Bitcoin at $60,000: K33 estimates the capitulation is over

Bitcoin hit $60,000 last week amid widespread panic. According to research firm K33, this plunge is not just another correction but indeed the end of capitulation. So, is the worst really behind us?

In brief

- K33 identifies capitulation conditions in spot markets, ETFs, and derivatives during BTC’s drop to $60,000.

- Bitcoin’s daily RSI fell to 15.9, its sixth most extreme oversold level since 2015.

- K33 anticipates a prolonged consolidation phase between $60,000 and $75,000 in the coming weeks.

K33 declares capitulation, signals that don’t lie

Vetle Lunde does not mince his words. In the report published Tuesday evening by K33, which he leads the research for, he states that the bitcoin drop to $60,000 in early February exhibits all the characteristics of a local bottom, and the supporting indicators are plentiful.

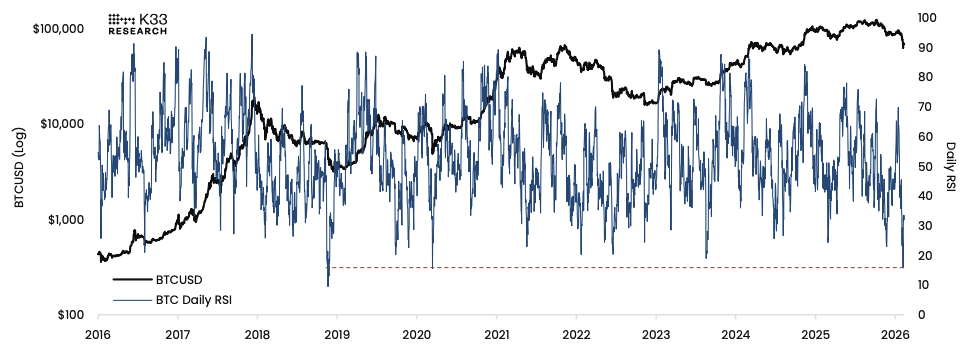

The daily RSI plunged to 15.9, its sixth highest oversold level since 2015. Only March 2020 and November 2018 showed lower values. Yet, these two episodes coincided with major cycle lows. Hard to ignore the comparison.

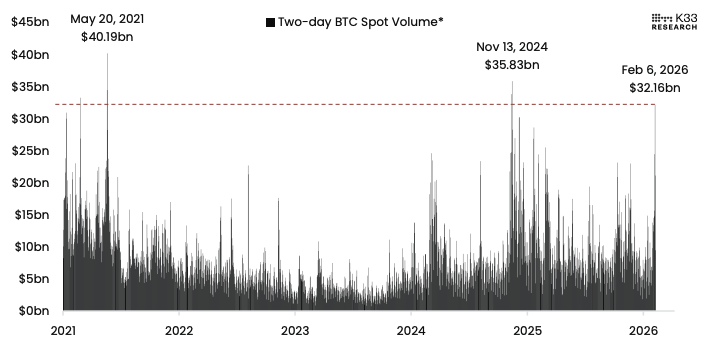

On the volume side, the figures are just as telling. On February 6, the spot volume on a rolling two-day basis reached $32 billion, an all-time record. On February 5 and 6, volumes ranked in the 95th percentile two days in a row, a phenomenon seen only once in five years, during the collapse of FTX.

The Crypto Fear & Greed Index itself fell to 6, its second-lowest level ever recorded. A signal of extreme panic which, paradoxically, often precedes reversals.

Derivatives, Bitcoin ETFs, and volumes, the markets have spoken loudly

Derivatives markets amplified the signal. The annualized funding rate of perpetual swaps dropped to -15.46% on February 6, a level unseen since March 2023. Option biases shifted into “extreme defensive territory,” readings not seen since the Terra Luna collapse or FTX bankruptcy.

US spot Bitcoin ETFs also experienced a historic day. On February 5, iShares’ IBIT shattered its daily volume record, exceeding $10 billion traded.

That same day, capital outflows ranked among the five largest since these products were launched. Despite inflows in following days, weekly net outflows reached 13,670 BTC.

This chart also recalls a rare signal observed in early 2026: for the first time since 2022, bitcoin’s profitable supply fell below 50%, a historically market bottom-associated threshold.

K33 is not yet declaring victory. The firm anticipates a prolonged consolidation between $60,000 and $75,000, with a risk of retesting lows. But it excludes any significant collapse below this floor. For patient investors, the message is clear: capitulation may have occurred, now the discomfort zone must be crossed before the next cycle.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.