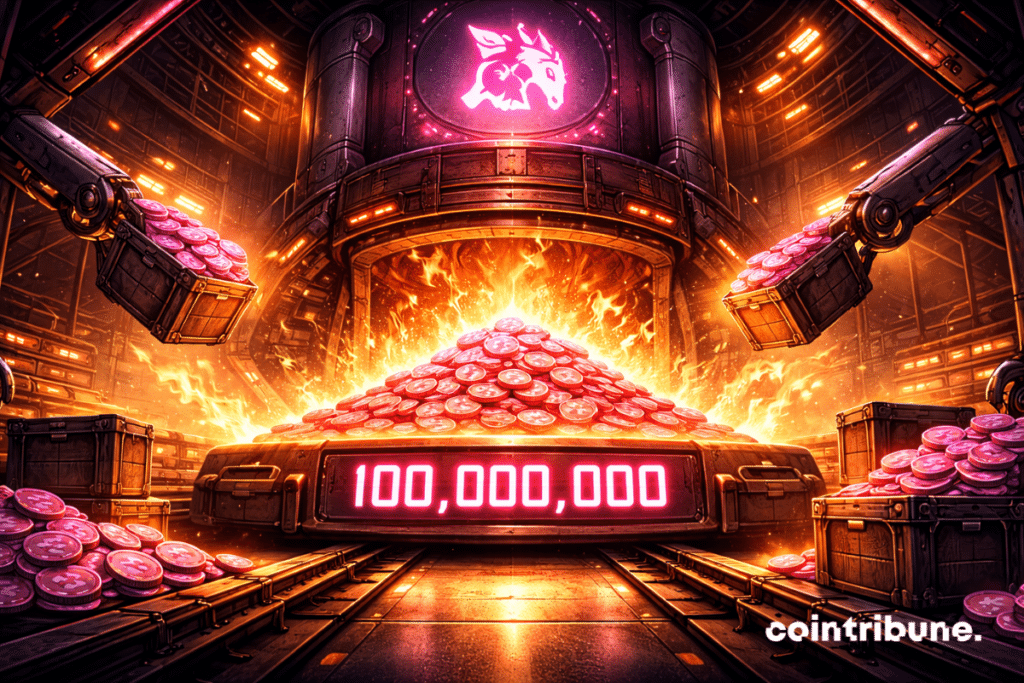

100M UNI Destroyed As Uniswap Shifts To Deflationary Model

On December 28, Uniswap carried out the destruction of 100 million UNI tokens, worth nearly 596 million dollars. This decision, validated by a massive community vote, marks the entry into force of a new economic framework called “UNIfication”. It inaugurates a structural change in the governance of the protocol, based on the activation of protocol fees and a sustainable burn mechanism. Uniswap thus initiates a new phase of its evolution, focused on active management of the value created.

In Brief

- Uniswap burned 100 million UNI tokens, worth nearly $596 million, on December 28, 2025.

- This decision followed the overwhelming approval of the “UNIfication” governance proposal, which passed with 99.9 % support.

- The move marks a strategic shift, introducing a new economic model based on fee redistribution.

- This decision could impact UNI’s supply dynamics and inspire other DeFi protocols.

Unequivocal governance for a historic decision

Uniswap carried out this Sunday, December 28, one of the largest token destructions ever carried out in the DeFi universe.

100 million UNI tokens were destroyed, worth an equivalent of 596 million dollars at the time of the transaction. This spectacular action results from the governance proposal “UNIfication”, widely supported by the community.

The vote ended with massive support at 99.9%, with over 125 million UNI tokens expressed in favor, against only 742 votes against. The burn execution was confirmed this morning, as announced by Uniswap Labs on X : “The UNIfication initiative has been officially implemented on-chain”.

Here are the key elements of this decision :

- The amount burned : 100 million UNI tokens from the protocol’s treasury ;

- The value at the moment of the burn: about 596 million dollars ;

- The vote result : 99.9 % approval (125M for / 742 against) ;

- Notable supporters : Jesse Walden (Variant Fund), Kain Warwick (Infinex, Synthetix), Ian Lapham (ex-Uniswap Labs) ;

- The activated mechanism : the “fee switch”, discussed for several years, is finally implemented.

This near-unanimous consensus among UNI token holders illustrates the growing maturity of on-chain governance. By activating this mechanism, Uniswap asserts its intent to redefine the value redistribution rules within its ecosystem, while significantly reducing the circulating supply.

An operational change of course for Uniswap

The execution of the burn is accompanied by a series of concrete economic measures that profoundly transform the revenue structure of the protocol.

According to information published by Uniswap Labs, interface fees have been reduced to zero, while protocol fees have been activated on Uniswap v2, as well as on some v3 pools on Ethereum.

Meanwhile, revenues generated on Unichain will now be used to fund regular burns, after covering Optimism and Layer-1 data costs. This direct redistribution of value flows introduces a deflationary mechanism which, if maintained over time, could deeply influence the supply dynamics of the UNI token.

Additionally, the Uniswap Foundation confirmed the establishment of a Growth Budget, endowed with 20 million UNI tokens. This fund will serve to finance developers and support projects built around the protocol. The organization specified that “funding for developers and funding programs will not be interrupted”. This distinction between burned tokens and reallocated tokens shows a clear intent: to reduce the supply in a targeted way while continuing to invest in ecosystem growth.

Uniswap initiates key adjustments that redefine its governance and economic model. By linking value capture and deflationary mechanism, the protocol lays the foundations for a new dynamic. It remains to be seen how these choices will shape ecosystem evolution and stakeholder engagement in the coming months.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.