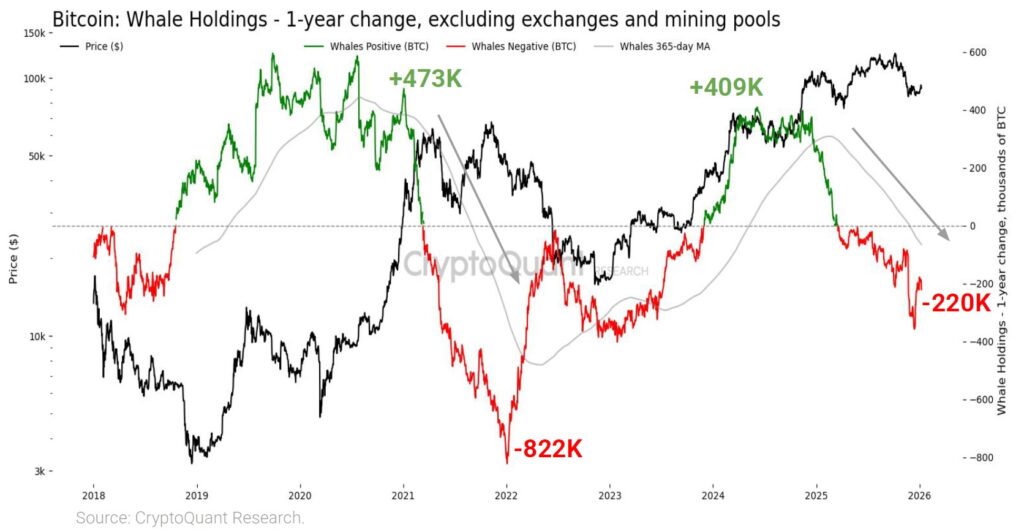

220 000 BTC sold in one year: Do Bitcoin whales anticipate a crash?

Recent crypto data shows that bitcoin whales (holders of 1,000 to 10,000 BTC) have reduced their holdings by 220,000 BTC in one year. A trend that raises questions: are these “whales” anticipating a major correction or simply adjusting their portfolios?

In brief

- Bitcoin whales have reduced their reserves by 220,000 BTC in one year, dropping from 409,000 BTC to their current lowest level.

- This trend reflects increased caution, potentially linked to regulatory, geopolitical uncertainties, or anticipation of a market correction.

- Investors should monitor key levels ($80,000, $95,000) and adapt their strategies (DCA, diversification) to limit risks.

Whales reduce their positions by 220,000 BTC

On-chain data reveals a notable trend: holders of 1,000 to 10,000 bitcoins have reduced their holdings by 220,000 BTC over the past twelve months. Indeed, in March 2024, these whales’ wallets peaked at 409,000 BTC! But their volume has since significantly decreased. Why?

- Regulatory uncertainties;

- Geopolitical tensions;

- The slowdown of institutional adoption could explain this trend.

Moreover, data shows that these bitcoin whales are gradually reducing their exposures, without panic, suggesting a risk management strategy rather than a mass dump. This caution contrasts with accumulation phases observed in previous years. However, such behavior could signal a severe correction in the coming days.

Do bitcoin whales anticipate a severe correction in the near future?

Bitcoin’s history shows that massive whale sells often precede significant corrections. In 2018 and 2022, similar moves were followed by drops of more than 50%. Today, with bitcoin testing key supports around $95,000, analysts fear a bearish scenario toward $80,000.

Additionally, small holders, in capitulation phase, are also selling, intensifying selling pressure. However, not everything is bleak. Bitcoin ETFs like BlackRock’s maintain their reserves, thus limiting a sharp collapse. If interest rates drop, a liquidity recovery could reverse the trend. But for now, whales’ caution remains a signal not to be ignored.

Bitcoin: How can investors position themselves in response to whale movements?

Faced with this uncertainty, bitcoin investors have several options. First for the long term, Dollar-Cost Averaging (DCA) allows smoothing purchases over several months, thus reducing the risk of bad timing in the market. Platforms like Binance or Kraken facilitate this automated strategy.

Then traders must monitor key levels: $95,000 as resistance and $80,000 as critical support for bitcoin. Tools like TradingView help track these thresholds with indicators like BTC’s MACD or RSI, which can indicate BTC’s future trajectory. Currently, RSI is approaching 20 and breaking this limit could trigger an explosion.

Finally, diversifying one’s portfolio remains a wise decision. Altcoins like ethereum, or traditional assets like gold, offer a hedge against bitcoin’s volatility. In 2026, with persistent uncertainties, this balanced approach could prove rewarding.

The reduction of whales’ positions by 220,000 BTC in one year is a strong signal, but not necessarily alarming. It reflects increased caution in an uncertain market. Investors must stay vigilant, adapt their strategies, and diversify their assets. And you, how do you interpret this trend? An opportunity or a risk to avoid?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.