Quantum computing, often seen as a sword of Damocles hanging over blockchains, has fueled fantasies and speculations for more than a decade. In this universe of uncertainty, Vitalik Buterin, co-founder of Ethereum, presents a contrarian diagnosis: lucid, quantified, but above all, confident. For him, the arrival of machines capable of breaking current cryptographic foundations is not a fatality, it is a deadline. And Ethereum will be ready for it.

Home » Archives for Evans SELEMANI » Page 9

Evans S.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

For a long time, bitcoin reigned supreme as the uncontested master of the cryptocurrency realm, particularly in the area of exchange-traded funds (ETFs). But today, a turning point is taking place. Discreetly, methodically, Ethereum is beginning to nibble away at market shares and is capturing the attention of institutional investors. A recent report from CoinShares highlights this astonishing dynamic: ether is no longer just following; it is asserting itself. Behind the numbers lies a reality taking hold: the dominance of bitcoin in crypto ETFs is no longer so evident.

Bitcoin has just crossed a symbolic and historical milestone: it surpasses Amazon in the stock market with a valuation of over 2.4 trillion dollars. It is no longer just a digital currency: it is now one of the most powerful assets on the planet. Decoding a silent but irreversible economic earthquake.

Sometimes, all it takes is a single week of silence to sow doubt. When Michael Saylor stopped his weekly bitcoin purchases, speculation ran rampant. Strategic pause or sign of fatigue? The answer hit skeptics like a slap in the face: a massive new buyback of BTC, accompanied by a colossal fundraising effort. Saylor's obsession with the digital asset is only intensifying, and behind this frantic accumulation lies a much more ambitious logic than that of a mere speculative bet.

As Bitcoin soars to new heights, some analysts shout about rational euphoria. Others, more cautious, remind us that the party may be short-lived. Behind the dizzying numbers and cascading records looms a shadow: that of the American Federal Reserve. For while markets anticipate a drop in rates, JPMorgan CEO Jamie Dimon plays the party pooper and suggests otherwise. A bad surprise from the Fed could derail Bitcoin's momentum, especially in a context where retail investors remain strangely absent. Is the king of cryptos running on empty? Analysis.

By continually reaching new heights, Bitcoin has finally surpassed them. This week, the pioneer of cryptocurrencies not only broke its own record: it has also pulled a host of stock values along with it, from exchange giants like Coinbase to the most aggressive miners. A spectacular surge that speaks volumes about the market's mindset: crypto is no longer on the sidelines; it is taking center stage. And when it ignites, an entire parallel economy, now institutional as well, is set ablaze. A breakdown of a week that will be remembered in the annals of digital finance.

Crypto is at a crossroads. Under the cold neon lights of the Capitol, the fate of a digital world is being decided with ink and calculations. Starting from July 14, Washington begins its "Crypto Week": a decisive parliamentary sequence where three major bills will be debated. Three texts, three possible directions for the future of digital assets in the United States.

