2025 Annual Crypto Industry Report

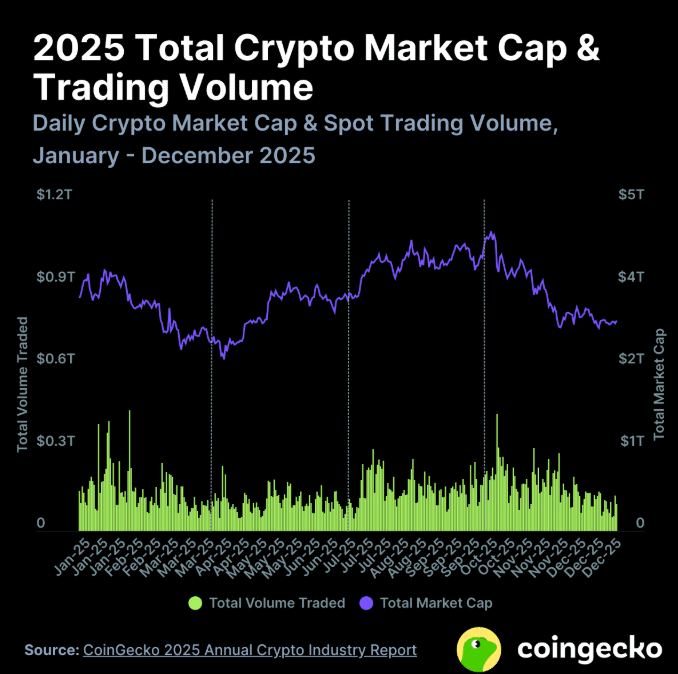

The crypto market faced a sharp correction in the final quarter of 2025, with total market capitalization plunging -23.7% to finish at $3.0 trillion. This marked a -10.4% Year-on-Year decline, crypto’s first annual downturn since 2022. While the quarter saw a brief all-time high of $4.4 trillion, a historic $19 billion liquidation event in October, sent prices slumping. Despite the price retreat, volatility pushed average daily trading volumes to a yearly high of $161.8 billion, while the stablecoin sector climbed +48.9% annually to hit a record $311.0 billion.

