BitMine Immersion, chaired by Tom Lee, has solidified its position as the largest Ethereum treasury holder after its latest accumulation. The firm disclosed on Monday that its combined crypto and cash holdings now stand at $10.8 billion. The company’s aggressive acquisition strategy has pushed its Ethereum balance above 2.15 million ETH, highlighting its determination to dominate long-term blockchain investments.

Home » Archives for Peter Mwenda

Peter M.

Peter is a skilled finance and crypto journalist who simplifies complex topics through clear writing, thorough research, and sharp industry insight, delivering reader-friendly content for today’s fast-moving digital world.

President Donald Trump has renewed his efforts to remove Federal Reserve Governor Lisa Cook just days before the central bank is expected to deliver its first rate cut in nearly a year. The case has turned into a controversial legal battle that is now overlapping with one of the most significant policy decisions in the US economy. As the administration continues with its appeal, new evidence looms to erode its claims and heightens its political and financial stakes.

Tron’s decision to lower transaction fees has quickly reduced the daily revenue earned by its block producers. Within 10 days of the fee change, revenue dropped sharply, according to recent on-chain data.

OpenSea has quietly doubled its trading fees just days before launching its long-awaited SEA token. The platform will now charge 1% on NFT trades, up from 0.5%, marking a 100% increase. The adjustment, announced by Chief Marketing Officer Adam Hollander in a lengthy update on X, takes effect September 15.

Sharplink Gaming Inc. has kicked off a $1.5 billion share buyback plan as its stock trades below the company’s net asset value (NAV). The buyback signals a strategic effort to enhance shareholder value while market sentiment currently undervalues its Ether treasury holdings. The company, the second-largest Ether treasury firm, is leveraging this move to strengthen investor confidence and optimize capital allocation.

Apple’s iPhone 17, launched this month at a stable $799, is drawing attention for reasons beyond design and performance. For crypto holders, the device has suddenly become far cheaper in digital asset terms. Buyers now need only 0.0072 BTC or 0.1866 ETH to purchase it. That is almost half of what was required for the iPhone 16 a year ago.

OpenSea, the leading NFT marketplace, has launched a $1 million reserve to acquire and preserve culturally important digital art. The reserve began with the purchase of CryptoPunk #5273, marking a new chapter for the platform in showcasing NFTs as historical and artistic artifacts.

El Salvador marked the fourth anniversary of its Bitcoin Law with a symbolic purchase of 21 BTC, just as analysts warned that September 8 often proves unfavorable for the cryptocurrency.