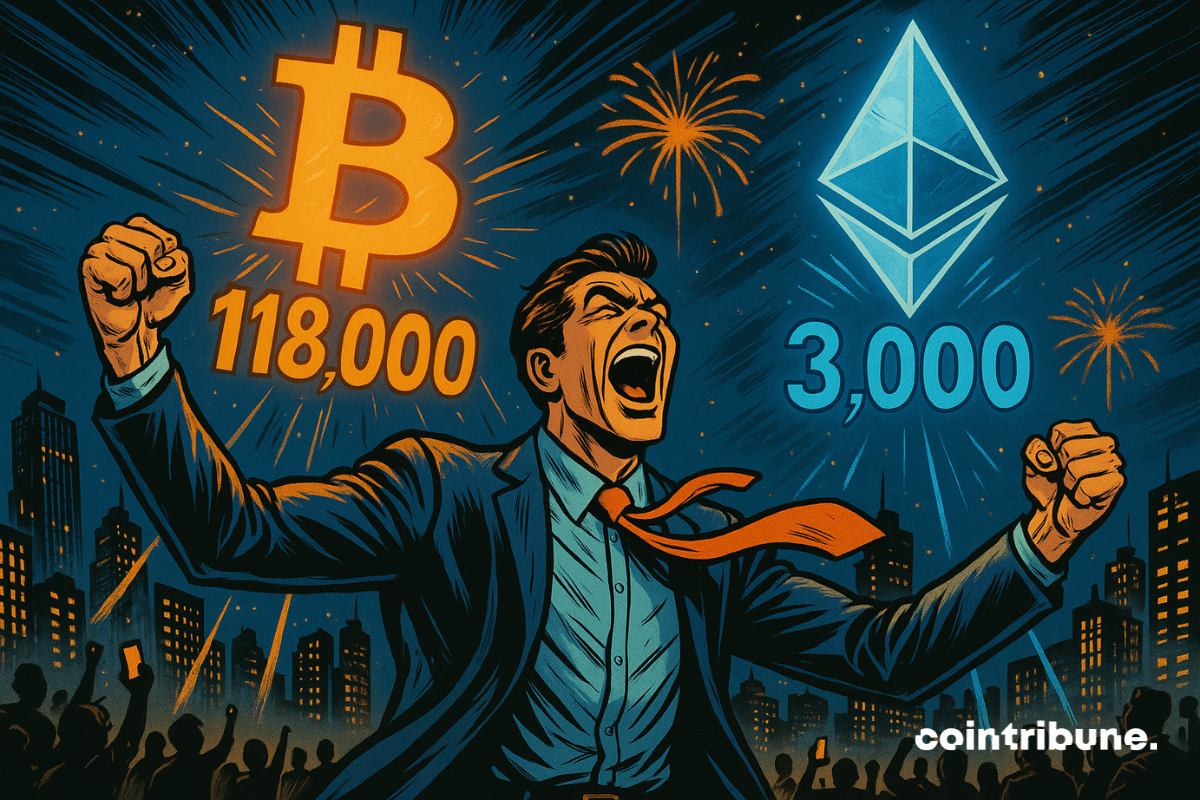

It is no longer just a sudden rise; it is a controlled explosion: bitcoin has just reached $118,000, driven by an institutional appetite rarely seen in the history of crypto. Meanwhile, Ethereum exceeds $3,000, like a second wind in this dizzying ascent. But how far can this madness go?

Bitcoin continues to defy predictions. While some declared it to be out of breath after its recent peaks, the market shows clear signs of a resurgence. This is no longer just fevered speculation: on-chain data paints a much more nuanced, yet terrifically optimistic picture. Heading towards $130,000, the indicators proclaim. The inflection point is approaching, and the signals are clear: Bitcoin is far from having said its last word.

No one bets on a campfire when the rain is falling. Yet, NFTs continue to crackle, even in the downpour. While trading volumes shrink quarter after quarter, sales are holding firm: $2.82 billion collected in the first half of 2025. Fewer dollars per transaction, but more hands are reaching out. The market is no longer frantic; it breathes differently, calmer, denser. And that might be the best news crypto has had in months.

A star shines brighter than the others in the saturated arena of neobanks: Revolut. In London, ambitions are no longer hidden. With a funding round of one billion dollars in preparation, the company aims for a colossal valuation of 65 billion dollars. And at the heart of this ascent? One word: crypto. Because it's not just a diversification, it's a strategy. A conviction. A compass.

Although Bitcoin is shaking up the markets and gradually establishing itself as a pillar of modern finance, it remains curiously discreet in the columns of major traditional media. In the second quarter of 2025, while crypto reached a new historical peak, its media presence was revealed to be meager. This absence is all the more striking as it does not reflect either the intensity of its adoption or the economic upheavals it brings about. The latest report from the Perception firm presents a clear observation: Bitcoin is unsettling, and some prefer not to talk about it!

The past never dies in the blockchain. More than ten years after the Mt. Gox scandal, a bitcoin address containing the equivalent of 8.7 billion dollars resurfaces... targeted by a phishing attempt as discreet as it is ambitious. At the crossroads of cybercrime and digital memory, this new episode raises a troubling question: are the forgotten treasures of bitcoin doomed to become the eternal prey of modern fraudsters?

When the crypto world dreams of physical anchoring, it sometimes gives birth to projects that are as bold as they are vague. The latest? An initiative from the TON Foundation aimed at offering a 10-year Golden Visa to Toncoin investors. The idea, appealing on paper, was quickly dampened by a blunt denial: the authorities of the United Arab Emirates never approved the program. Behind the announcement effect lies the ongoing tension between decentralized innovation and state sovereignty.

Bitcoin is advancing, unperturbed, flirting with $110,000. The bullish momentum seems unstoppable, but beneath the surface, signals are multiplying. Trapped liquidity, extreme euphoria, macro tensions: this week could very well be the one for crossing over... or a false start.