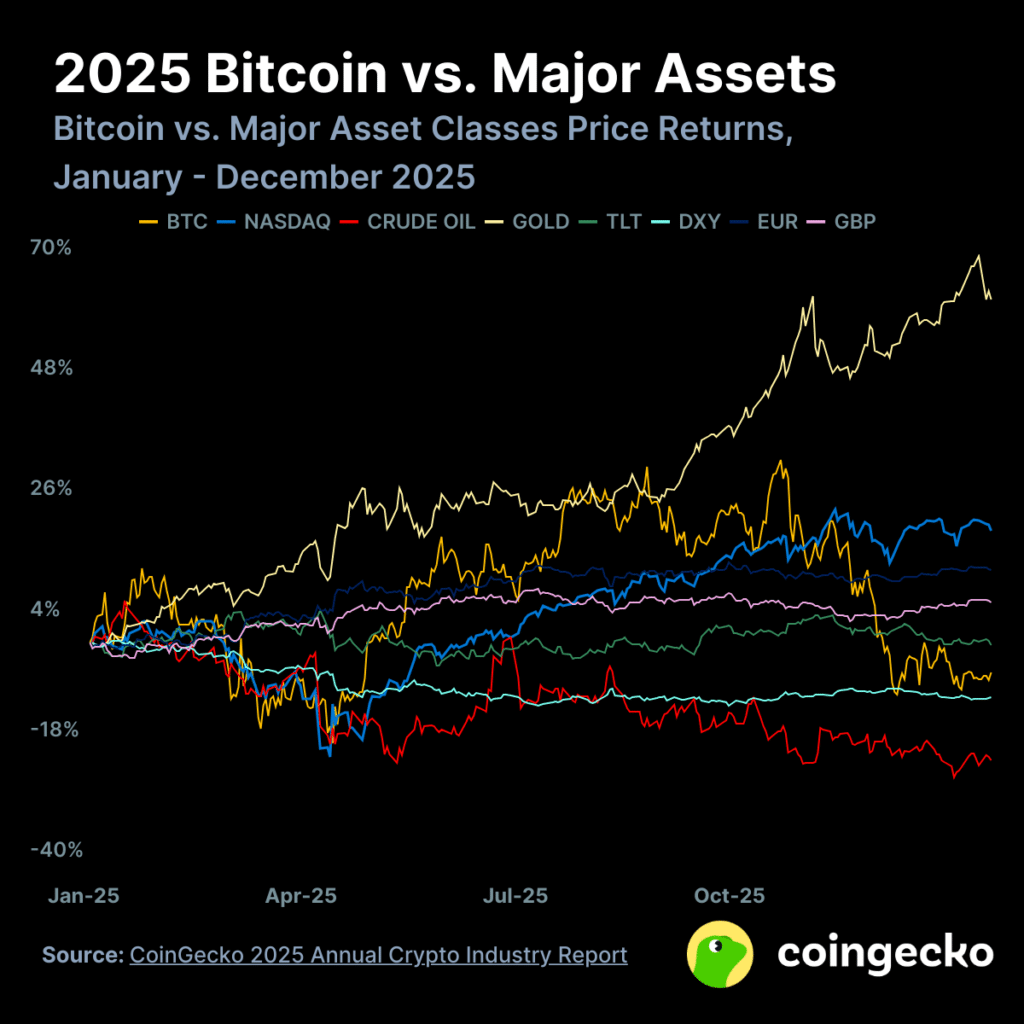

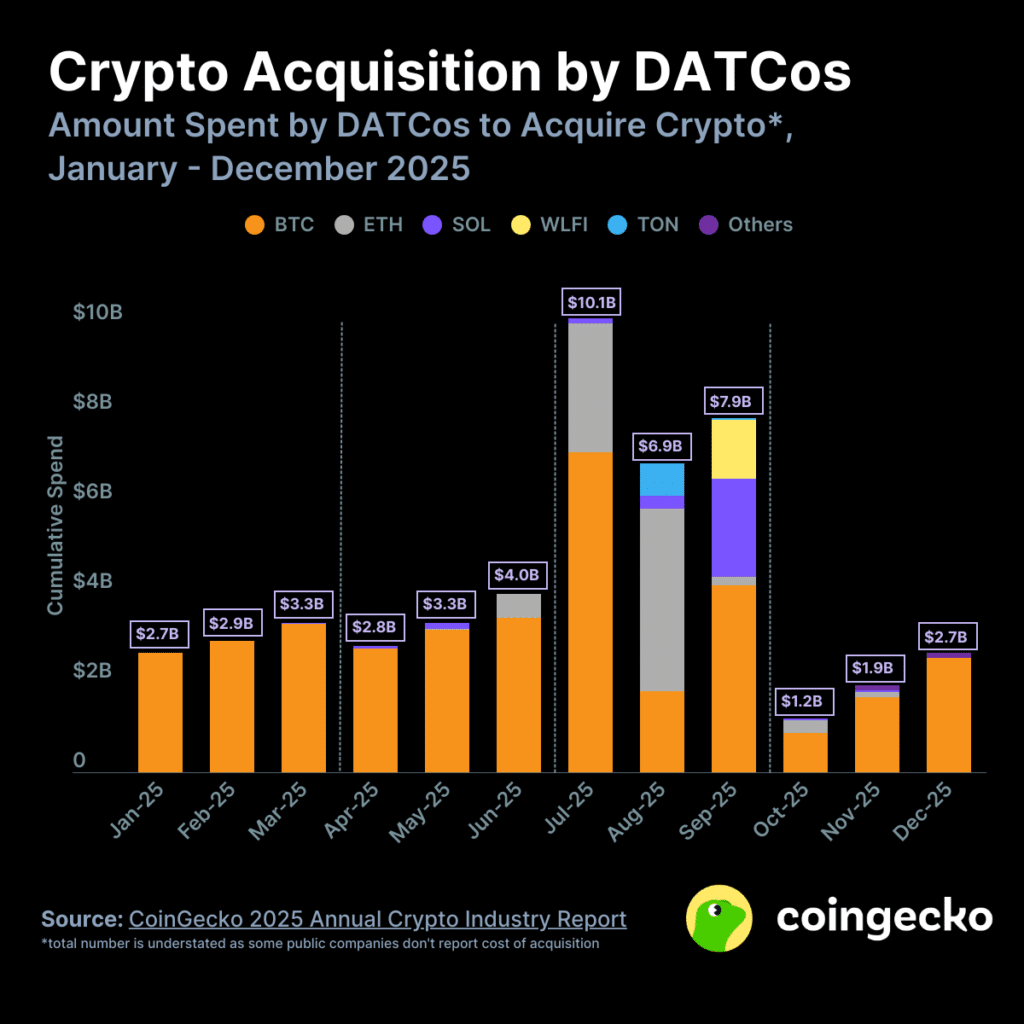

The year was characterized by a decoupling from traditional assets, as Gold (+62.6%) and US Equities significantly outperformed Bitcoin (-6.4%). However, institutional adoption deepened through Digital Asset Treasury Companies (DATCos), which deployed at least $49.7 billion to acquire over 5% of the total BTC and ETH supply. Other bright spots included a +302.7% explosion in Prediction Market volumes and a historical high of $86.2 trillion in annual perpetual trading volume on centralized exchanges, signaling that despite the price contraction, market infrastructure and utility continue to scale.

Our comprehensive 2025 Annual Crypto Industry Report covers everything from the crypto market landscape to analyzing Bitcoin and Ethereum, deep diving into the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and reviewing how centralized exchanges (CEX) and decentralized exchanges (DEX) have performed.

We’ve summarized the key highlights, but be sure to dig into the full 60 slides below.

