Bitcoin deemed too vulnerable: Jefferies bets on gold against quantum threat

Bitcoin has lost some of its shine on Wall Street. The asset once seen as the quintessence of financial modernity no longer attracts major managers as much. Institutional investors seem to be returning to more tangible assets. Is this a simple pause in the romance between finance and blockchain, or the start of a break? One thing is certain: mistrust has settled in at Jefferies’ offices.

In brief

- Jefferies removes 10% of bitcoin from its portfolio, replaced by physical gold and mining stocks.

- Quantum computing raises fears of a major vulnerability of cryptos to future attacks.

- Developers like Adam Back and Jameson Lopp see the threat as still distant but real.

- The crypto market reorganizes: institutional caution, post-quantum financing, and return to material security.

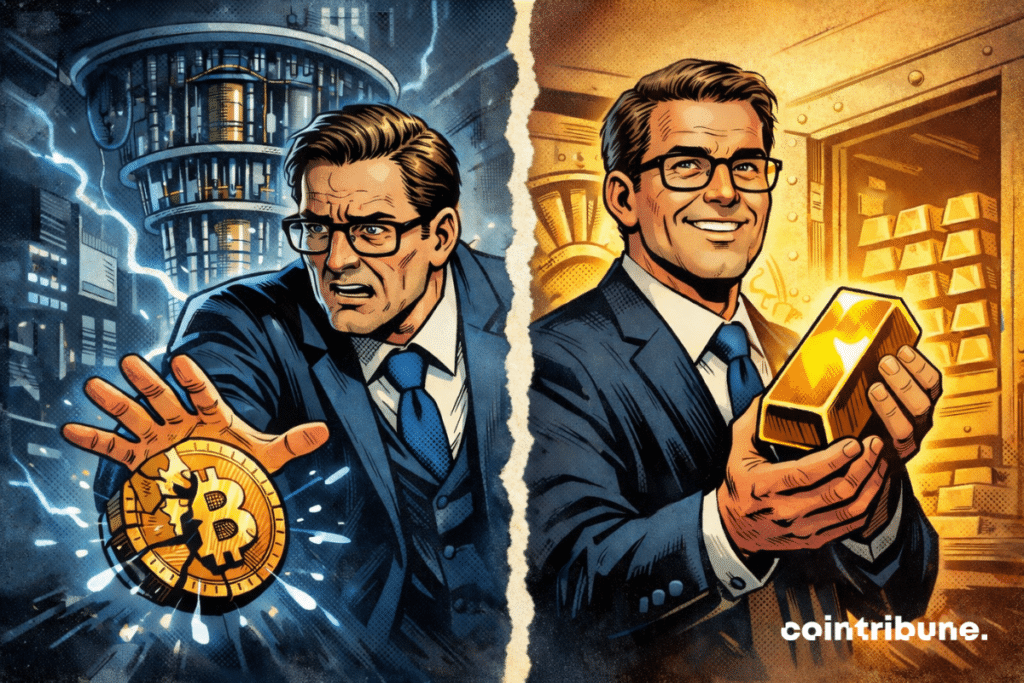

From surge to caution: when Jefferies turns its back on bitcoin

The crypto market seems to stabilize after months of uncertainty, but confidence remains fragile. Christopher Wood, Jefferies’ global strategist, made a choice that makes noise: he removed 10% of bitcoin from his model portfolio to invest equally in physical gold and mining stocks. A strong symbol. The man who saw BTC as a digital alternative to yellow metal now believes that the cryptographic security of the network could be threatened by advances in quantum computing.

In his Greed & Fear letter, he mentions a threat that goes beyond price: the loss of the “store of value” status among institutional investors.

There is an ongoing debate about whether to “burn” coins vulnerable to quantum or to do nothing and risk those coins being “stolen” by entities equipped with what are called CRQC (cryptographically relevant quantum computers). The problem seems to be that deriving a public key from a private key is a simple computational operation, whereas the inverse would take supercomputers thousands of trillions of years.

Christopher Wood

For him, the risk is no longer theoretical. In a world where computational power is exploding, gold becomes an anchor again. A return to matter in the face of code volatility.

The quantum weapon: an existential challenge for the crypto sphere

The debate around the “quantum threat” is not new, but it is gaining unprecedented scale. In February 2025, Microsoft presented the Majorana 1 chip, a quantum computing prototype supposed to speed up the arrival of the famous Q-Day, the day current cryptography will give way. Since then, the crypto community has been closely following this development.

A Chaincode Labs study estimates 4 to 10 million BTC potentially vulnerable to a quantum attack, up to 50% of the total supply. Coinbase’s head of research, David Duong, estimates that nearly a third of bitcoin in circulation — including wallets dating back to the Satoshi era — would remain exposed to this risk.

Developers remain calm. Adam Back, CEO of Blockstream, reminded that breaking current signature schemes would still take 20 to 40 years.

Between institutional caution and technical confidence, the gap widens. Finance wants to anticipate, crypto wants to believe in the long term.

Crypto, fear and repositioning: when gold becomes the absolute refuge again

For some analysts, Jefferies’ decision is not a condemnation of bitcoin but an adaptation to the times. Crypto investors are seeing a portfolio reallocation toward assets perceived as more stable. Even El Salvador has fragmented its BTC reserves into 14 distinct addresses to limit exposure risks.

On the ground, the industry is organizing. Project Eleven raised 20 million USD to develop post-quantum cybersecurity tools. And the crypto sphere is lively: on X, developer Jameson Lopp wrote last December:

No, quantum computers will not break Bitcoin anytime soon

But the signals are clear: the market is searching for a new narrative. Gold regains its role as insurance, while Bitcoin tries to preserve its legitimacy in a world where even qubits are involved.

Key figures to remember in the Bitcoin–quantum battle

- $94,803: current BTC price;

- 10%: share of Bitcoin removed from Jefferies’ portfolio;

- 4 to 10 million BTC: estimated vulnerable stock;

- 20 million USD: raised by Project Eleven to strengthen crypto security;

- 14 addresses: new management of El Salvador’s Bitcoin reserves.

Grayscale experts also believe the quantum threat is still distant. They point out that the blockchain has time and tools to adapt. Indeed, post-quantum solutions, like those developed by Naoris, are progressing quickly to prepare for that future where cryptography will have to reinvent itself.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.