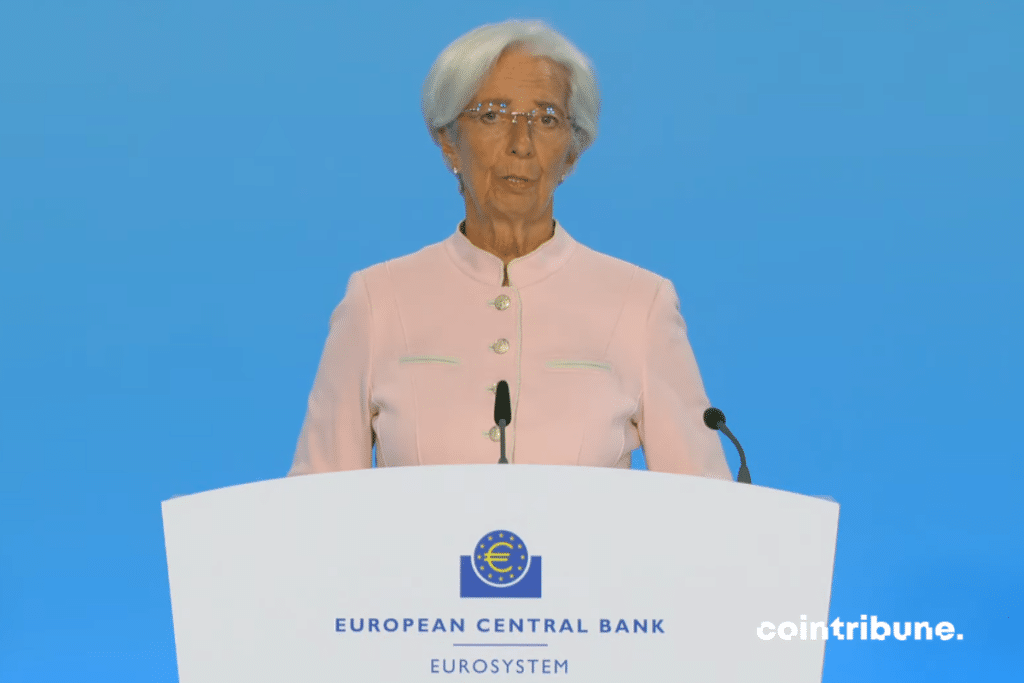

WATCH: ECB President Christine Lagarde says inflation continues to decline but is still expected to remain "too high for too long" https://t.co/K3Uu1haQHM pic.twitter.com/y5GLy7dc4R

— Bloomberg Markets (@markets) September 14, 2023

A

A

ECB: Several governors no longer want to raise rates

Fri 15 Sep 2023 ▪

3

min read ▪ by

Getting informed

▪

Crypto regulation

Will the ECB stop raising its key interest rate soon? Some governors hope so.

Last rate hike for the ECB?

The ECB has raised its key rate for the tenth time in a row. The rate at which private banks borrow from the ECB is now 4.50%.

The ECB’s new macroeconomic projections assume average inflation of 5.6% in 2023, 3.2% in 2024 and 2.1% in 2025.

These forecasts are questionable, given that oil is heading towards $100 a barrel. The ongoing war between NATO and Russia in Ukraine should not help matters this winter.

Christine Lagarde made it clear that “upside risks to inflation include further increases in energy and food costs”.

Overall, the ECB President notes that “inflation continues to fall”, but still expects “it to remain too high for too long”.

The key sentence in the ECB press release was:

“We consider that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target. Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.”

Asked about the governors’ vote, Christine Lagarde conceded that there was no unanimity. While a “solid majority” was achieved, this dissension suggests that monetary tightening is coming to an end.

Much will ultimately depend on what the United States does. J.P. Morgan no longer expects further rate hikes from the Fed. Goldman Sachs, for its part, expects rates to fall as early as next summer.

And how could it be otherwise, given that the annual amount of interest paid by the US government has now reached $800 billion. That’s more than the defense budget.

Rates can’t stay high for long. The debt is too high. We need only look to Japan for proof.

The physical limits to growth unfortunately promise a slowdown in growth. It will become increasingly difficult to repay the debt without creating more debt…

This runaway trend will force the Fed and ECB to bring out the money printing presses and cut rates. The reversal of monetary policy will be the main domino in the next wave of bitcoin’s rise.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.