Top 7 Highlights of CoinGecko’s 2025 Annual Crypto Industry Report

- Total Crypto Market Cap Fell -10.4% in 2025, Ending The Year at $3.0T

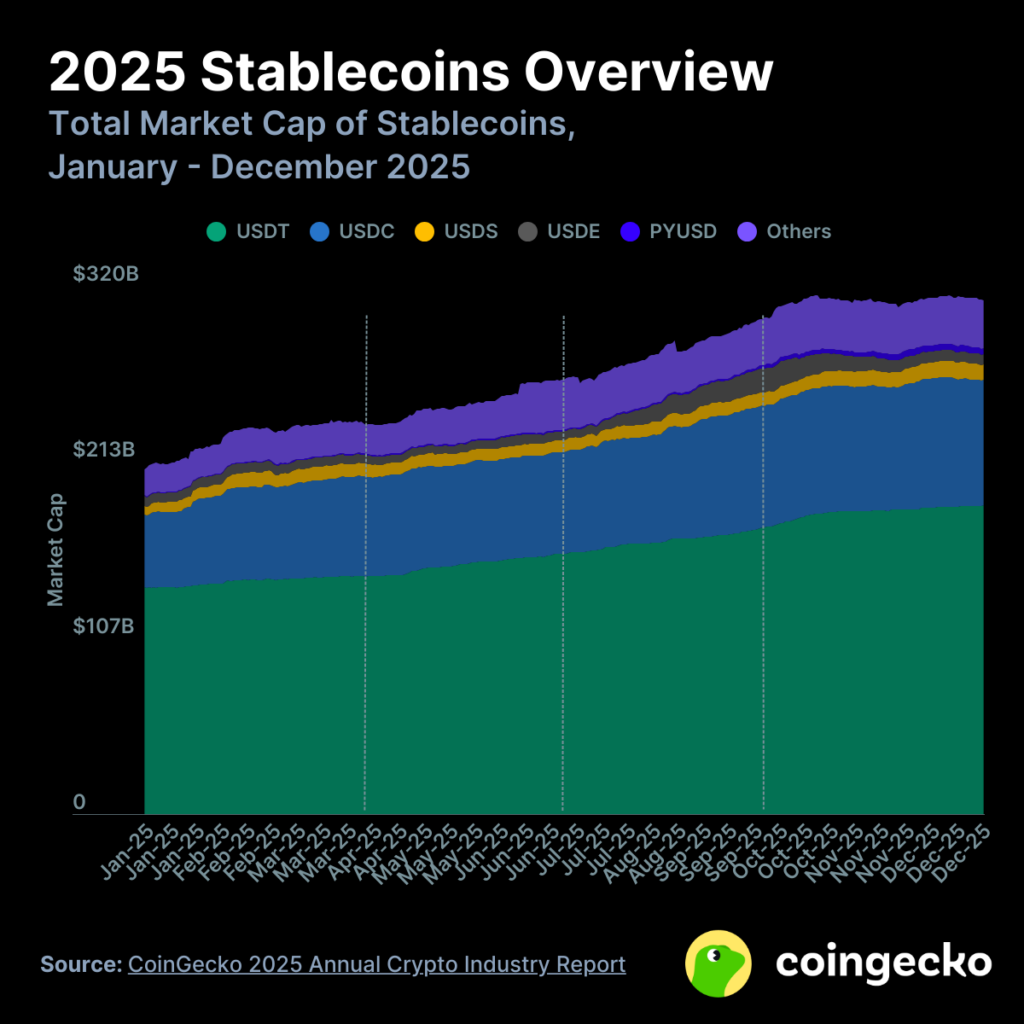

- Stablecoin Market Cap Surged +$102.1B (+48.9%) in 2025, Reaching a New All-time High of $311.0B

- Gold Dominated 2025, Rising +62.6%, While Bitcoin Lagged Behind, Falling -6.4%, Alongside The Dollar and Oil

- Digital Asset Treasury Companies Spent at Least $49.7B in 2025, with ~50.0% Deployed in Q3 Itself

