Bitcoin Faces Rising Macro Risk as Trump Speech, Fear, and Outflows Converge

Global markets are entering a concentrated period of macroeconomic risk that could shape sentiment into early February. Five key U.S. economic releases are scheduled for January 27, increasing pressure on already cautious investors. Crypto markets remain highly sensitive in this environment, with Bitcoin still absorbing the majority of capital flows.

In brief

- Bitcoin trades below its 200-day average as leverage rises and short-term momentum continues to weaken.

- Trump’s upcoming remarks add political risk as Bitcoin remains exposed due to dominant capital inflows.

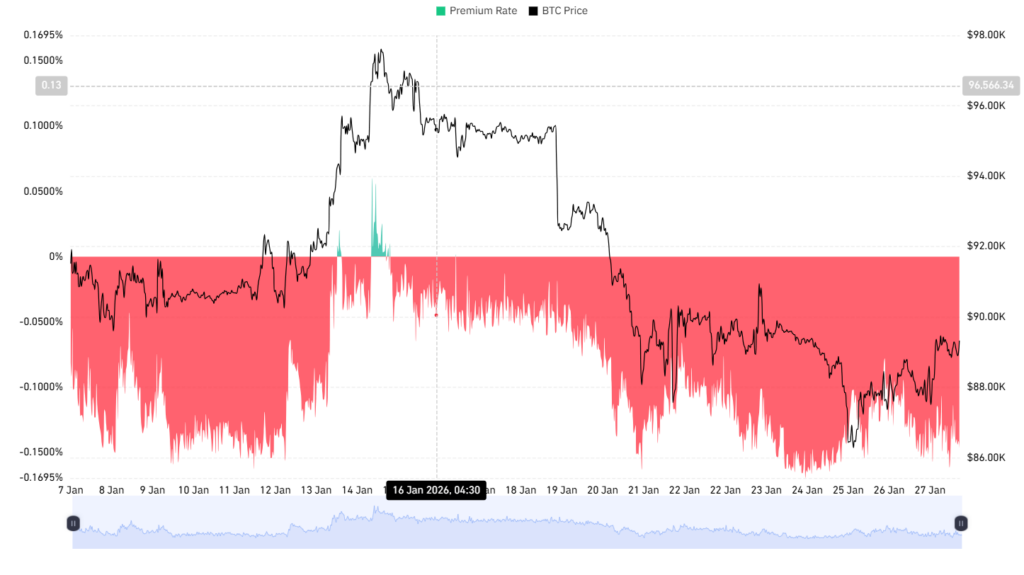

- ETF outflows and a negative Coinbase Premium Index signal fading U.S. institutional demand.

- Liquidation imbalances and extreme fear readings point to rising stress across derivatives markets.

Markets Brace for Trump Comments as Bitcoin Demand Weakens

According to reports, President Donald Trump is scheduled to speak at 4:00 p.m. ET. Markets will closely monitor the remarks for any signals related to government shutdown risks, interest rate policy, or broader fiscal direction.

And as such, this adds another layer of uncertainty to an already fragile macro backdrop. With Bitcoin continuing to dominate crypto capital inflows, the asset remains particularly exposed to any negative shift in market sentiment.

Institutional participation continues to weaken. Persistent Bitcoin ETF outflows and a negative Coinbase Premium Index point to fading demand from U.S. investors, as capital shifts toward lower-risk assets. This retreat in risk appetite comes just as macro uncertainty reaches a near-term peak.

Fear Deepens as Bitcoin Leverage and Liquidations Signal Market Strain

Bitcoin is exchanging hands at $89,041 at the time of writing, up 0.87% over the past 24 hours. Despite the modest gain, the price remains below the 200-day simple moving average, signaling lost momentum. Only 14 of the past 30 sessions have closed in the green zone, keeping short-term conviction uneven.

At the same time, the Fear and Greed Index has fallen 12 points over the past week and now sits near the “extreme fear” threshold. Historically, readings at these levels often coincide with early capitulation, as holders prioritize loss mitigation over recovery expectations.

Positioning data highlights a market split between caution and leverage:

- Spot Bitcoin flows remain muted, indicating limited new buying.

- U.S. Bitcoin ETFs continue to see net outflows.

- BTC/USDT positioning on Binance shows a 70% long bias.

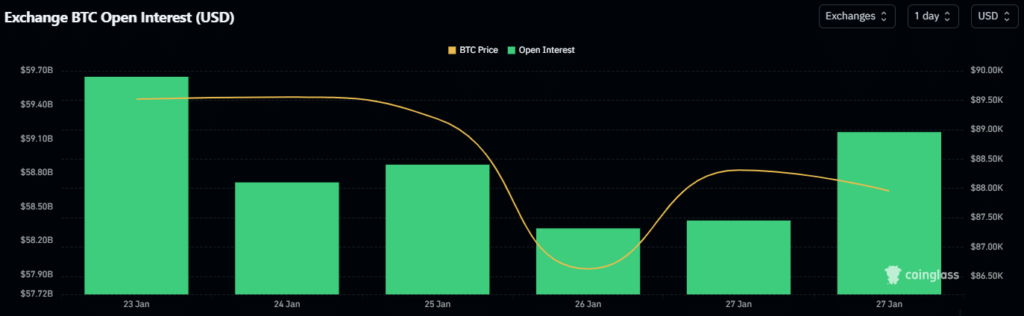

- Open interest has rebounded toward $60 billion.

- Rising leverage ratios suggest increasing risk exposure.

Derivatives markets reinforce the tension faced by the OG coin. Over the past 24 hours, Bitcoin experienced a 299% liquidation imbalance totaling $67.31 million. Short liquidations accounted for $50.46 million, while long liquidations reached $16.85 million. This skew suggests traders remain positioned for upside, even as broader conditions weaken.

Regulatory Setback and Macro Headwinds Put January Gains at Risk

Market odds for passage of the Clarity Act—intended to establish a more supportive U.S. crypto framework—have dropped from roughly 80% to near 50%. The decline adds another source of uncertainty to Bitcoin’s near-term outlook.

With macroeconomic data, political developments, and the upcoming Federal Open Market Committee meeting converging, January’s gains face meaningful downside risk. A move into negative territory would mark Bitcoin’s first January loss since the 2022 bear market and could set a volatile tone for February.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.