97% of Bitcoin Supply Now in Profit as Prices Hit New Heights

Almost the entire Bitcoin market is now sitting on gains after a rally that lifted prices to historic highs. Recent blockchain data shows that the majority of circulating coins are worth more than their original purchase value, signaling broad profitability and positive investor sentiment.

In brief

- Nearly the entire Bitcoin market is currently profitable, with 97% of circulating supply valued above its original purchase price.

- Despite widespread gains, realized profits remain modest, indicating that investors are holding positions.

Broad Profitability Across Bitcoin’s Supply

Blockchain analytics platform Glassnode reported in its latest weekly on-chain update on October 8 that 97% of Bitcoin’s circulating supply is currently profitable. The figure jumped as the cryptocurrency broke above $126,000, setting a new all-time high and pushing nearly all holders into profit.

However, despite the high levels of profitability, realized profits remain modest, indicating that investors are not rushing to sell. This suggests the market is experiencing a steady and orderly rotation rather than facing significant selling pressure. Glassnode noted, “Overall, selling remains controlled and consistent with a healthy bullish phase, though continued monitoring is warranted as prices advance.”

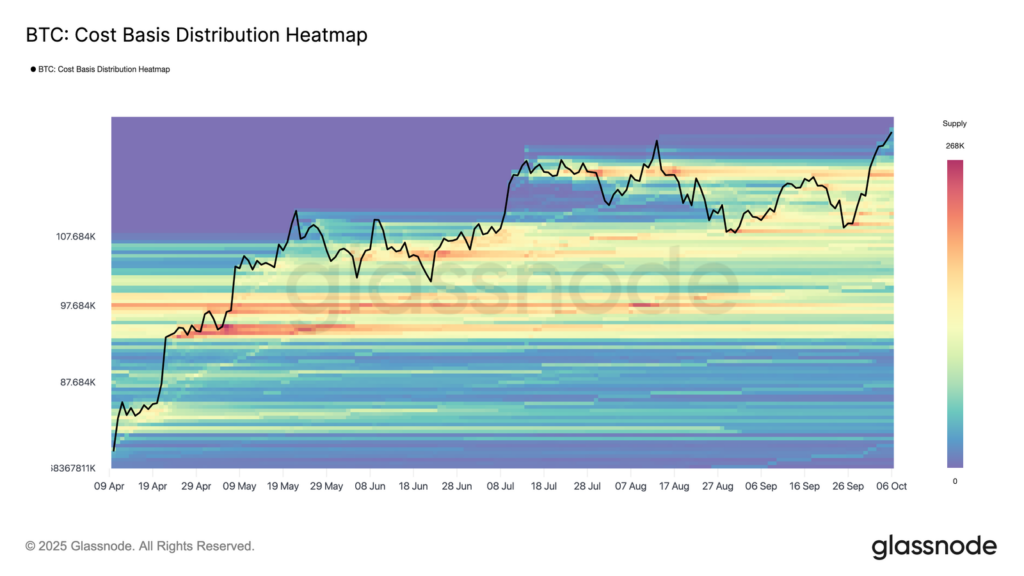

The firm also examined price levels where investors are likely to defend their positions. Using the Cost Basis Distribution Heatmap, Glassnode highlighted thin support between $120,000 and $121,000, meaning fewer coins were acquired there and price stability might be weaker in that zone. A stronger price base was identified near $117,000, where around 190,000 BTC were previously acquired.

If Bitcoin dips toward this level, previous buyers may step in again to protect their gains. This makes the $117,000 range an important zone for potential market stability and a possible point of momentum recovery if prices ease.

ETF Inflows Drive Demand and Trading Surge

Glassnode attributed Bitcoin’s latest breakout largely to a sharp increase in inflows into U.S. spot BTC exchange-traded funds (ETFs). These investment vehicles, which directly hold Bitcoin, have seen renewed interest from both institutions and retail participants.

Data from market intelligence firm Farside shows that more than $2.5 billion has entered U.S. spot BTC ETFs so far this week. This consistent inflow has fueled demand and added upward pressure to Bitcoin’s price.

The surge in ETF activity has also energized the broader spot market.

- Spot trading volumes have climbed sharply, reaching their highest levels since April, as renewed demand from ETF inflows draws more participants into direct Bitcoin trading.

- This rise in activity has carried over to the futures market, where open interest has hit new highs after Bitcoin moved above $120,000, signaling increased confidence and stronger speculative positioning.

- Alongside that growth, funding rates have pushed past 8% on an annualized basis, reflecting the growing appetite for leveraged long positions as traders bet on further price gains.

The collection of indicators from Glassnode paints the picture of a robust but increasingly sensitive uptrend. Demand remains solid, underpinned by heavy ETF inflows and greater engagement in spot and derivatives markets. The broad profitability across Bitcoin’s supply shows investor confidence and sustained buying interest.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Ifeoluwa specializes in Web3 writing and marketing, with over 5 years of experience creating insightful and strategic content. Beyond this, he trades crypto and is skilled at conducting technical, fundamental, and on-chain analyses.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.