Bitcoin ETFs record $562 million inflows after a gloomy week

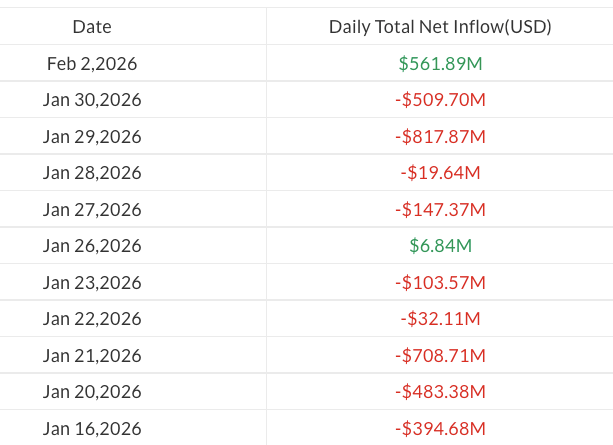

Bitcoin exchange-traded funds finally stopped the bleeding on Monday with $562 million in fresh inflows, after four consecutive days of massive outflows. But will this breath of fresh air be enough to reverse the trend in a crypto market still under pressure?

In brief

- Bitcoin ETFs attracted $562 million on Monday, ending four consecutive days of outflows.

- These inflows partially offset the $1.5 billion withdrawals recorded the previous week.

- Bitcoin now trades 7.3% below the ETFs’ average cost basis, set at $84,000.

- Cumulative outflows since early 2026 reach $1 billion for spot Bitcoin ETFs.

Flows return to Bitcoin ETFs after $1.5 billion of withdrawals

Institutional flows timidly regained some color this Monday. With $562 million in investments, spot Bitcoin ETFs finally interrupted a black streak of four days. A relief for a bleeding market that had seen $1.5 billion leave just the previous week.

This lull occurs in a particularly tense context. Bitcoin flirted with $74,000 over the weekend before rebounding above $78,000 on Monday. Such volatility reflects the ambient nervousness. Especially since the balance since early January remains heavily negative: $1 billion in net outflows, the result of a gap between $4.6 billion withdrawals and only $3.6 billion inflows.

Galaxy Digital analysts point to a critical level. “BTC is currently trading 7.3% below the ETFs’ average cost basis,” highlights Alex Thorn. This psychological threshold of $84,000 represents the average purchase price of investors through these funds.

In clear terms, many holders show losses on their positions. A situation unprecedented since summer 2024, when Bitcoin bottomed at -9.9% below this level before rebounding. This cost basis could therefore serve as a “short-term support,” according to the expert.

Meanwhile, Ether ETFs continue their descent into hell. No inflows to report on Monday, on the contrary: $2.9 million more left these investment vehicles.

Persistent headwinds despite the rebound

The upturn remains fragile in the face of multiple pressures on the market. James Butterfill of CoinShares draws a blunt conclusion: Bitcoin decoupling from global liquidity trends, geopolitical tensions, and uncertainty over U.S. monetary policy with Kevin Warsh’s appointment to lead the Fed. All factors that keep institutional investors wary.

The numbers speak for themselves. Last week, crypto exchange-traded products lost $1.7 billion in total. Double the previous week.

This acceleration in outflows reflects a generalized “risk-off” move. Investors are fleeing risky assets, including gold which also dropped 4% after passing $5,300 an ounce.

BlackRock’s IBIT ETF perfectly illustrates this difficulty. Long presented as the quintessential institutional vehicle, it now shows a negative average return. Investors who entered at the top, especially during the massive capital inflow last October, are now suffering heavy losses. The entry timing proved catastrophic for these holders.

Despite this $562 million rebound, the outlook remains heavy for Bitcoin ETFs. Technical fundamentals suggest that support could form around the $56,000 realized price, a historic floor level before bull markets. It remains to be seen whether institutional confidence will return quickly enough to turn this clearing into a true sustainable recovery.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.