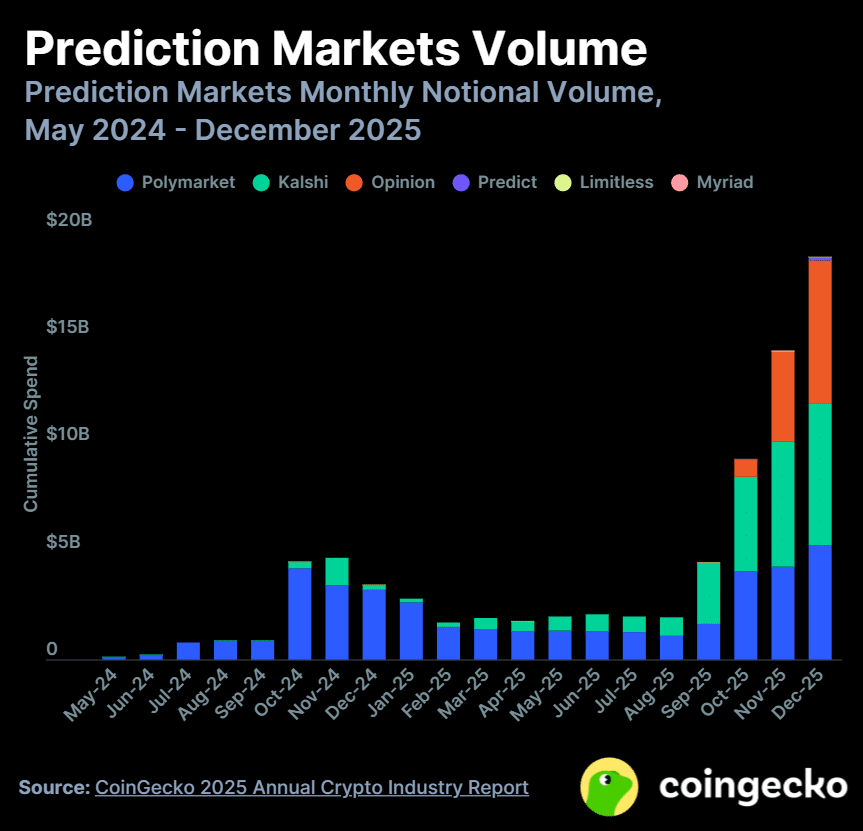

- Prediction Markets Saw Volumes Grow +302.7% in 2025, Hitting $63.5B

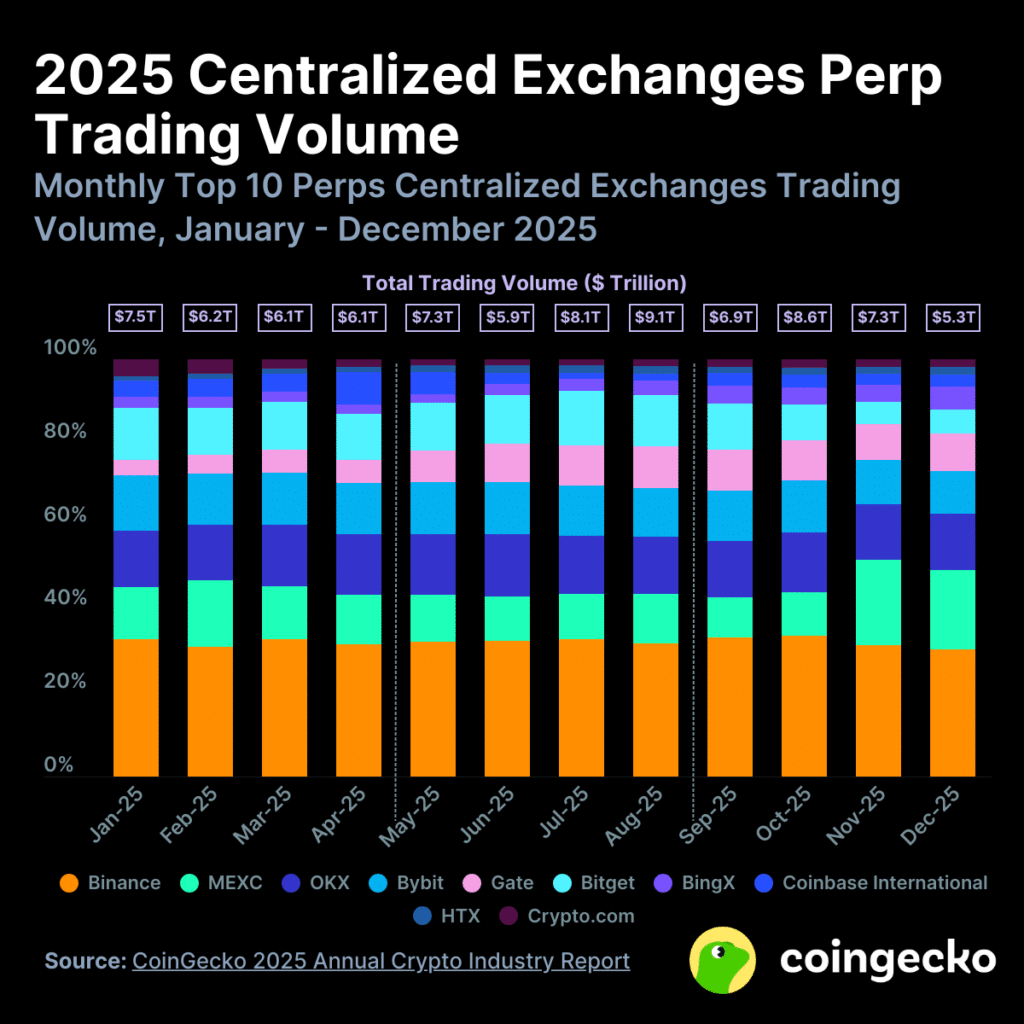

- Perp Trading Volume on Centralized Exchanges Grew +47.4% in 2025 to Hit $86.2T, Marking a Historical High

