European regulators are increasing pressure on TikTok to strengthen how it verifies the age of its users. In response, the video platform is introducing a new system designed to better detect accounts run by children under 13 and remove them when necessary. According to reports, the rollout will begin in Europe in phases over the coming months, following a year of testing.

Home » Archives for James Godstime » Page 3

James G.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

U.S. lawmakers have put a major crypto market structure bill on hold after strong pushback from Coinbase. Fresh criticism from the exchange’s chief executive raised doubts about whether the proposal could move forward without changes. As a result, Senate Banking Committee members delayed a planned markup while reassessing industry and regulatory concerns tied to the draft.

Crypto scams reached a new level of speed and scale in 2025 as artificial intelligence tools made fraud more convincing and harder to detect. A new report from blockchain analytics firm Chainalysis shows that scammers are stealing more money per victim while running cheaper and wider operations. Losses tied to crypto scams are now estimated at $17 billion for the year, the highest level ever recorded.

Gold and silver closed 2025 at record highs, and that rally has accelerated into early 2026. A combination of strong demand, constrained supply, and rising political uncertainty is driving investors toward precious metals. New concerns about central bank independence have further intensified buying pressure.

U.S. Senate lawmakers are advancing efforts to establish a clear regulatory framework for crypto markets, marking a pivotal moment for digital asset oversight in the United States. Two Senate committees are preparing to debate competing versions of a long-anticipated market structure bill, setting the stage for negotiations that could determine how the industry is governed for years to come.

Investment firm VanEck expects the first quarter of 2026 to favor risk assets, citing clearer fiscal policy, steadier monetary signals, and renewed interest across several major investment themes. After years of uncertainty, improved visibility is shaping how investors position their portfolios heading into the new year.

Former New York City Mayor Eric Adams unveiled a new memecoin project on Monday, drawing swift attention from both local media and crypto analysts. The token, called NYC Token, was introduced during a press conference in Times Square shortly after Adams officially left office on Jan. 1. Within hours, on-chain data began raising concerns about the project’s liquidity structure and risk profile.

Reports of a potential large-scale Instagram data leak have sparked widespread concern, as cybersecurity researchers and Meta offer sharply different accounts of what occurred. While a security firm claims millions of user records are being sold online, Meta insists its systems were not breached. The conflicting narratives have left many users uncertain about the safety of their accounts.

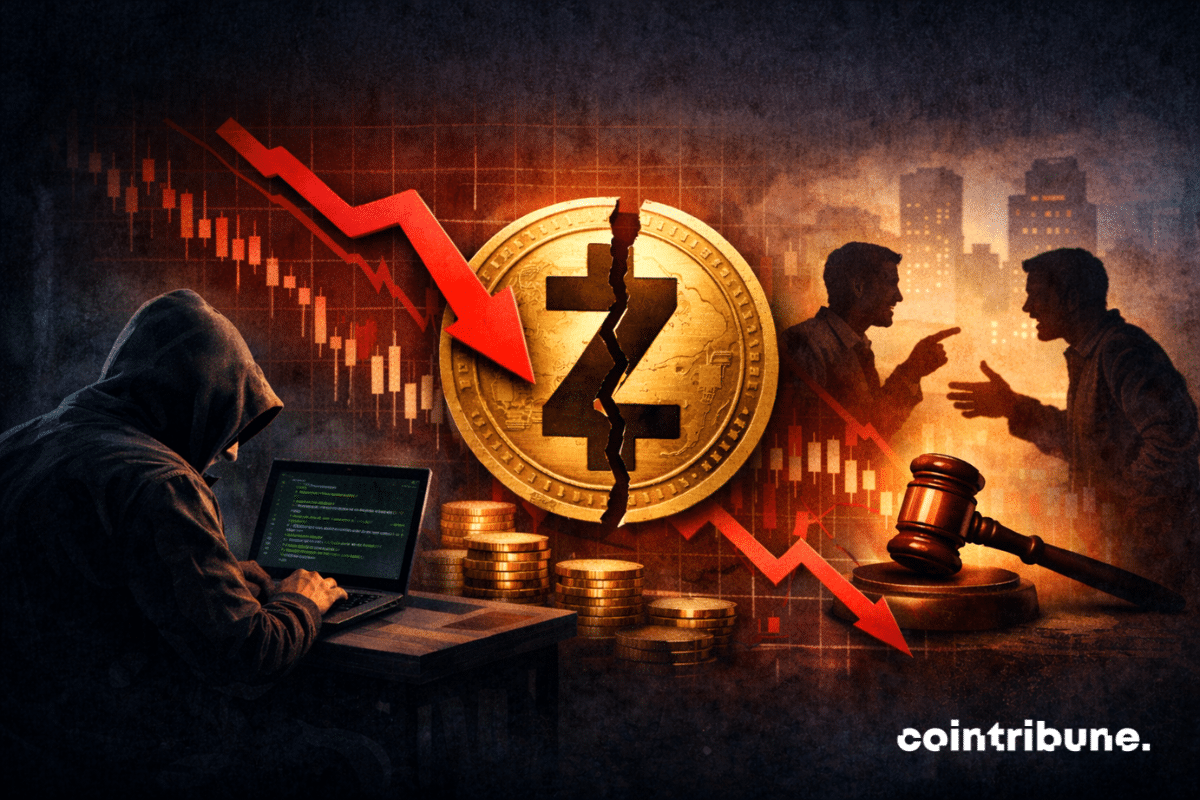

Zcash’s developer activity has fallen to its lowest level since late 2021, as governance disputes and prolonged market weakness continue to cloud sentiment. The slowdown comes amid a sustained decline in ZEC’s price, even as large holders continue to accumulate the token. At the same time, these trends point to an increasingly complex outlook for one of the crypto sector’s longest-standing privacy-focused networks.

A new advertising campaign tied to crypto policy has stirred debate in Washington as lawmakers prepare to review a major market structure bill. Ads airing on Fox News urge viewers to pressure senators to support legislation that excludes decentralized finance provisions. The timing of the campaign coincides with key Senate activity on crypto regulation.

A crypto user known as “The Smart Ape” lost about $5,000 from a hot wallet during a short hotel stay. No phishing links were opened, and no fake sites were used. Instead, a chain of small missteps created the conditions for a delayed wallet drain. Security researchers say the case shows how everyday actions, both online and offline, can combine into a serious loss.

Rising global sanctions and increased state involvement drove illicit cryptocurrency activity to record levels in 2025. Data indicates that sanctioned entities were the primary source of these flows, even though illegal use continued to account for only a small portion of total crypto transactions. Analysts describe the shift as a response to mounting geopolitical pressure rather than a breakdown in compliance.

Solana Mobile has confirmed plans to distribute its new ecosystem token, SKR, through an airdrop scheduled for January 20. Distribution will target second-generation Seeker smartphone users and developers building apps for the device. Earlier Saga phone owners will not qualify, marking a shift toward the newer hardware.

Ledger users are being targeted by a new phishing campaign following a data breach at Global-e, a third-party e-commerce provider used by the hardware wallet company. Attackers are using stolen order information to send personalized scam emails that impersonate Ledger and promote false claims of a merger with rival wallet maker Trezor.

Efforts to establish clear rules for the U.S. crypto market are likely to take longer than many industry participants expect. An analysis from TD Cowen indicates that while passage remains possible in the near term, political dynamics in Washington increase the likelihood of delays. Approval may not occur until 2027, with full implementation extending to 2029.