FTX is (finally) refunding other former clients... but not as planned! 5 billion at stake, anger from creditors, and scams lurking. Why could this refund reignite the turmoil? Discover what this shocking operation conceals.

Archive 2025

Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

And if the recent surge in Bitcoin had nothing to do with ETFs? Discover the true reason that is alarming the markets and driving investors to flee to the crypto queen… An invisible shock, but heavy with consequences.

As bitcoin confidently crossed the $105,000 mark, a significant pullback has disrupted this momentum, raising doubts among investors. However, far from a collapse, several technical indicators suggest a controlled consolidation. In an ecosystem where volatility is the norm, this retracement phase reveals a subtle tension between speculation and structural strength. More than just a simple fluctuation, the current situation illustrates the precarious yet strategic balance that the market is trying to maintain, at the crossroads of bullish signals and necessary phases of breathing.

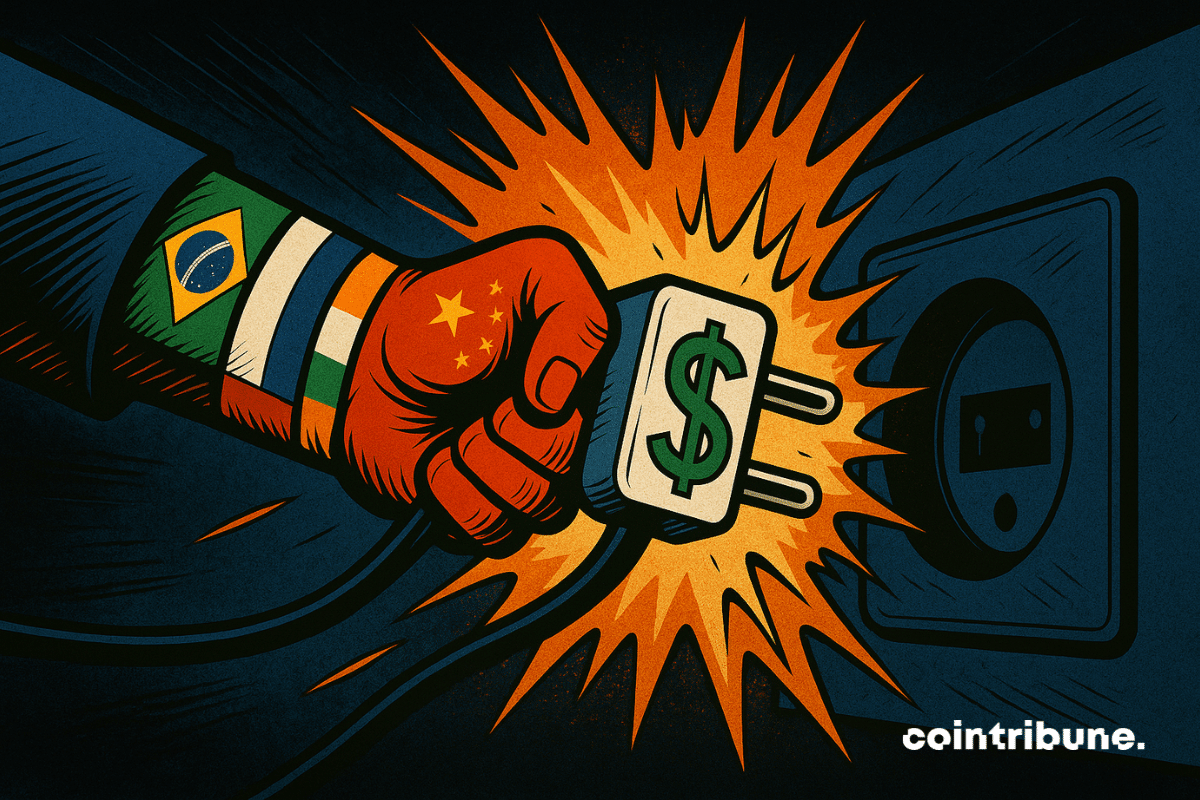

And what if one of the largest capital transfers in modern history was already underway, away from the spotlight? In the face of rising geopolitical tensions and the fatigue of the dollar-dependent model, Asian nations, led by the BRICS, are initiating a withdrawal of about 7.5 trillion dollars in American assets. This reorientation, based on strategic choices and concrete data, challenges the foundations of Western finance and signals a silent yet decisive restructuring of the global monetary order.

Pakistan wants to power up its machines to mine bitcoin, but the IMF, thermometer in hand, fears a diplomatic power outage. Who will falter, the state or crypto?

While it was believed that the memecoin season was over on Solana, a new frenzy of token launches has reignited network activity. Solana is becoming the most active blockchain.

Bitcoin is stumbling, but altcoins are taking off! Ethereum, Solana, Cardano... all defy gravity. Is an explosive altseason on the horizon? Discover why technical signals are driving traders wild and how these tokens are reshaping the crypto market.

Crypto prices dip slightly, but investor optimism stays strong amid new token launches, political support, and tech gains.

Farage, former Brexiteer, transforms into a crypto-evangelist: bitcoin reserve, digital donations, and futuristic legislation. The United Kingdom, the new paradise for crypto?