98% Chance That The Fed Will Keep Rates Steady In June: Find Out Why

The United States Federal Reserve is close to confirming its pause on key interest rates in June, with a 98% probability. This decision reflects the growing economic uncertainty, caught between persistent inflation and a robust labor market, placing the American economy in a crucial dilemma for its future.

In Brief

- The Fed has a 98% chance of maintaining its key interest rate stable in June.

- Inflation remains high despite a strong labor market, complicating monetary policy management.

- The Fed’s decision impacts the economy and financial markets, causing increased volatility.

Fed: 98% Chance to Keep Rates Stable in June

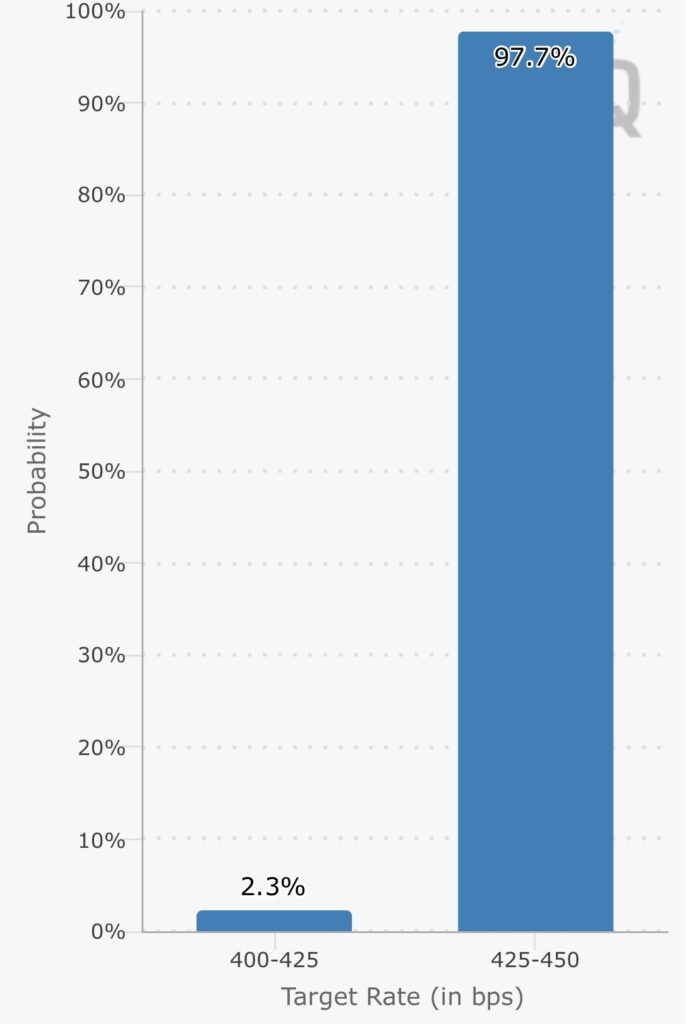

While Donald Trump demands a swift response from the Fed regarding inflation, the Federal Reserve itself has a 98% chance of keeping its key interest rate stable, according to reliable market tools like the CME FedWatch Tool. This tool analyzes futures contracts and investor expectations, reflecting policymakers’ caution in the face of a complex and uncertain economy.

The key factors supporting this forecast are:

- The current key interest rate maintained between 4.25% and 4.5%;

- An economic context marked by risks of persistent inflation and moderate growth;

- A desire to avoid a negative shock on employment and consumption;

- The transparency of the minutes providing insight into the wait-and-see strategy.

This stance reflects the search for a balance to stabilize the economy without abruptly slowing its momentum.

Stubborn Inflation Despite a Strong Labor Market

The American economy faces a major paradox: inflation remains above the 2% target, while the labor market retains surprising strength. This tension complicates economic outlooks, as prolonged inflation erodes household purchasing power, slowing consumption, which is a key driver of the economy.

Moreover, tariffs have increased pressure on prices. Companies, faced with higher costs, pass those increases on, reinforcing inflation. Stable unemployment around 4.2% hides an underlying fragility: a slowdown in employment could quickly impact confidence and growth. This dynamic strengthens the idea that the Fed must remain vigilant to preserve economic balance without causing lasting imbalances.

Impact on Markets: What Are the Economic Prospects?

The early decision by the Fed, with a 98% chance of leaving rates unchanged, influences the overall economy and financial markets.

Investors interpret this pause as:

- A sign of caution in the face of an uncertain economy;

- An incentive to seek higher-yielding, sometimes risky, assets;

- A factor of increased volatility, especially in cryptos like bitcoin and equities.

This situation reflects the current complexity of the economy, torn between controlling inflation and supporting growth. The Fed is counting on clearer information gathering to adjust its monetary policy. This waiting scenario could prolong uncertainty but also limits the risks of a sharp market correction.

The Fed chooses caution in face of a fragile economy, favoring rate stability. This strategy raises questions: will patience be enough to control inflation without hindering growth? For deeper insight, discover our analysis on economic concerns related to a possible rate cut in June.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.