Bitcoin down in October: November, month of revenge?

For the first time since 2018, bitcoin closed October down, breaking a streak of seven consecutive years of gains. This unexpected decline raises a crucial question: will November, traditionally the best-performing month for the crypto queen, manage to reverse the trend? Analysis of causes, possible scenarios and strategies for investors.

In Brief

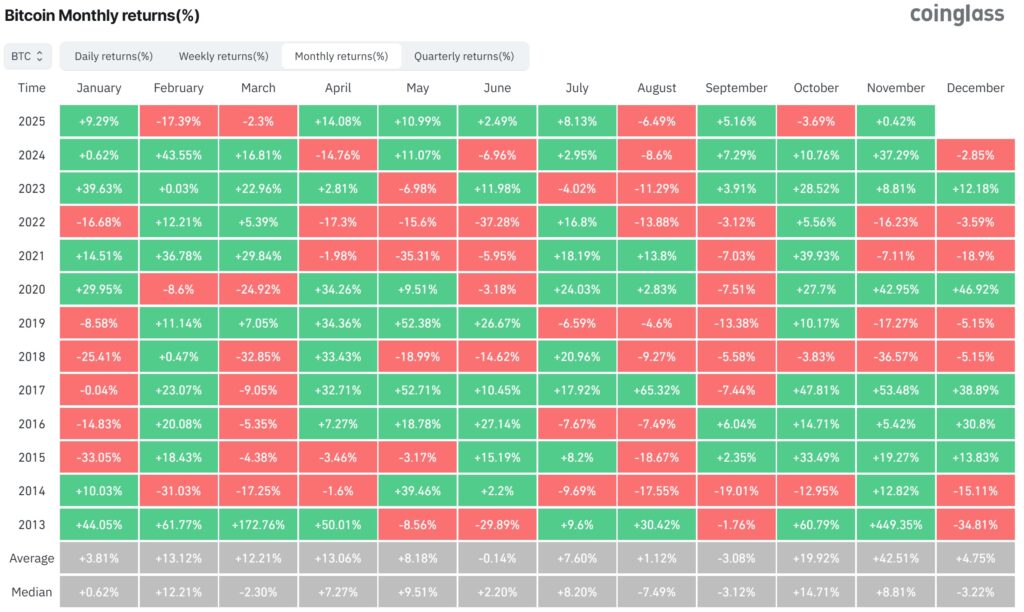

- October 2025 marks bitcoin’s first closing decline since 2018, with a drop ranging from 3.35% to 3.69%.

- November, historically the best-performing month for bitcoin (+42.51% on average), could offer either a rebound or a 36.57% drop.

- In November 2025, bitcoin investors should watch the Fed’s upcoming decisions, ETF flows, and whale movements.

Why the “Uptober” 2025 disappointed bitcoin investors

October, nicknamed “Uptober” by the crypto community, disappointed expectations this year. Indeed, bitcoin recorded a drop between 3.35% and 3.69%, a rare performance since 2018. Several factors explain this setback:

- The massive liquidations, estimated near 19 billion dollars, played a key role, amplified by increased market volatility;

- Geopolitical tensions, notably the trade war between the United States and China, also weighed on prices.

Furthermore, buyer enthusiasm faded after months of relative stability, where bitcoin traded within a narrow range between 107,000 and 126,000 dollars. According to Kronos Research, this correction does not mark a trend break, but rather a temporary liquidity stress. Investors therefore remain divided between caution and opportunity.

November, the month of all records… or all drops?

Historically, November is the best-performing month for BTC, with an average increase of 42.51% since 2013. Because of this, bitcoin is expected to soar to 160,000 dollars during this month. However, this year, expectations are mixed. Some analysts anticipate a rebound, supported by the easing between the United States and China, as well as by the Fed’s recent 0.25% rate cut. Others, more cautious, fear a repeat of 2018, where November fell by 36.57% after a red October.

Key factors to watch include:

- The Fed’s next decisions in December;

- The dynamics around Bitcoin ETFs;

- The crypto market’s reactions to macroeconomic data like inflation and employment.

Moreover, investors will need to track whale movements and liquidations to anticipate reversals.

Strategies for investors: buy, sell or wait?

Faced with this uncertainty, strategies vary. Optimistic buyers see current levels as an opportunity to accumulate, betting on a historic bitcoin rally in November. The more cautious prefer to wait for trend confirmation, such as a break of key resistances or supports.

Risks to avoid include FOMO (Fear Of Missing Out) in case of a sudden rally, as well as panic in case of a new decline. Use of stop-loss orders is recommended to limit losses. Tools from Glassnode or CryptoQuant can help analyze on-chain data and Greed and Fear indicators, offering a clearer market view.

Finally, a red October does not necessarily mean a prolonged crypto winter. November remains a decisive month for bitcoin, where investors will have to navigate between opportunities and risks. The question remains open: will November 2025 be the month of revenge or decline for bitcoin?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.