Asia Ditches Treasuries Amid Rising US Debt Fears

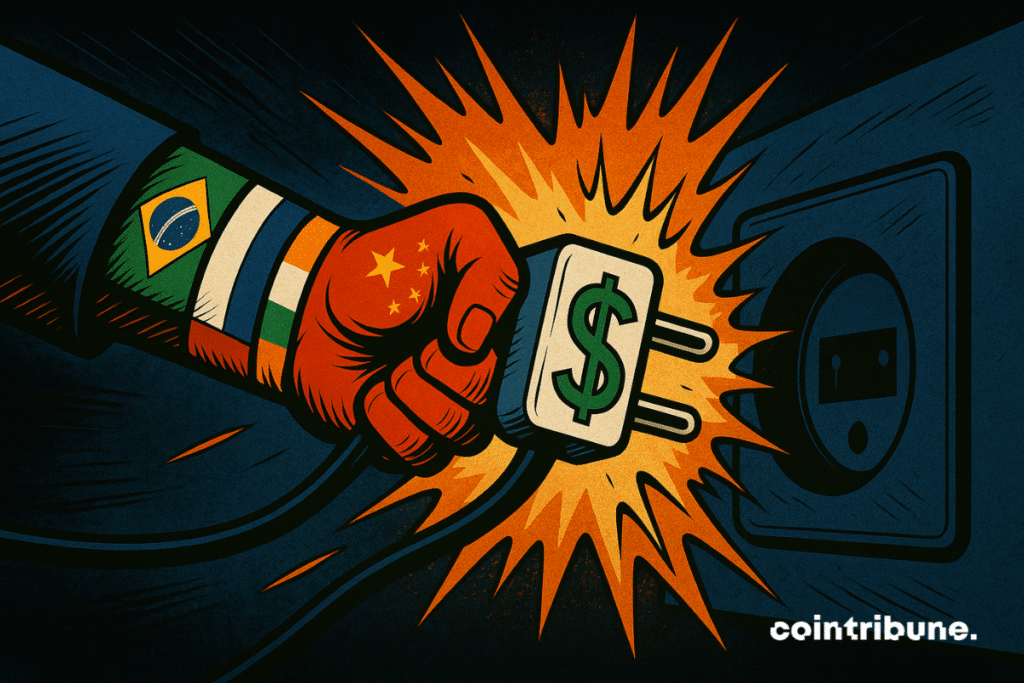

What if one of the largest capital transfers in modern history was already underway, away from the spotlight? Faced with rising geopolitical tensions and the faltering dollar-dependent model, Asian nations, led by the BRICS, have begun withdrawing about $7.5 trillion in American assets. This reorientation, based on strategic choices and concrete data, challenges Western financial foundations and heralds a silent but decisive reshaping of the global monetary order.

In Brief

- Asian countries, notably the BRICS, are considering withdrawing up to $7.5 trillion of assets from the United States.

- This gradual disengagement has already begun, with China having sold $150 billion of U.S. Treasury bonds in 2024.

- The BRICS now prioritize diversifying their reserves, especially towards gold, considered safer than the dollar.

- If this trend intensifies, the U.S. risks losing its central position in the international monetary system.

An Asian Disengagement Already Underway

China, an influential BRICS member, is progressively reducing its holdings of U.S. Treasury bonds, a decision that is causing growing concern in global markets.

For several months, a discreet but consequential movement has been emerging. Other BRICS members and several Asian nations are following this momentum by also initiating a withdrawal from American financial assets, mainly Treasury bonds.

This withdrawal is already underway and fits into a logic of diversifying foreign reserves. Here are the most important factual elements:

- China has sold $150 billion of U.S. Treasury bonds in 2024, in a clear effort to reduce its dollar exposure ;

- This disengagement is not limited to China: other emerging economies within the BRICS bloc have begun liquidating their dollar assets to convert them, notably, into gold, considered safer ;

- Such a trend marks the end of a dominant economic model for decades, where Asia exported to the United States and then reinvested the revenues in U.S. debt ;

- Experts estimate that $7.5 trillion of Asian assets are still exposed to U.S. markets, a colossal sum, whose potential withdrawal would represent an unprecedented event for the American economy ;

- This shift is directly linked to the growing loss of confidence in the U.S.’s budget stability, whose debt has surpassed $36 trillion.

This strategic realignment is therefore not a theoretical anticipation: it is already underway. It stems from a desire to regain control over sovereign reserves, in a context of increasing trade tensions, geopolitical fragmentation, and growing distrust towards the United States’ financial trajectory.

The Rise of a New Financial Order Led by Emerging Countries

Beyond asset sales, it is the very logic of the post–World War II system that is being questioned. As Virginie Maisonneuve, head of investments at Allianz Global Investors, states: “We are witnessing a change in the world order, and I do not think we will return to the way things were before.”

According to her, this movement is largely linked to China’s rise, especially in technological and economic fields, which pushes emerging countries to assert their financial sovereignty more strongly.

Alongside the disinvestment, many countries are strengthening their gold reserves and moving away from the dollar, which is increasingly seen as risky. The U.S. budgetary context, with debt now exceeding $36 trillion, increasingly worries foreign decision-makers.

They fear a medium- to long-term loss of value of the greenback, and consequently a devaluation of their holdings. This phenomenon now affects all of Asia beyond the BRICS, in a potentially irreversible monetary diversification movement.

If this trend confirms and accelerates, the consequences could be severe for the United States. Losing their privileged status as a destination for foreign reserves would reduce their financial influence, as well as erode their ability to finance themselves at low cost. The declining dollar could then lose part of its global dominance with disastrous consequences, benefiting alternative assets or new reserve currencies that certain BRICS members, led by China, seem determined to promote. The chapter of the dollar-centered international monetary system is not yet closed, but the first lines of its epilogue may already be written.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.