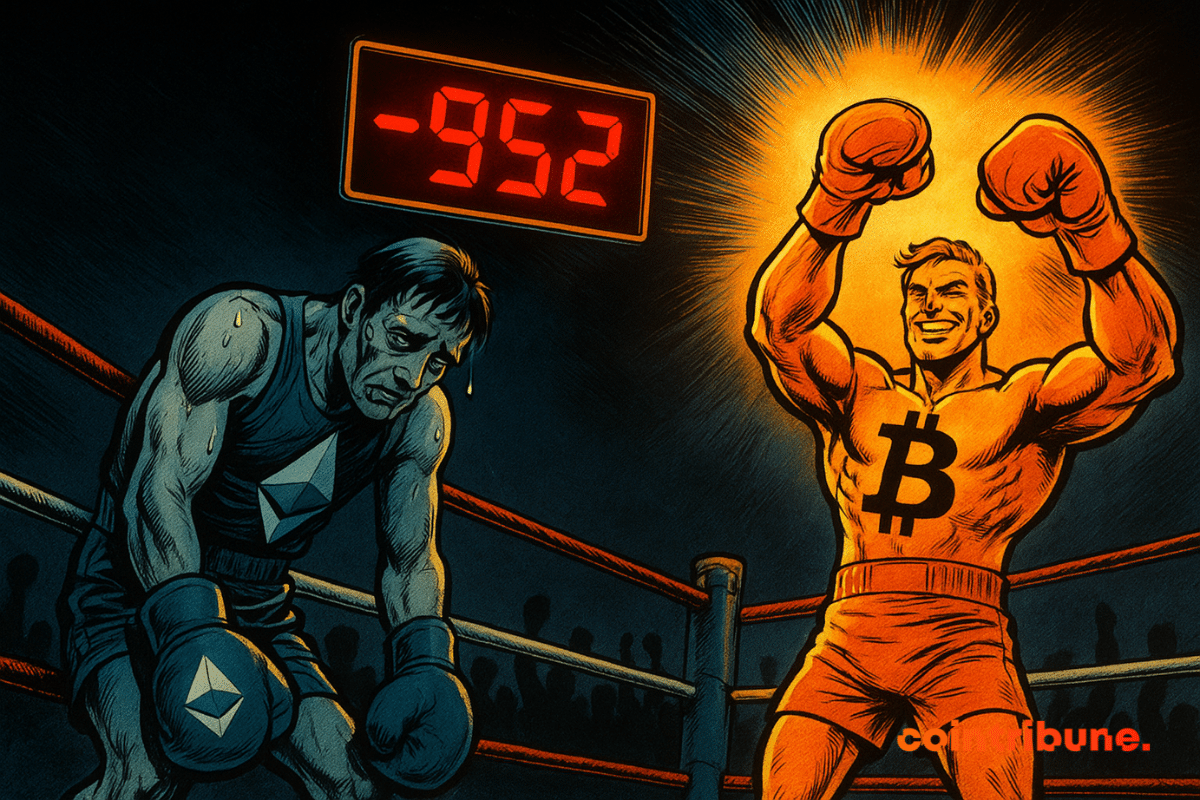

Spot Ether exchange-traded funds (ETFs) recorded $952 million in outflows over five trading days, raising concerns across digital asset markets. Investors reduced exposure to Ether products managed by major firms such as BlackRock and Fidelity, while capital shifted toward bitcoin ETFs. The withdrawals came during a period of rising recession fears and increased expectations of monetary policy easing in the United States.

Software supply-chain attacks are evolving in a disturbing way as cybercriminals use Ethereum smart contracts to hide malicious code within open-source libraries. Research presented by a security firm ReversingLabs shows that hackers now insert command-and-control instructions within blockchain contracts, complicating detection and closure by defenders. This approach signifies the increased complexity of malware distribution and blockchain becoming a tool of cybercrime.

The United States has leaped to the second spot on the Chainalysis 2025 Global Adoption Index due to regulatory clarity and increased ETF adoption. India retained its leading position as the third consecutive global leader, and Pakistan, Vietnam, and Brazil were the top five. This ranking reflects a broader trend, crypto adoption is expanding rapidly in both mature markets with clearer rules and emerging economies where digital assets address real financial needs.

Bitcoin’s recent 12% pullback has drawn attention, but on-chain data indicates that this correction is a normal phase in the market. Analysts say the decline is within historical patterns and reflects a healthy reset rather than the end of the ongoing bull cycle.

Anthony Scaramucci, the founder of SkyBridge Capital, has projected a turbulent path for Bitcoin before it eventually climbs to half a million dollars. Speaking with Coinage, the veteran investor warned that the cryptocurrency could face a sharp decline of up to 40%, even as he maintains confidence in its long-term potential.

United States spot Bitcoin exchange-traded funds (ETFs) are now driving billions in daily trades, rivaling global crypto exchanges. Data from CryptoQuant shows that US Bitcoin ETFs are becoming a major channel for institutional access to Bitcoin.

Bitcoin stands at a crossroad as traders anticipate a number of forthcoming macroeconomic announcements. At the time of writing, the flagship cryptocurrency was trading around $112,787, a small gain of 0.30% per day, but a weaker performance over the week. Despite the resilience of Bitcoin, analysts are cautious that the short run direction of Bitcoin will rely on how investors will respond to major levels of support and resistance in the coming days.