As the crypto landscape evolves at a breakneck pace, Ethereum is launching a strategic offensive to consolidate its position as a leader. The "Trillion Dollar Security Initiative," unveiled on May 14, goes beyond merely fixing technical flaws. It aims to redefine global security standards, laying the foundation for an ecosystem where trillions of dollars can flow with complete trust. A bold move that highlights why Ethereum remains the essential backbone of decentralized finance (DeFi).

Archive 2025

Encrypted messaging has dealt a fatal blow to the largest illicit market ever created on its platform. Haowang Guarantee, a hub of Chinese organized crime that facilitated $27 billion in dubious transactions, has shut down. A spectacular victory that ironically comes as Telegram staunchly defends its users' privacy against French authorities.

Polymarket reached an all-time high in new market creation in April, but trader activity and trading volume have slowed since the 2024 U.S. election. Speculation around a possible token launch could drive renewed engagement and further growth.

While Ethereum surged by 43.6% in a week, reaching $2,600, the prospect of a return to $5,000 is back in discussions. This threshold, long considered out of reach, is once again appearing in analysts' scenarios. For some, this surge goes beyond a mere speculative bounce but could mark the starting point of a deeper bullish phase, driven by strong technical fundamentals and a rapidly changing adoption.

In a crypto market driven by spectacular announcements, some signals go unnoticed while revealing deep dynamics. This is the case with discreet, yet massive movements around XRP on Binance. Unusually high volumes circulate in strategic silence, capturing the attention of analysts. Behind this silent accumulation could be a significant buying pressure, often heralding a trend reversal. Away from the spotlight, XRP seems to be gearing up for a phase.

Altcoins beat Bitcoin in April! In this article, find out why this trend will shake up the crypto market.

After several years of hostility towards Bitcoin, Taiwan may soon reconsider its viewpoint given its precarious geopolitical situation.

Coinbase, the largest American crypto exchange platform, has just suffered a large-scale cyberattack involving the leak of sensitive data from about 1% of its users. This security breach comes at a particularly delicate time for the company, just days before its entry into the prestigious S&P 500 index. What will be the consequences for this giant that claims over 105 million users?

When Ukraine wants to create its Bitcoin vault, it resonates! But between pending laws and crypto-donations, the financial war has its new digital front.

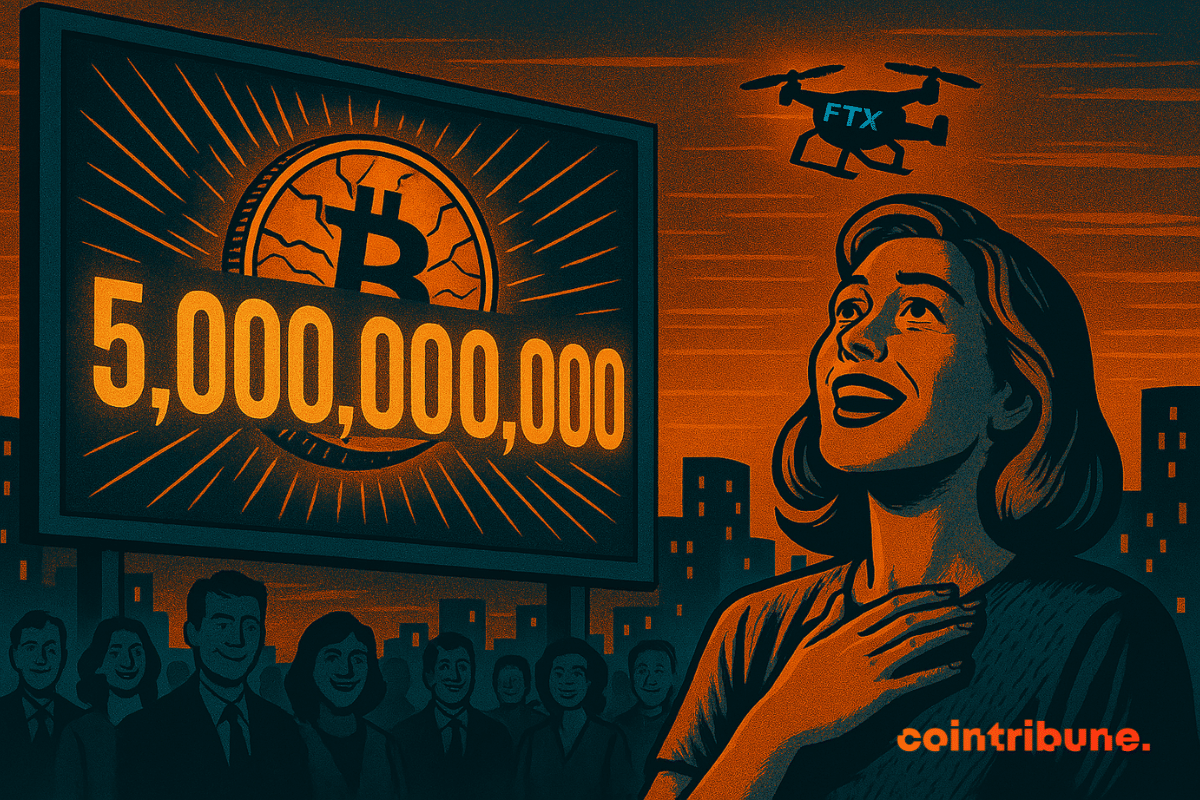

FTX reopens the floodgates with 5 billion to distribute. Crypto investors rejoice, but in the background, Sam Bankman-Fried is still scheming in the shadows. Guaranteed suspense in the crypto world!