The stability of the market's largest stablecoin is questioned. On November 29, the S&P agency downgraded USDT's ability to maintain its dollar peg. Tether, through its CEO Paolo Ardoino, denounces a biased analysis and defends its figures. This standoff between a central crypto player and a major financial institution reignites the debate on reserve solidity and trust in the ecosystem.

Home » Archives for Luc Jose Adjinacou » Page 3

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

What if Ethereum was worth much more than the market thinks? According to a study conducted by CryptoQuant, 9 valuation models out of 12 estimate that ETH is currently largely undervalued. For Ki Young Ju, CEO of the platform, these analyses reveal a significant gap between the current price of Ether and its real theoretical value. This finding rekindles the debate on how cryptos should be valued.

Bitcoin ends this year on a familiar note. Down more than 36% from its annual highs, the asset eerily replicates the movements of the 2022 bear market. This correlation alarms analysts as crypto ETFs register positive inflows again. Between the return of institutional capital and memories of a previous crash, the market oscillates between concern and hopes of a rebound.

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

The crypto market gave way under the pressure of its own leverage. In a few days, nearly 8 billion dollars of open interest on Bitcoin futures contracts were liquidated, triggering a brutal purge of speculative positions. Behind this shock, a rebalancing is emerging, suggesting that a stabilization cycle could begin.

While the Bitcoin market remains under pressure, an analyst suggests that the bottom may have been reached. Contrary to the climate of distrust, he envisions a rebound towards 100,000-110,000 dollars, reigniting speculation about a trend reversal. This scenario, based on precise technical indicators, contrasts with the prevailing sluggishness and captures investors' attention.

After 18 days in the extreme fear zone, the crypto market shows a first sign of relief. The Crypto Fear & Greed Index rises slightly, finally leaving its lowest level. This rebound occurs while November, traditionally favorable to Bitcoin, ends in uncertainty.

What if the market was massively wrong about bitcoin? For André Dragosch, head of research at Bitwise Europe, the current context oddly resembles that of March 2020, during the crash caused by the pandemic. In a tense post-halving climate and facing contradictory macroeconomic signals, he believes bitcoin today offers one of its best risk/reward profiles since the health crisis. This statement shakes certainties and reignites the debate on the timing of market entry.

Do Kwon, former DeFi star, is now at the center of an unprecedented judicial scandal. Less than two years after the collapse of Terra-Luna, which swallowed $40 billion, he is trying to avoid a heavy sentence in the United States. His goal is to convince the court to limit his sentence to five years in prison. Two weeks before his hearing, this request reignites debates about the responsibility of crypto founders in the face of the devastating consequences of their projects.

Monero (XMR) gained more than 23% this week, while Zcash (ZEC) dropped by nearly 25%. Such a gap highlights the high volatility of the privacy coins market, in a context of low activity related to Thanksgiving. This divergence between two key privacy assets raises questions about the internal dynamics of the sector.

The imminent launch of a structured product on bitcoin by JPMorgan is causing reactions. For part of the crypto community, this is not just a simple financial innovation, but a targeted offensive against actors like Strategy. As bitcoin gains ground as a reserve asset, the divide between traditional finance and pro-BTC strategies becomes clearer. Behind the apparent neutrality of the markets, some denounce an attempt to influence aimed at weakening the companies most exposed to the asset.

Bhutan surprises by entering the Ethereum universe. This small Himalayan state staked 320 ETH, nearly one million dollars, via the Figment validator, thus asserting a clear strategy of integration into the blockchain. Far from a simple investment, this initiative is part of a broader technological shift, where digital sovereignty and public infrastructure meet on Ethereum. A rare approach at the state level, redefining the contours of national engagement in the crypto ecosystem.

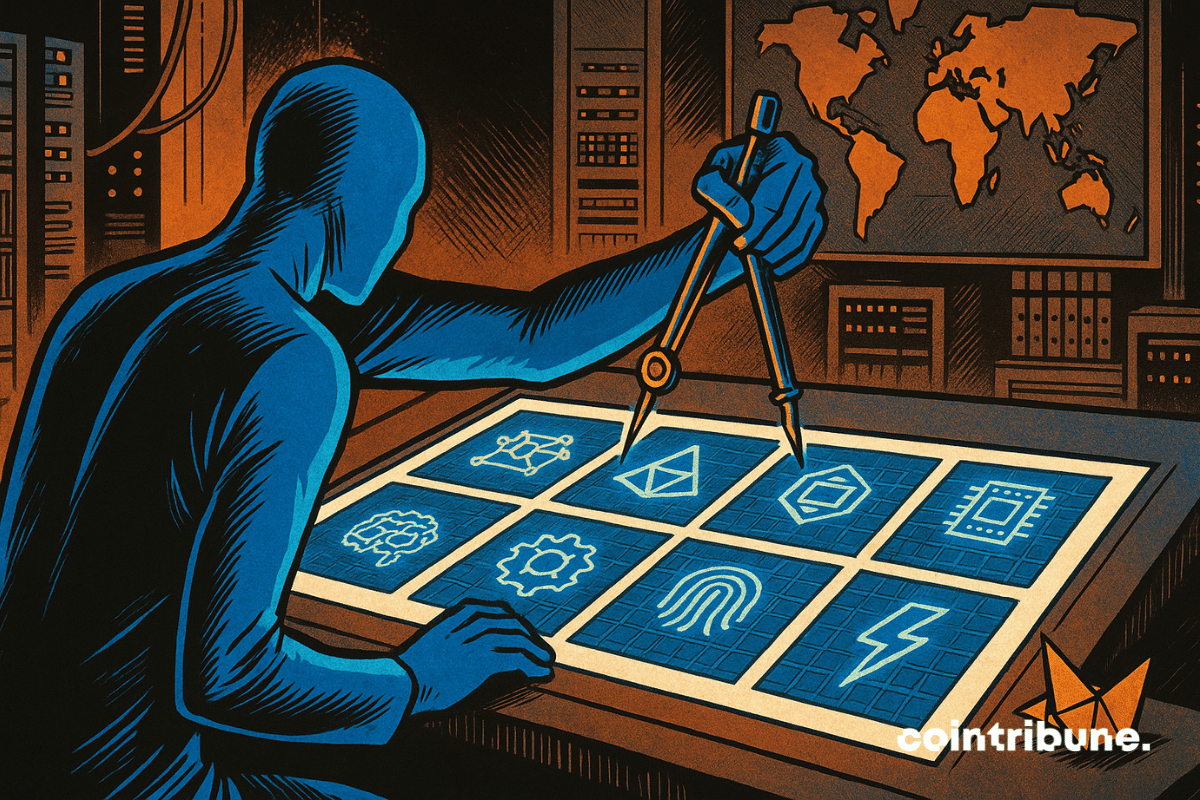

Coinbase Ventures has just unveiled its investment strategy for 2026, outlining the strong points of a changing Web3 ecosystem. Nine key areas have been identified, revealing the sectors where capital could soon flow. More than a simple manifesto, this roadmap lays out the technological and economic bets of one of the most influential players in the crypto industry, a strong signal sent to developers, investors, and builders of the decentralized web.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

Bitcoin has fallen more than 22% in one month, casting doubt on its momentum. Yet, behind this pullback, several signals point to a possible return to the symbolic threshold of $112,000. While markets are restless, institutional and retail investors watch four key factors likely to revive the bullish trend. In a context of macroeconomic uncertainty and tension in derivative markets, the scenario of a rebound can no longer be ruled out.