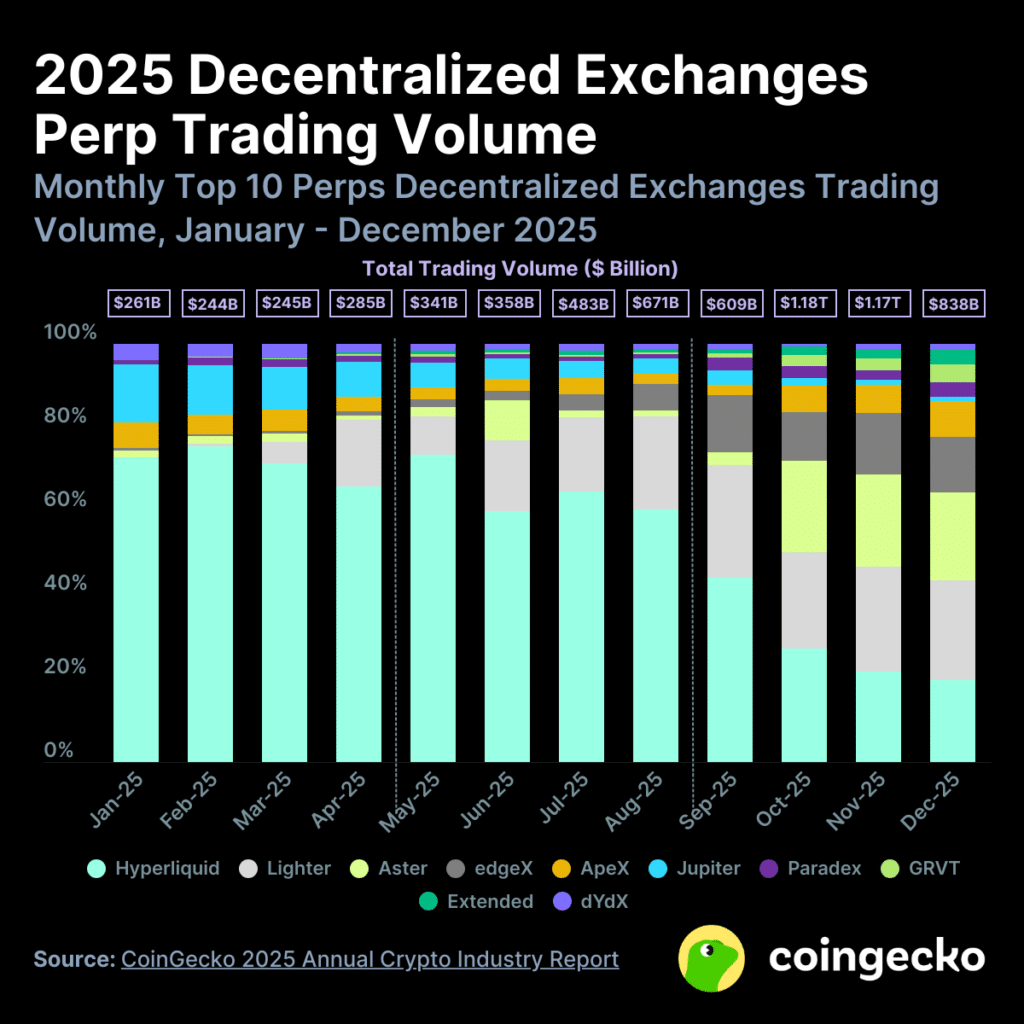

- Perp Trading Volume on Decentralized Exchanges Grew +346% in 2025, to Hit a New All-Time High of $6.7T

1. Total Crypto Market Cap Fell -10.4% in 2025, Ending The Year at $3.0T

Total crypto market cap declined by -23.7% (-$946.0 billion) in Q4 to end 2025 at $3.0 trillion. It was down -10.4% Year-on-Year (YoY), marking the first downturn year for crypto since 2022.

2025 Q4 started off on a strong foot, with market cap hitting a fresh all-time-high of $4.4 trillion. However, this was short-lived as prices tumbled until late-November, before range-bounding till year-end. This decline was triggered by a historic $19 billion liquidation event on October 10, following the announcement of 100% tariffs on China by the US.

Meanwhile, average daily trading volume grew in Q4, to hit a yearly high of $161.8 billion (+4.4% Quarter-on-Quarter). This was largely driven by the historic liquidation event and the subsequent high volatility. However, once the market turned rangebound, volume steadily declined.

2. Stablecoin Market Cap Surged +$102.1B (+48.9%) in 2025, Reaching a New All-time High of $311.0B

Total stablecoin market cap climbed by +$6.3 billion to end 2025 Q4 at a fresh high of $311.0 billion. In 2025, the stablecoin sector surged +48.9%, a gain of $102.1 billion Year-on-Year (YoY).

The most significant change within the Top 5 in Q4 was the rapid deleveraging of Ethena’s USDe, which saw its market cap plummet by -57.3% (-$8.4 billion) in mid-October. Its supply collapsed from a peak of nearly $15 billion to $6.3 billion due to a depeg event on Binance, eroding investor confidence in high-yield looping strategies.

Meanwhile, PayPal PYUSD has emerged as the fifth-largest stablecoin, having surged +48.4% (+$1.2 billion) to reach $3.6 billion. It has replaced World Liberty Financial’s USD1 at #5. This growth can be attributed to the launch of creator payouts on YouTube and a ~4.25% yield offered through the Spark Savings Vault.

