2026: The Year When RWAs Will Become the Standard for Global Payments

The boundary between traditional finance and blockchain is fading. In 2025, over 1% of the US money supply circulates as stablecoins, while RWAs attract billions of dollars in institutional investments. A transformation promising to redefine the global economy and crypto in 2026.

In Brief

- RWAs (real world assets tokenized) will revolutionize finance in 2026, becoming the standard for global payments.

- Financial institutions are massively adopting RWAs for their stable yields, liquidity, and transparency.

- Ethereum dominates the RWA and yield stablecoin market, with projects like USDY (Ondo) and sDAI (MakerDAO).

RWA: When Blockchain Charms Wall Street

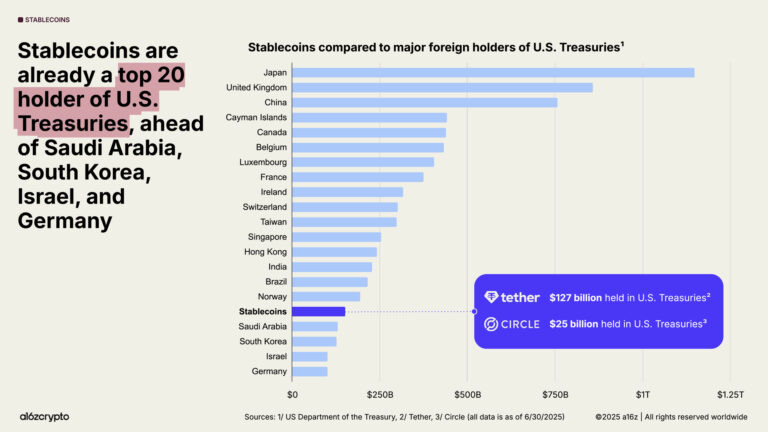

Tokenized government bonds, or “tokenized Treasuries”, are sovereign bonds (such as US Treasury bonds) converted into digital assets on a blockchain (RWA). This market is experiencing exponential growth, driven by institutional adoption. Indeed, stablecoins represent 1% of the US money supply and have become the 17th largest holder of Treasuries in the United States with over 150 billion dollars invested in 2025.

Giants like BlackRock, with its BUIDL fund, or Fidelity, via its OnChain project, are leading this transition. These institutions see it as a way to optimize their collateral management and reduce costs related to clearinghouses.

However, challenges remain, such as regulatory fragmentation between the US and Europe, or concentration of reserves with a few issuers. Despite this, projections remain ambitious, with the tokenized real world assets market estimated at 18.9 trillion dollars by 2033.

Next-Generation Stablecoins: The Programmable Money of Tomorrow

Stablecoins no longer just replicate the dollar. In 2025, assets like USDe or USDY, backed by tokenized government bonds, offer high annual yields. These programmable stablecoins attract institutions: 49% of financial companies already use them for cross-border payments or cash management. As Ignacio Aguirre, CMO of Bitget, highlights:

Yield-bearing stablecoins are emerging as “programmable digital dollars,” promoting wider blockchain adoption and financial innovation, while offering a low-risk, high-return alternative.

Their advantage? Reduce transaction costs by 50 to 80%, while offering permanent liquidity. Additionally, transaction volumes exceeded 19.4 billion dollars this year, illustrating their growing adoption. The regulatory framework, notably the GENIUS Act, played a key role in legitimizing these assets! Allowing players like Circle or JPMorgan to develop innovative solutions.

Ethereum: The Playground of Tokenized Assets

Ethereum dominates the tokenized asset ecosystem, with numerous tokenized government bonds and yield stablecoins issued on its blockchain. Projects like Ondo Finance, with its USDY stablecoin backed by government bonds, or MakerDAO, with its sDAI generating significant annual yield, illustrate this dynamic.

However, challenges persist, notably scalability. Layer 2 solutions, like Arbitrum or Optimism, reduce costs, but competition from blockchains like Solana is intensifying. Nevertheless, Ethereum remains the undisputed leader, with a projected 75% market share of RWAs by 2026.

RWAs and next-generation stablecoins are no longer niche concepts. Driven by institutional demand and clearer regulatory frameworks, these innovations are redefining the rules of finance. The question is no longer whether traditional assets will migrate to blockchain, but when your portfolio will include them. So, would you be ready to incorporate these assets into your crypto investment strategy?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.