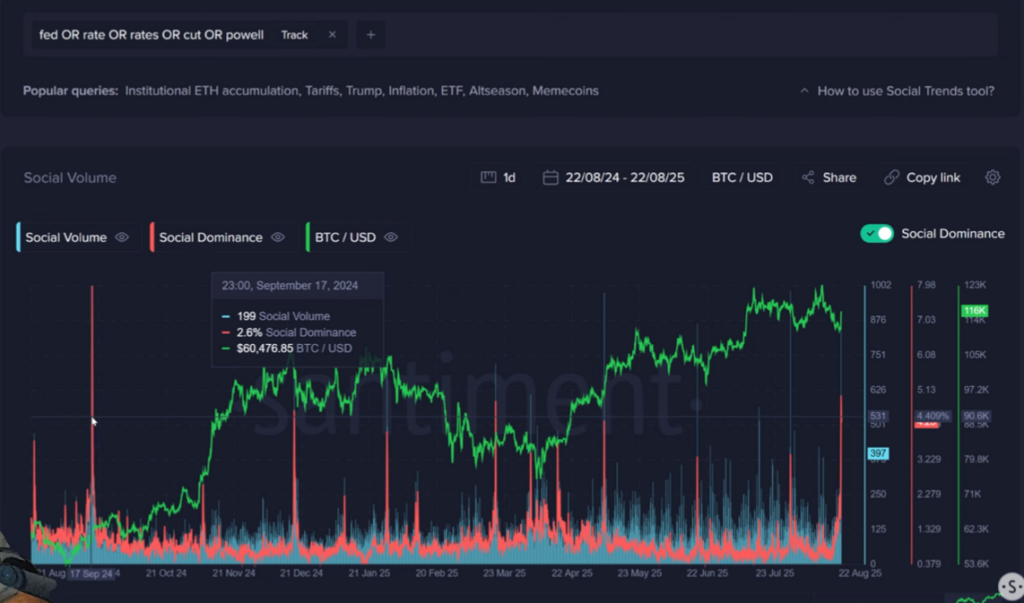

- Santiment has observed a record increase in mentions of “Fed” and “rate cut” on social media, the highest in 11 months.

- According to FedWatch, 75% of market participants anticipate a rate cut in September.

- Analysts remain divided on the real impact of a rate cut on cryptocurrencies.

A social media frenzy worrying analysts

Santiment, a platform known for its market sentiment analysis, published an alarming report on Saturday. Following Jerome Powell’s intervention at the Jackson Hole symposium, mentions of keywords like “Fed”, “rates”, “cut” and “Powell” literally exploded on social networks. They now reach their highest level in nearly a year.

This frenzy occurs in a particularly favourable context for cryptos. On Friday, bitcoin crossed 116,000 dollars, while the Fear & Greed index jumped from 50 to 60 in just twenty-four hours, before falling back.

The atmosphere is euphoric: crypto markets ride the optimism sparked by Powell, who acknowledged that a monetary policy adjustment might be justified.

However, Santiment urges caution:

Historically, such a massive increase in discussions around a single bullish speech can indicate that the euphoria is too strong and may signal a local peak. .

This call for caution contrasts with the prevailing enthusiasm, as 75% of traders, according to CME’s FedWatch tool, anticipate a rate cut in September.

In the current context, this signal takes on particular resonance. The US public debt has surpassed 37 trillion dollars, fueling doubts about the dollar’s strength.

Faced with this fragility, investors massively turn to cryptos perceived as a credible alternative. Yet, this rush towards bitcoin and Ether could mask a danger: that of a market getting intoxicated too quickly, whose momentum risks abruptly running out of steam.

Santiment exposes the risks of the Fed-crypto obsession

Crypto analysts’ reactions reveal a mixed landscape. On one side, some experts see a possible rate cut as a major catalyst for the sector.

Ash Crypto, a recognized trader, predicts the Fed will begin printing money in the fourth quarter and that trillions will flow into the crypto market. He even anticipates a parabolic phase where Altcoins explode by 10 to 50 times.

This optimistic view is based on an established economic logic: lower rates reduce the opportunity cost of holding non-yielding assets like bitcoin. Moreover, the potential weakening of the dollar would mechanically strengthen the appeal of digital currencies as an alternative store of value.

However, some analysts urge caution. Markus Thielen, head of research at 10x Research, already considered in April that it was premature to bet on a genuine bullish impulse.

According to him, even if a long-term opportunity might emerge for bitcoin, the market could face short-term pressure driven by recession fears.

This analysis aligns with concerns voiced by Timothy Peterson, network economist, who warned in March that any delay in rate cuts could cause a crypto market slowdown.

These dissenting voices remind us that cryptocurrencies remain closely linked to traditional economic cycles, despite their status as “alternative” assets.

In short, the frenzy around Powell’s announcements reflects the central role of monetary policy in the trajectory of cryptos. Yes, a rate cut could open a new bullish phase. But if euphoria runs too fast, the shock of a Fed reversal could be brutal. Investors would do well to keep a cool head.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.