6 Cryptocurrencies Stirred by Whales to Watch Out for

Large and small cryptocurrency wallets were massively profitable with Bitcoin and at least five high-cap altcoins on Wednesday afternoon (28). This was shown by a Santiment mapping, highlighting the “zero-sum game” of cryptocurrencies due to the possibility of profit realization for these retail investors and wealthy whales. In another publication, the on-chain monitoring platform implied that cryptocurrency investors need to be cautious about the fluctuations in Donald Trump’s narratives. According to Santiment’s analysis, those who bet against the President of the United States in recent months did well.

In brief

- Six favorites return profits to 71% to 98% of investors.

- Technical analysis ignores market sentiment.

- Those who buy into Trump’s talk end up badly off, Santiment suggests.

Five altcoins on Bitcoin’s bandwagon

In a possible profit realization, Bitcoin (BTC) was retreating to US$ 107.3k (-2.7%) at the time of this edition, despite optimism about a new all-time high (ATH) in the short term.

Santiment data published on X revealed that 98.4% of traders remained profitable with Bitcoin, even if this percentage was +0.00001%. In this case, the mapping highlighted that 98.3% of retail investors and whales were also profitable with XRP. This coincided with speculation around the launch of spot Exchange-Traded Funds (ETFs) for the blockchain transfer company Ripple’s token.

For this winning retail investors and whales criterion, Santiment also listed Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), and Chainlink (LINK). Their respective percentages of winners were 71.5%, 77.9%, 71.0%, and 80.5%.

“A zero-sum game”

Santiment emphasized that the analysis focused on numbers, thus ignoring crypto market nervousness. In this case, the platform reminded that “cryptocurrencies are a zero-sum game.” This implied that these retail investors and fat whales might want to realize their profits, pushing prices down.

The platform also praised the “Percentage in Profit” analysis, arguing that this metric includes mined cryptocurrencies. Therefore, this measurement “avoids misleading conclusions and helps investors assess whether a coin is relatively overbought or oversold.” In this regard, the platform highlighted increased accuracy by combining this metric with MVRV (Market Value to Realized Value), RSI (Relative Strength Index), Realized Network Profit/Loss, among other analyses.

Therefore, when large portions of a network are strongly in profit, the chances of profit realization and a short-term retracement increase. But when most holders are at a loss, this generally indicates fear, undervaluation, and a potential opportunity to enter or increase a position before a price recovery.

Santiment

Betting against Trump could be a good move

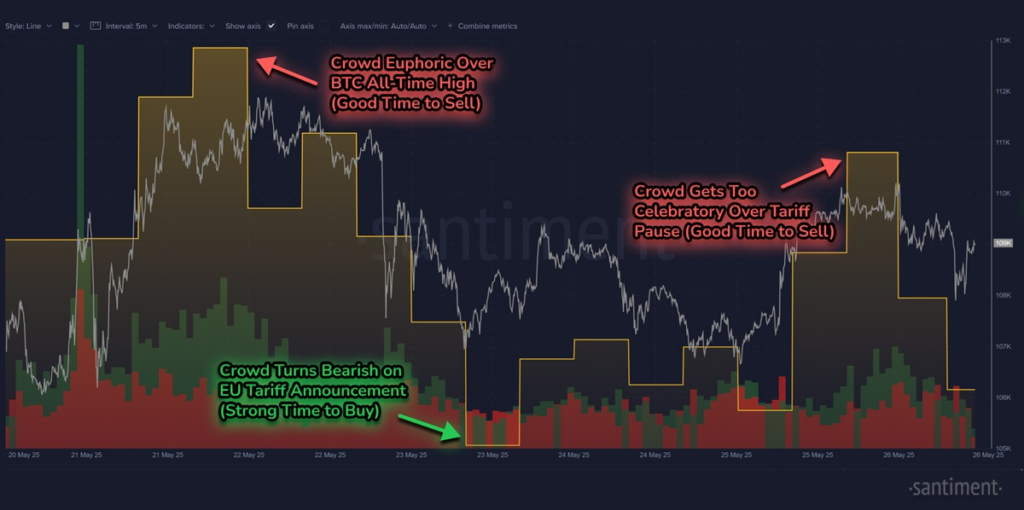

In an insight this week, Santiment observed that markets often move opposite to crowd expectations. As an example, the analysis listed some recent episodes where Bitcoin’s price fluctuated contrary to the pessimism or optimism of investors based on U.S. President Donald Trump’s tariff narratives.

In one of these contrary moves, BTC recovered from a bottom below US$ 107k to a peak of US$ 109k last Friday (23). On that occasion, Trump threatened to tariff European Union products by 50% and caused skepticism among the crowd of investors.

However, Santiment recommended caution, highlighting that “although cryptocurrencies may benefit in the long term from instability in traditional finances, sudden shocks tend to push traders to more cautious positions, at least immediately after events.” Furthermore, the monitoring platform warned cryptocurrency investors because, despite the temporary ceasefire, the tariff war promoted by Trump is not over yet.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A versatile journalist who began his career in the exact sciences without ever leaving writing. He began his career in fiction, working in several editorial positions until he discovered the fascinating and revolutionary world of cryptocurrencies in 2020. Since then, blockchain and other technologies have been part of his daily routine, learning and contributing to this fascinating and transformative universe.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.