3. Gold Dominated 2025, Rising +62.6%, While Bitcoin Lagged Behind, Falling -6.4%, Alongside The Dollar and Oil

Gold was the standout performer of 2025, surging +62.6% throughout the year. It jumped +11.4% in Q4 alone, driven by central bank accumulation and tariff-related uncertainty. US Equities followed closely behind, with the NASDAQ (+20.5%) and S&P 500 (+16.6%) fueled by the ongoing AI narrative.

While commodities and equities thrived, Bitcoin (BTC) lagged behind, dropping -6.4% in 2025. The only assets to perform worse than BTC were the US Dollar Index (-10.0%), hit by rate cuts and political shifts, and Crude Oil (-21.5%), which struggled under a global supply surplus and record non-OPEC production.

4. Digital Asset Treasury Companies Spent at Least $49.7B in 2025, with ~50.0% Deployed in Q3 Itself

Digital Asset Treasury Companies (DATCos) emerged as significant market players in 2025, deploying at least $49.7 billion throughout the year to acquire cryptocurrencies. Deployment peaked in Q3, which accounted for half of the year’s total spend as a wave of altcoin DATCos launched.

However, the pace of acquisition slowed significantly in 2025 Q4, dropping to $5.8 billion, as the crypto market crashed, dragging down the share prices of DATCos. This resulted in the mNAV of many DATCos to fall below 1.0, forcing them to deploy funds to buyback shares rather than accumulate crypto.

As of January 1, 2026, DATCos collectively held $134.0 billion worth of crypto, a +137.2% jump from $56.5 billion on January 1, 2025. DATCos now collectively hold more than 1 million BTC and 6 million ETH, representing >5% of their respective total supply.

5. Prediction Markets Saw Volumes Grow +302.7% in 2025, Hitting $63.5B

Prediction Markets saw its notional volume grow from $15.8 billion in 2024 to $63.5 billion in 2025, representing a +302.7% increase.

Polymarket started 2025 with an 85.6% market share in Q1, but was overtaken by Kalshi in Q4. Kalshi had a 39.6% share in Q4, followed by Polymarket with a 32.4% share. Meanwhile, Yzi Labs-backed Opinion, built on BNB Chain, emerged in November to challenge the incumbents. Its volume hit $7 billion in December, equalling that of Kalshi’s, though current volumes may reflect airdrop farming activities.

6. Perp Trading Volume on Centralized Exchanges Grew +47.4% in 2025 to Hit $86.2T, Marking a Historical High

In 2025 Q4, the Top 10 perpetual centralized exchanges (Perp CEXes) recorded $21.2 trillion, a -12.0% decrease from Q3’s $24.0 trillion. In 2025, trading volume reached $86.2 trillion, representing a +47.4% increase from 2024 and marking a historical high.

October 2025 was the second-highest trading volume month on record, following August 2025, as BTC hit its last ATH. In contrast, December was the least active month of the year, with $5.3 trillion in volume.

Relative market share between the Top 10 Perp CEXes has remained largely unchanged throughout the quarter and the year. The only notable exception is the surge of MEXC in November and December, which leapfrogged OKX, Bybit, and Bitget into the #2 spot.

Just outside the Top 10, KuCoin garnered significant volume in 2025, becoming the only Perp CEX outside of the Top 10 to cross $1 trillion.

7. Perp Trading Volume on Decentralized Exchanges Grew +346% in 2025, To Hit a New All-Time High of $6.7T

In 2025 Q4, trading volume of the Top 10 perpetual decentralized exchanges (Perp DEXes) grew by +80.8% from $1.8 trillion in Q3 to $3.2 trillion in Q4. In 2025, the Top 10 perp DEXes recorded $6.7 trillion, a monumental increase of +346% from $1.5 trillion in 2024. Perp DEX:CEX ratio now sits at 7.8%, compared to 2.5% a year ago.

The increase in trading volume was driven by incentives and airdrop farming on exchanges such as Lighter, Aster, edgeX, GRVT, and Paradex. Hyperliquid remained the most active perp DEX overall in 2025, though it was surpassed by Lighter in Q4. Hyperliquid and Lighter are now among the Top 10 largest perpetual exchanges by annual volume, with $2.9 trillion and $1.3 trillion of trading volume, respectively.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more