Binance, Bybit, Hyperliquid… crypto exchanges targeted after historic crash

In 24 hours, 20 billion dollars of positions were liquidated, an absolute record. Triggered by US tariffs on China, this crash on October 10-11, 2025 revealed the flaws of crypto exchanges like Binance, Bybit and Hyperliquid. Traders denounce technical malfunctions and call for urgent regulation.

In brief

- A historic crypto crash triggered by Trump tariffs on China shattered records, with Hyperliquid, Bybit and Binance leading the losses.

- Technical malfunctions, token depegs (USDe, WBETH) and excessive leverage (100x) amplified the crisis, pushing traders to demand urgent regulatory investigations.

- Binance announced paying 283 million dollars in compensation to crypto users.

An unprecedented crash in crypto history

The October 2025 crypto crash will certainly go down in history. Indeed, between the 10th and 11th, many exchanges suffered billions of dollars in capitalization losses. Notably:

- Hyperliquid, which recorded 10.31 billion dollars in liquidations;

- Bybit, 4.65 billion dollars in liquidations;

- Binance, 2.41 billion dollars in liquidations.

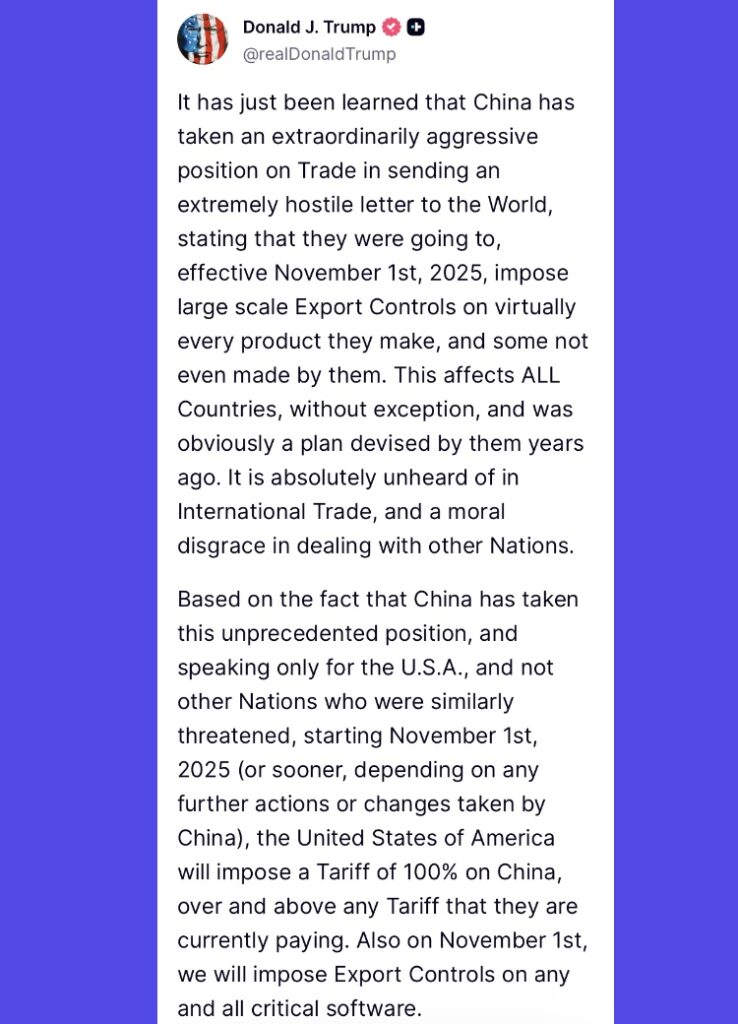

These figures exceed those of the FTX crisis or the 2020 crash. The trigger? Donald Trump’s announcement of a 100% increase in tariffs on China, which created chaos.

To make matters worse, an explosive mix hit the crypto market: ultra-leveraged positions (up to 100x), token depegs like USDe and WBETH, and extreme volatility. Traders, trapped, saw their accounts evaporate in a few hours! Some exchanges even temporarily froze withdrawals on their platform.

Crypto exchanges under fire

Binance, Bybit and Hyperliquid are accused of worsening the crisis through technical malfunctions. Many testimonies abound: unexecuted orders, frozen interfaces, prices detached from the market. Kris Marszalek, CEO of Crypto.com, demanded an investigation into their management of the crash, highlighting potentially misleading practices.

Hyperliquid, less known but leader in liquidations, is particularly scrutinized. Binance, despite its giant status, did not escape criticism, notably after the depegs of tokens on its crypto platform.

