Two crypto bullish stars promise an ETH at $10,000... But between ETFs, staking, and crashes, is the prophecy more of a miracle than a mathematical model?

Archive 2025

The Hong Kong subsidiary of one of the largest Chinese banks has just made history by tokenizing a colossal fund on the Binance blockchain. A bold initiative that comes in a highly tense regulatory context.

Bitcoin dropped as it approached its all-time high. In a few hours, the market erased several billion dollars, revealing once again its extreme volatility. Despite this marked correction, several analysts maintain a bullish scenario, estimating that this pullback does not call into question the underlying trend.

Donald Trump declared that the United States is in a trade war with China. This statement, made in Washington, marks an escalation of economic tensions. In the aftermath, the markets wavered. Bitcoin, particularly sensitive to geopolitical shocks, plunged. This declaration comes as the administration targets Chinese technological imports, directly threatening the mining industry. The American trade offensive now takes a strategic turn with immediate repercussions on the crypto ecosystem.

Coinbase is preparing to list BNB, the flagship token of its historic rival Binance. Such an unexpected gesture contrasts with past tensions between the two giants. In a climate of enhanced regulation and strategic repositioning, this decision could mark a turning point in the power dynamics of the sector. Calculated opportunism or signal of appeasement? This rapprochement intrigues as much as it raises questions.

Ethereum is running out of steam... but that's because it's breathing emptiness! Between ETF injections, staking fridges, and digital treasures, ether is evaporating. And the price could explode.

In Q3 2025, bitcoin makes a big impact: 172 companies now hold 1.02 million, or 4.87% of the total supply. Why are these giants betting heavily on this crypto? Strategies, risks, and opportunities.

Cloudflare has partnered with Visa, Mastercard, and American Express to help shape the future of digital payments through a secure foundation for “agentic commerce.” The collaboration aims to develop authentication systems that enable trusted software agents to make purchases and payments autonomously—while protecting merchants from fraudulent bots.

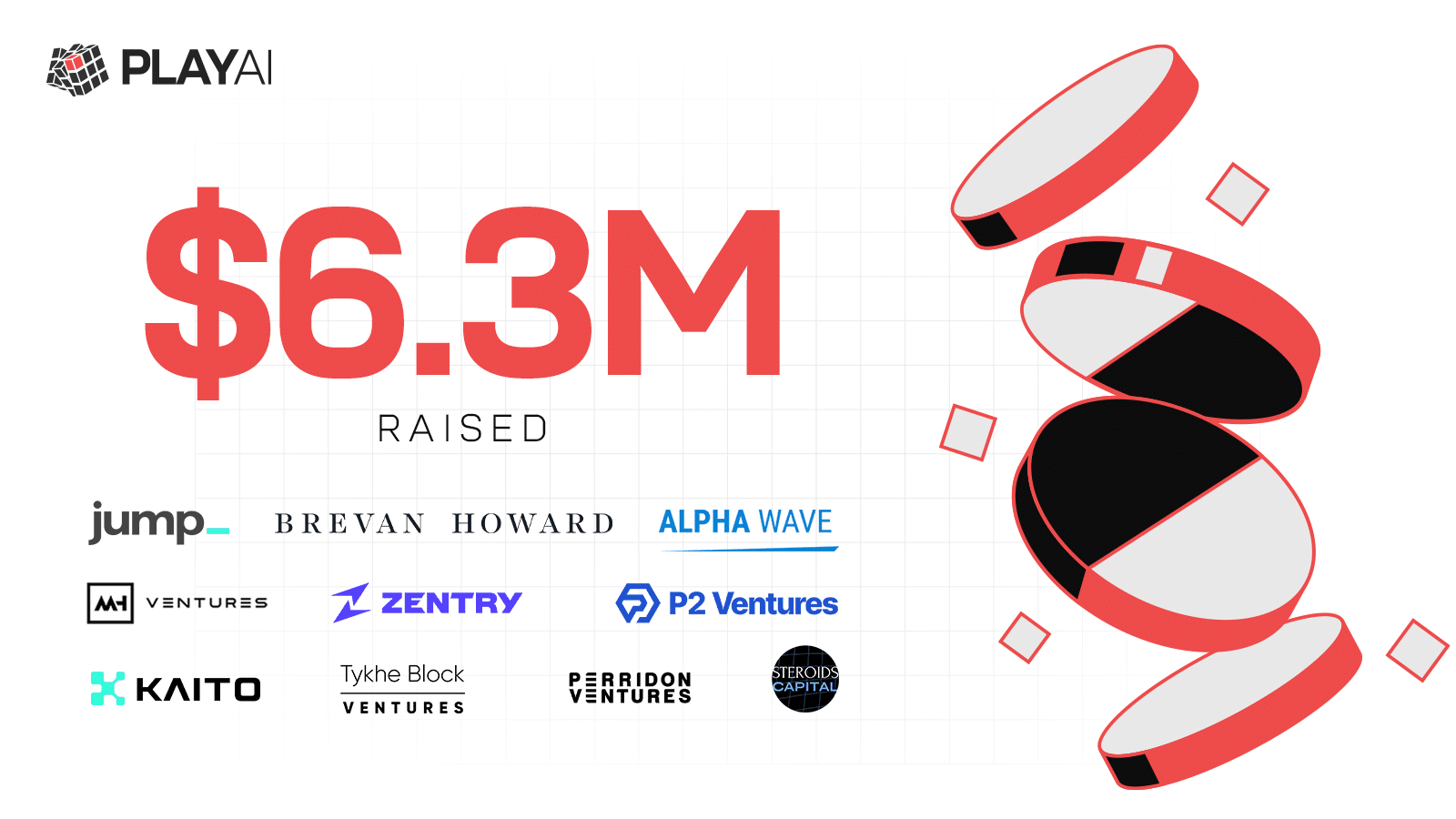

PlayAI has just announced the official launch of its mainnet following a $2 million community fundraising led in partnership with Kaito. This news brings the project's total funding to $6.3 million, reinforcing its mission: to democratize automation powered by blockchain-native AI.

Following new strategic funding and the upcoming mainnet launch, PlayAI has now raised $6.3 million, accelerating its mission to make AI-powered automation native to the blockchain.