Bitcoin at $82,000: The Fall Accelerates with $2 Billion in Liquidations

In just 24 hours, bitcoin has collapsed to 82,000 dollars, triggering 2 billion in liquidations and record outflows of Bitcoin ETFs. Between trader panic and Fed uncertainties, this historic crisis raises questions: should we fear a prolonged crash or seize the opportunity of an explosive rebound?

In brief

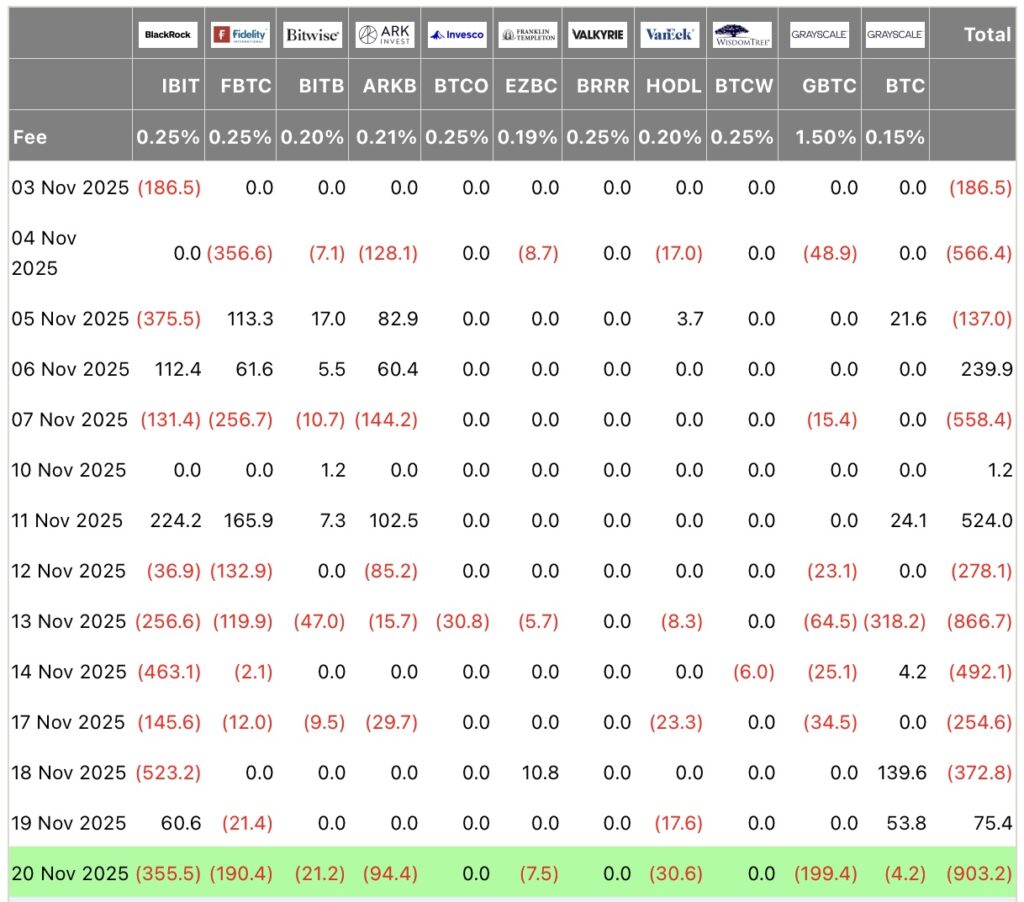

- Bitcoin drops to $82,000, with $2 billion in liquidations within 24H and record outflows of $903 million from ETFs.

- Fed uncertainties and forced sales accelerate pressure on bitcoin, pushing the market into capitulation territory.

- Analysts identify $84,000 and $73,000 as max pain levels: should you buy the dip or wait for the rebound?

Bitcoin at $82,000, $2 Billion in Liquidations in 24h… What is Happening?

In less than 24 hours, the crypto market has suffered a historic collapse, with nearly $2 billion in liquidated positions! This was marked by a drop of bitcoin to $82,000, its lowest level since April. According to CoinGlass, 396,000 traders were affected, including a record $36.78 million position liquidated on Hyperliquid. This carnage occurred while net outflows from Bitcoin ETFs reached $903 million, their second worst day since launch.

Bitcoin: Why is the Current Fall Different?

Unlike past corrections, this fall is amplified by two key factors: massive outflows from Bitcoin ETFs and uncertainty around interest rates. Indeed, US employment data (119,000 new jobs in September) have reduced hopes for a rate cut in December, while Kevin Hassett, nominated to the Fed, said that a pause would be very unwelcome. As a result, the bitcoin Fear & Greed index fell to 14, an extreme distress level.

With liquidations of nearly $2 billion, analysts emphasize that the market is now in capitulation territory, where forced sales dominate rationality. This pushes bitcoin towards critical levels of $81,900, the last barrier before confirmation of a bear market.

Critical Thresholds to Watch for BTC

Analysts identify two key levels where institutional investors’ pain could reach its peak:

- $84,000: average cost of BlackRock’s IBIT ETF, the largest American Bitcoin ETF;

- $73,000: average cost of MicroStrategy, often considered a psychological floor.

If bitcoin does not regain the $88,000–$90,000 zone, analysts predict a fall towards $78,000–$82,000, where forced sellers might exhaust themselves. However, a “bottom” could form between these two levels, marking a full cycle reset.

Bitcoin: Should You Buy, Sell or Wait? Experts’ Strategies

Facing this storm on Bitcoin (BTC), strategies diverge:

- Defensive: reduce exposure and wait for a rebound confirmation above $88,000;

- Offensive: target the “max pain” levels ($84,000 and $73,000) for long-term buys, assuming seller exhaustion;

- Watchful: monitor the Fear & Greed index and institutional flows, which could signal a reversal.

Note that altcoins like ethereum, solana, and BNB also fell by more than 10%, reflecting broad pressure. Experts recall that capitulation phases often precede violent rebounds, but timing will depend on the return of institutional flows.

This bitcoin drop marked by ETF outflows and record liquidations recalls past crises, but with an unprecedented institutional dimension. While analysts are divided on the possibility of a quick rebound or a worsening drop, a question persists: will $73,000 mark the cycle floor, or is the crypto market entering a prolonged bear phase?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.