Ethereum in the Green for 13 Days: Institutions Are Pouring In

Finance giants are rushing to Ethereum. In 13 days, ETH ETFs recorded $4 billion in purchases. Off-exchange accumulation, supply-demand imbalance: all indicators point to unprecedented bullish pressure. Bitcoin wavers, Ethereum captures the attention of crypto investors.

In brief

- In 13 days, Ethereum ETFs have recorded over $4 billion in inflows, dominated by BlackRock and Fidelity.

- Institutional demand is exploding against limited supply: only 0.8 million ETH issued annually.

- Massive ETH withdrawals from crypto exchanges confirm strategic accumulation by whales.

They are all in on Ethereum: $4 billion injected in 13 days

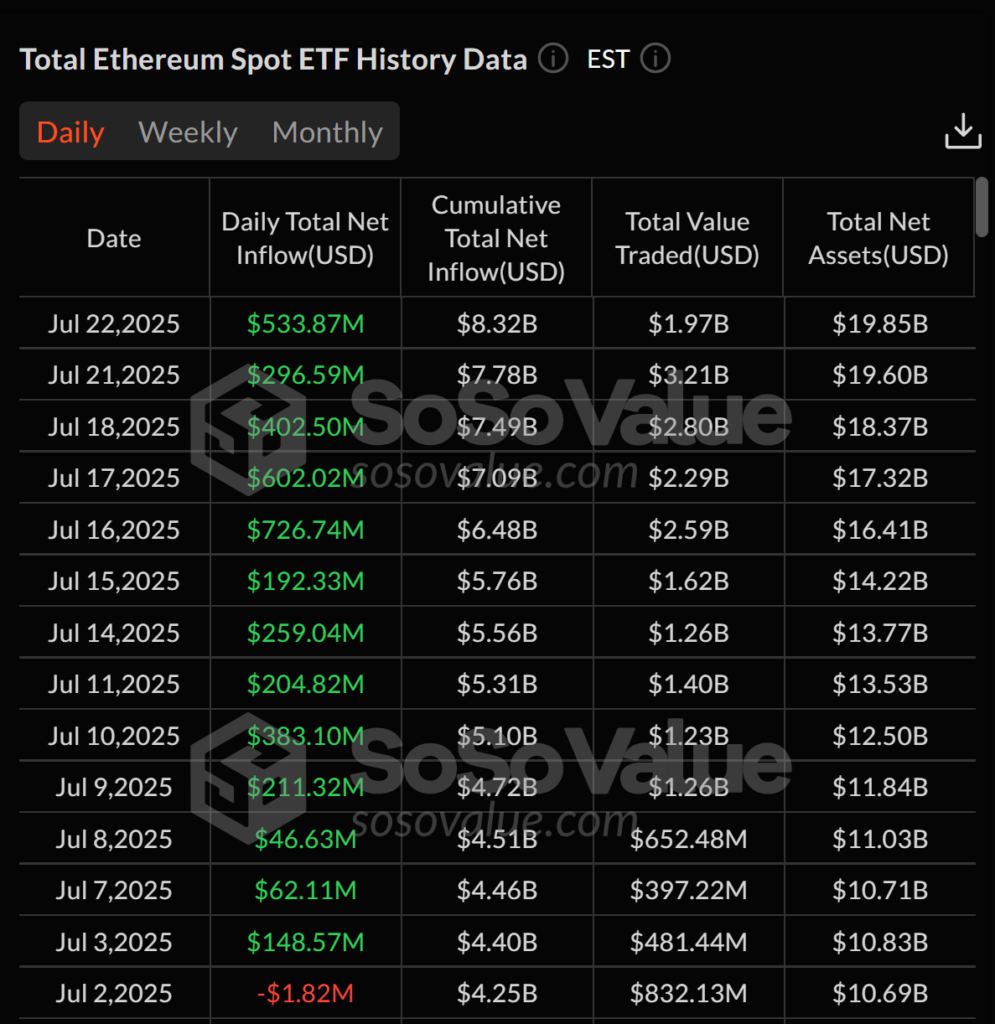

Spot ETFs on Ethereum listed in the United States have just completed their 13th consecutive day of positive net inflows. This flow intensified on July 22 with an influx of $533 million! Bringing the total to over $4 billion injected since the launch of crypto products.

Among the dominant players, BlackRock (ETHA) captures $426 million alone, followed by Fidelity (FETH) with $35 million. In total, Ethereum ETFs now accumulate $19.85 billion in assets under management, or 4.44% of ETH’s total market capitalization. This figure is all the more remarkable as it already surpasses the market shares held by Bitcoin ETFs at the same maturity stage.

This rise contrasts with the $68 million of net outflows recorded the same day by Bitcoin ETFs, especially through products from Bitwise (BITB) and ARK Invest (ARKB). The contrast highlights a potential reconfiguration of institutional preferences.

Soon running out? Ethereum supply no longer keeps up with institutional demand

According to Matt Hougan, Chief Investment Officer at Bitwise, the crypto market faces a clear under-allocation to Ethereum. While ETH represents nearly 19% of the total cryptocurrency market capitalization, its ETPs capture only 12% of assets under management compared to Bitcoin’s.

Hougan estimates that ETFs, funds, and corporate treasuries could soon represent a structural demand of $20 billion in ether. In comparison, the protocol generates only about 0.8 million ETH per year. This 1:7 ratio between supply and projected demand could act as a catalyst for prices in the medium term.

This imbalance fuels a long-term vision where Ethereum, beyond its technology, becomes a rare and sought-after asset.

Millions of ETH disappear from exchanges: whales prepare the assault

In addition to the $4 billion inflow over 13 days into Ethereum ETFs, on-chain flow analysis provides complementary insight. Indeed, on July 22, 76,987 Ethereum (about $285 million) were withdrawn from the Kraken crypto exchange, according to data compiled by Lookonchain.

Ethereum attracts billions, sees its supply contract, and draws finance giants. The current equation combines growing scarcity and exponential demand. This dynamic redefines the balances of the crypto market. Towards a lasting dominance of Ethereum over digital assets? Or will the prophecy of 21Shares, which sees Solana dethroning Ethereum in 2025, come true?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.