Binance compensates 283 million dollars: a historic first

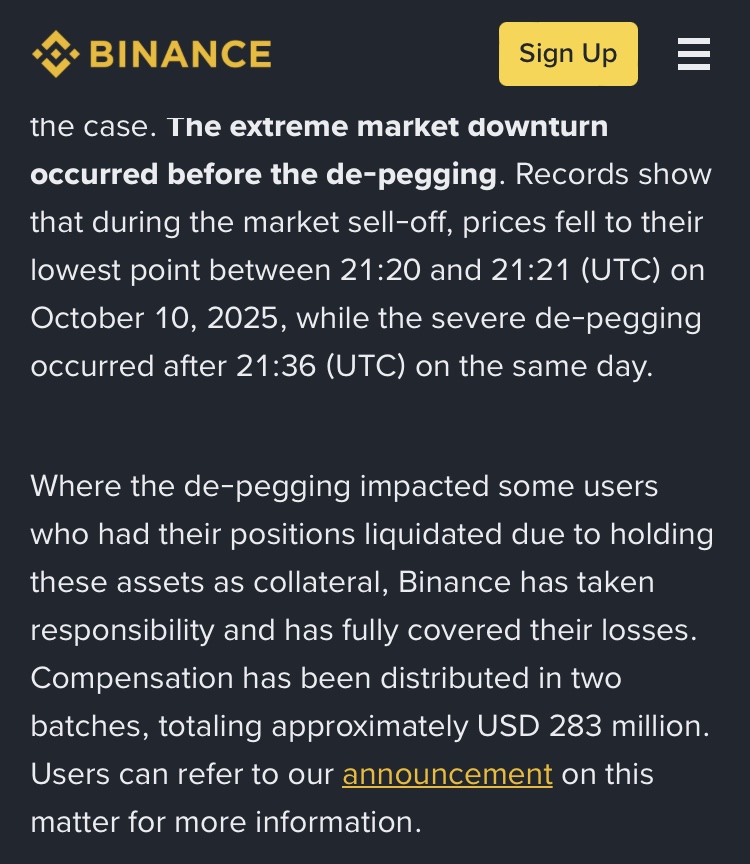

On October 12, 2025, Binance announced paying 283 million dollars in compensation to crypto users affected by the depegs of three major assets: USDe (Ethena), BNSOL (Binance Solana) and WBETH (Wrapped Beacon ETH). This compensation was distributed in two waves to traders impacted between 21:36 and 22:16 UTC on October 10, as well as to those who suffered losses during internal transfers or redemptions via Binance Earn.

According to Binance, the depegs — such as the drop of USDe to $0.66 — occurred after the crash, not before, ruling out rumors of a targeted attack. However, the crypto exchange admitted major technical flaws:

- Obsolete limit orders (sometimes dating back to 2019) exacerbated the drop of tokens like ATOM;

- A display issue made it appear that some assets completely crashed to 0 dollars (e.g., IOTX/USDT) due to a reduction in decimals allowed for price movements;

- Speculation persists about exploitation of internal oracles (via the “Unified Account” system) before the switch to external oracles planned for October 14, which could have amplified price discrepancies.

To prevent new incidents, Binance has promised:

- Integration of buyback prices into benchmark indices;

- A price floor for USDe;

- A review of liquidation mechanisms.

The responsibility of crypto exchanges: protect or compensate?

The massive liquidations of October 2025 highlighted a key issue: should crypto exchanges just compensate after crises, or do they have the obligation to prevent them? Binance, by reimbursing 283 million dollars, set an example, but this compensation must not mask the technical and organizational failures at the origin of the problem. Especially since bitcoin and ethereum suffered colossal losses, while more than 1.6 million traders were affected, some losing millions within minutes.

Platforms thus have a dual responsibility: securing users’ funds and ensuring market stability. This involves:

- Regular audits;

- Circuit-breaker mechanisms;

- Limitation of excessive leverage.

Regulators, such as the SEC in the United States or the AMF in Europe, will have to impose strict rules to avoid repeated scandals. Investor confidence will now depend on the ability of crypto exchanges to combine innovation and protection, otherwise new crises could arise.

This crash marks a turning point for the crypto industry. Exchanges, once untouchable, are now under pressure. Calls for regulation grow louder, but answers are slow. Trust, once lost, is hard to rebuild. If authorities don’t respond quickly, traders might turn to more transparent alternatives… or leave the market. One question remains: can centralized exchanges still be trusted after such a fiasco?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.