Uncertainty hovers over crypto markets as macroeconomic conditions slow down the usual November bullish momentum. Will bitcoin manage to maintain its reputation as the best performing month of the year?

Archive 2025

Michael Selig, nominated to lead the CFTC, will face his Senate confirmation hearing on November 19 as lawmakers review his approach to crypto regulation.

DBS and J.P. Morgan are working together to enable seamless tokenized deposits between banks while exploring interoperability across blockchain platforms.

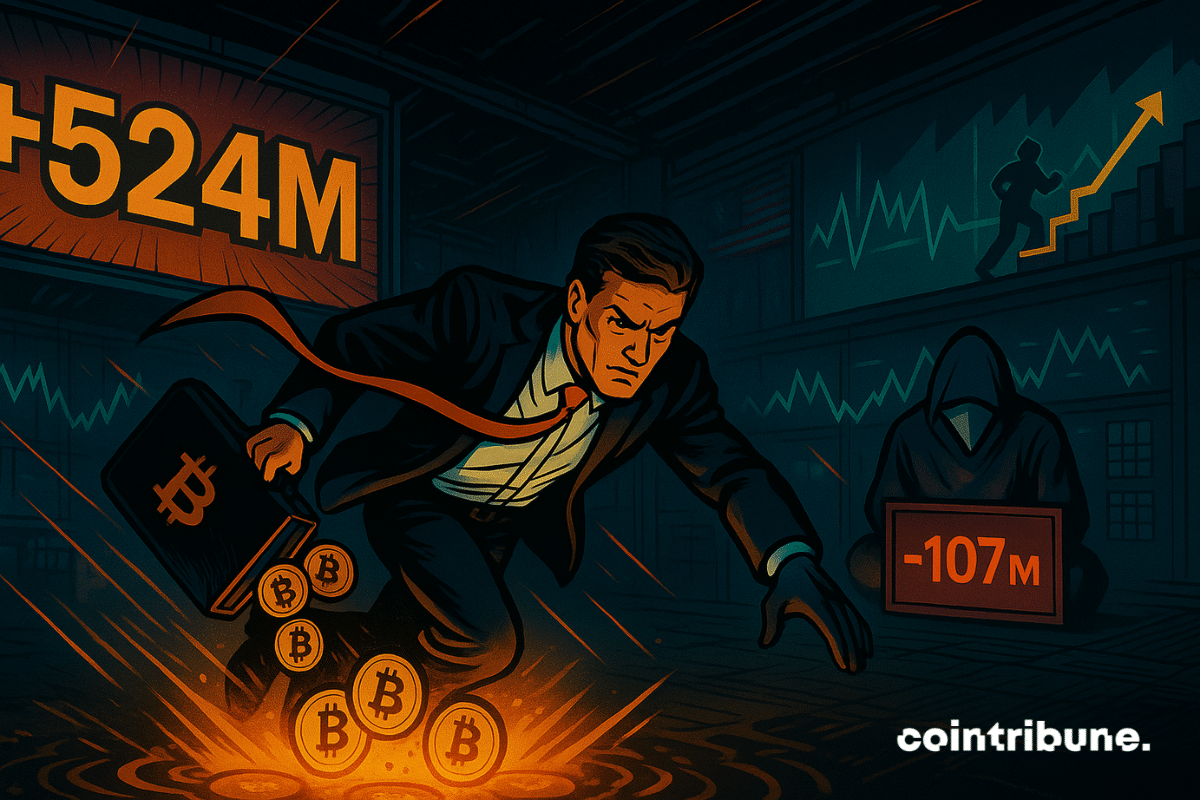

Bitcoin explodes in ETFs with $524M in 24h: simple rebound or massive return of institutions? Complete analysis here!

Coinbase’s planned $2 billion acquisition of BVNK, a stablecoin infrastructure firm, has collapsed, ending what could have been one of the largest deals in crypto history. The decision, reached during the due diligence stage, was mutual, according to statements from both companies.

The end of the longest shutdown in US history could have marked a turning point for the crypto market. Unlike in 2019, the expected euphoria did not materialize. Bitcoin is retreating, investors are doubtful. Why doesn't this political restart trigger the hoped-for explosion in prices? Between regulatory paralysis, blurred economic signals, and political uncertainties, the market struggles to find new momentum. This complex situation weakens investors' expectations.

A former BlackRock executive has just thrown a wrench in the works. For him, Ethereum will not be just another blockchain. This network will actually become the digital backbone of all global finance. A bold vision as crypto has just lost a key support at 3,600 dollars.

Morgan Stanley warns of a possible turning point in the crypto market. In a recent analysis, the bank mentions an end of cycle for Bitcoin and recommends investors to take their gains. In a context of persistent volatility, this signal from a major institution invites caution.

Under Atkins, the SEC pulls out the highlighter to sort tokens. Congress, meanwhile, is stalling. And crypto projects? They are sharpening their passports for more stable skies.

Visa is taking another major step in digital payments with a new pilot program that allows U.S. businesses to send stablecoin payouts directly to crypto wallets. Announced at the Web Summit in Lisbon, the initiative connects traditional bank accounts to blockchain-based transfers, aiming to speed up cross-border payments and support the expanding freelance economy.