Aave Secures MiCA Approval to Launch Zero-Fee Stablecoin Ramps Across Europe

Aave Labs has taken a significant step toward regulated on-chain finance in Europe. The company has received authorization under the EU’s Markets in Crypto-Assets (MiCA) framework, allowing euro-to-stablecoin conversions at no cost. This places Aave among the first major DeFi projects cleared to offer compliant payment services across the European Economic Area.

In brief

- Aave receives MiCA approval, enabling zero-fee euro-to-stablecoin access through its regulated gateway, Push, across the EEA.

- Stablecoin supply surpasses $300 billion globally, raising demand for compliant fiat ramps as Aave expands regulated access to GHO and additional assets.

- Aave DAO weighs a long-term buyback plan using up to $50M yearly revenue, building on strong activity and rising protocol liquidity.

- V4 upgrade and broader multi-chain expansion, including Aptos, position Aave for continued growth in regulated and decentralized markets.

Central Bank of Ireland Authorizes Regulated Stablecoin On-Ramp

Ireland’s Central Bank granted approval to Push Virtual Assets Ireland Limited, the Aave subsidiary responsible for its fiat gateway, Push. With this authorization, users can convert euros into digital assets—including Aave’s stablecoin GHO—without needing accounts on centralized exchanges. Ireland’s rise as a regulatory center continues, following Kraken’s MiCA approval in the country earlier in the year.

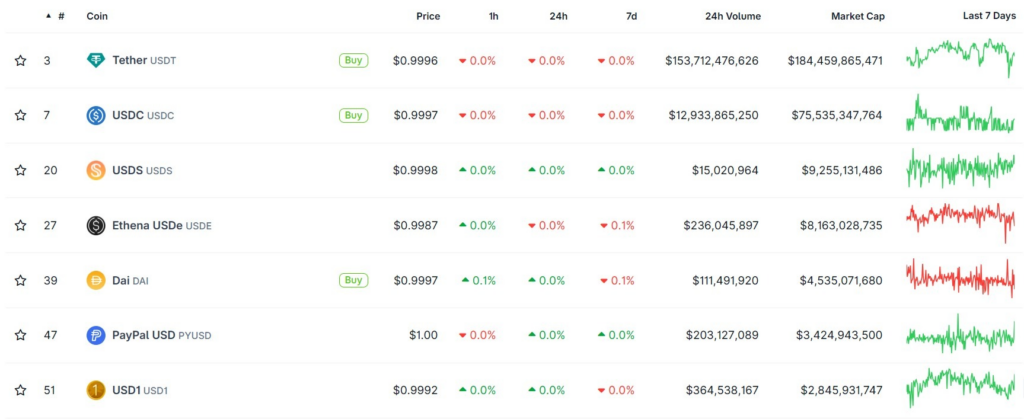

Interest in regulated fiat access is growing as global stablecoin supply expands. Market data indicate that the total stablecoin capitalization has surpassed $300 billion, suggesting sustained demand for both euro- and dollar-denominated assets in digital markets.

Push aims to offer regulated on- and off-ramps for GHO and other stablecoins connected to Aave’s product suite. Conversion fees are set to zero, making Push a competitive option compared to the fees commonly charged by fintech firms and exchanges. Aave Labs has not specified whether the zero-fee model will remain permanent.

Aave Gains EU Green Light for Stablecoin On-Ramps

According to Aave, reliable and transparent payment channels are important for broader DeFi participation. Clear options for moving between euros and digital assets may lower a barrier that often affects new users. Instead of relying on traditional exchange accounts, individuals can access stablecoins directly through a regulated gateway that is aligned with decentralized finance.

Key elements of Aave’s approach include:

- Creating a euro-to-stablecoin path without added conversion costs.

- Meeting MiCA’s statutory requirements throughout the EEA.

- Reducing reliance on centralized exchanges for basic fiat access.

- Supporting wider use of GHO through regulated distribution channels.

- Strengthening Aave’s position as stablecoin liquidity grows globally.

Activity on the protocol continues to rise. Data from DefiLlama shows Aave posting $542 million in daily volume and more than $22.8 billion borrowed across its lending pools. With substantial stablecoin liquidity in circulation, regulated fiat entry points form a meaningful extension of the Aave ecosystem.

In parallel with this regulatory progress, the Aave DAO is reviewing a proposal for a long-term buyback program. The plan would convert what has historically been an occasional initiative into an ongoing policy.

Up to $50 million in annual revenue could be allocated toward weekly AAVE token buybacks, ranging from $250,000 to $1.75 million, depending on market conditions. A previous $4 million buyback in April was followed by a noticeable increase in AAVE’s price, strengthening support for a recurring structure.

Aave is also preparing its V4 upgrade, which is expected to be completed by the end of 2025. At the same time, the protocol continues expanding to additional networks, including Aptos, extending its presence beyond EVM-compatible chains.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.