olana is preparing to replace TowerBFT with Alpenglow, a new consensus model aimed at faster finality, stronger security, and performance closer to traditional financial markets.

Archive 2025

Within 24 hours, new wallets have acquired nearly 280 million dollars in Ethereum, while the asset trades just below its yearly highs. This sudden accumulation, spotted by on-chain analysts, raises questions: are we witnessing a simple strategic accumulation phase or the precursor signal of a larger bullish movement?

Cardano (ADA) ignites the crypto market with a surge in its futures volume, reaching nearly 7 billion dollars. This bullish momentum, driven by the shadow of a potential ETF, places ADA back at the center of discussions. Towards a lasting return above 1 dollar?

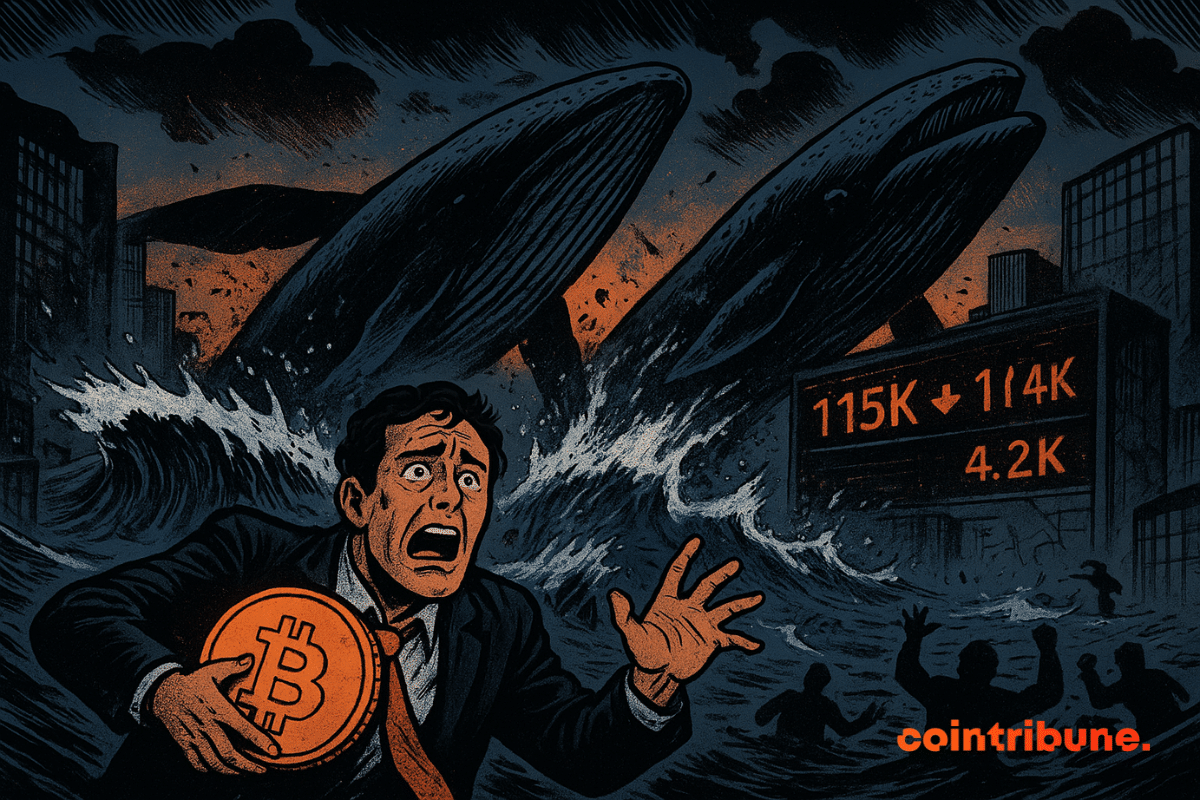

The broader crypto market took a tumble overnight, sending top assets including Bitcoin (BTC) and Ethereum (ETH) below key price levels. Market observation tools have linked this sudden price action to profit-taking activities by large asset holders.

Bybit, the world’s second largest crypto exchange by volume, reaches a new milestone in Europe. The platform has just announced the launch of spot margin trading on Bybit.eu, offering European users leverage of up to 10x under a strict regulatory framework.

Bitcoin giant Strategy has added another 430 BTC to its balance sheet, according to a fresh SEC filing. The company spent $51.4 million at an average price of $119,666 per coin, raising its total holdings to 629,376 BTC, worth more than $72 billion at current market prices.

While the wait around Pi Network drags on, a discreet statement from a moderator reignites hopes. Millions of users are still waiting to access their mined tokens, but a second migration to the mainnet could change the game. This signal, although unofficial, comes amid growing frustration. If it materializes, it would mark a strategic turning point for a project still locked in its mainnet, far from the promises of a truly accessible blockchain.

The crypto market remains paradoxical. While Ether records a sharp drop of nearly 6% in a single session, ETFs linked to the world's second largest crypto continue to capture record volumes and inflows. A contradictory dynamic that illustrates the growing maturity of institutional investors: short-term corrections are no longer enough to slow the rush towards financial products backed by Ethereum.

Bitcoin in free fall, "hidden hands" at work, and the Fed lying in ambush: who is manipulating the market while traders play prophets?

After weeks of bullish euphoria, the crypto market violently corrected, revealing an underlying tension ignored for too long. In just 24 hours, over 500 million dollars of long positions were liquidated, dragging down bitcoin, Ethereum, and XRP in their fall. This brutal wave revealed the fragility of a market fueled by leverage, where technical indicators, sidelined by optimism, suddenly regain all their importance. A return to reality is necessary for investors.