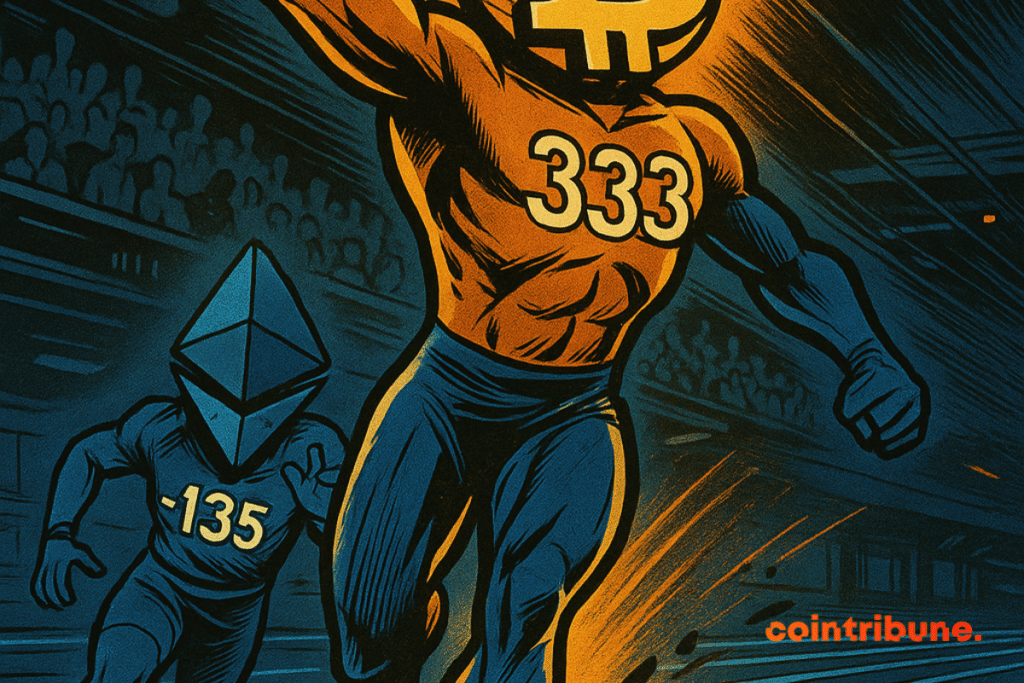

Bitcoin Gains $333M Inflows as Ether Faces $135M Outflows

September starts with a marked contrast on crypto ETFs: Bitcoin captures $333M in inflows, while Ether suffers $135M in outflows. This movement confirms bitcoin’s place as a safe haven, but the decline in overall volume ($3.93B) and net assets ($143.21B) highlights persistent caution in the crypto market. Crypto ETF flows reveal a clear divide between triumphant Bitcoin and struggling Ether. This crypto dynamic reflects a strategic repositioning by investors, strengthening confidence in bitcoin despite the caution.

In brief

- Bitcoin attracts $333M in inflows, Ether suffers $135M in outflows

- Crypto ETFs split: confidence in BTC, distrust in ETH

Ether losing speed despite solid volumes

On the Ether side, recently marked by explosive volatility, the story is different. ETFs related to ETH continue to suffer massive withdrawals. Fidelity stands out again, but this time with an outflow of $99.23 million from its FETH.

Bitwise also suffers a significant loss ($24.22M), followed by 21Shares and Grayscale, with smaller outflows. Despite sustained trading volumes at $1.85 billion, net assets remain stagnant at $27.22 billion, a sign of a hesitant market.

The difference is striking: while bitcoin benefits from renewed confidence, ether remains stuck in a disinvestment spiral. Some will see this as a temporary correction, others as a signal that the ETH ecosystem must still convince, especially given uncertainties related to technical updates and growing competition from alternative blockchains.

A symbolic divide for the crypto market

Beyond the numbers, this divergence illustrates a deeper dynamic. Bitcoin seems to reaffirm its stature as a “digital gold,” attracting institutional capital again after a period of turbulence.

Ether, on its side, must cope with a more speculative perception and headwinds that tarnish its immediate appeal.

For investors, this divide opens a new chapter: should one bet on the relative stability of BTC or on ETH’s innovation potential, despite its increased volatility? This seesaw dynamic could shape the trajectory of crypto ETFs in the coming months, in a market where every move is closely scrutinized.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.