Bitcoin Holds $110K as Traders Eye Key Levels and “Uptober” Momentum

Bitcoin hovered around $110,000 on Sunday evening after a turbulent September, with traders weighing ETF outflows, technical support, and macroeconomic pressures. The market has entered consolidation mode, with volatility easing and traders watching for direction. With October approaching, the focus turns to whether “Uptober”—a month often associated with positive crypto momentum—will ignite the next breakout.

In brief

- Bitcoin stabilizes at $110K after a volatile week, with traders eyeing key support at $107K and resistance near $113K.

- A break above $113K could fuel a rally toward $115K–$120K, while a drop below $107K risks a slide toward $105K or lower.

- Market sentiment has cooled, with fear rising, ETF outflows noted, and traders awaiting a catalyst for clear direction.

- October’s “Uptober” narrative could reignite bullish momentum if macroeconomic signals align with softer policy conditions.

Bitcoin Holds $110K Amid Volatile Week, Key Support and Resistance Levels in Focus

On Sunday, Bitcoin traded between $110,324 and $110,595. This came after a volatile week that saw the asset fall about 4–5% compared to the prior week. The biggest drop came on September 26, when Bitcoin slipped from around the $115,000 region to $109,000, wiping out billions in leveraged long positions. As expected, the reset cooled excessive bullish bets and left the market resting on firm support.

Here’s what technical and on-chain trends show:

- Support levels: Bitcoin is holding firm between $107,000 and $108,700. This zone has acted as a key floor, with buyers consistently stepping in to defend it.

- Downside risk: A clean break below that support could shift momentum, opening the path toward $105,000 and, in a deeper sell-off, even $100,000.

- Resistance levels: Overhead resistance lies between $112,000 and $113,000, a band that has capped upside attempts in recent sessions.

- Upside potential: A decisive move above that resistance range could clear the way for a retest of $115,000, with room to extend toward the $120,000 threshold.

Technical indicators remain mixed, with the RSI hinting at bullish divergence, while the MACD shows a bearish lean on higher time frames. Market commentators note that as long as Bitcoin holds $110,000, the broader bullish channel is still intact.

Market Reset: Caution Prevails as Traders Await Clear Direction

Even though market sentiment has cooled, broader trends indicate that the overall outlook has not collapsed. The Fear & Greed Index has declined into the ‘fear’ zone, while open interest has moderated but remains present. At the same time, social sentiment is cautious, a setup that has historically preceded surprise rallies if resistance breaks.

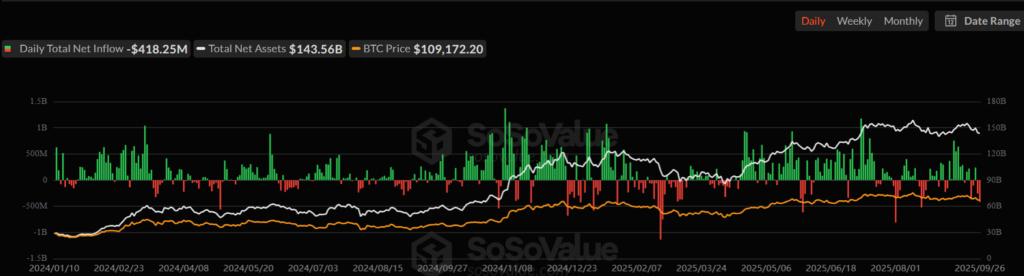

Spot Bitcoin ETFs also saw notable outflows last week, while whales shuffled coins between wallets and exchanges. This activity added to market volatility but left Bitcoin’s long-term outlook unchanged. In essence, positioning has been reset, traders remain cautious, and the market is awaiting a clear signal for direction.

Bitcoin Range-Bound Ahead of October

Bitcoin continues to trade in step with equities, with U.S. dollar strength, Federal Reserve commentary, and economic data such as PCE inflation shaping direction. Assuming policymakers signal softer conditions heading into October, the “Uptober” narrative could gain support. If not, sideways price action may continue.

Analysts anticipate price action to remain range-bound between $105,000 and $113,000 until a catalyst emerges. To build a bullish case, Bitcoin must hold above $107,000, reclaim the $112,000–$115,000 zone, and then target $120,000. Conversely, a bearish scenario would unfold if $107,000 breaks decisively, potentially driving the asset down to $105,000 or lower.

In the near term, bitcoin is expected to remain range-bound, with traders watching $107,000 on the downside and $112,000 on the upside as key levels. A sustained move above resistance could open the way toward $115,000 and $120,000, while a break below support risks a slide toward $105,000.

At the time of writing, Bitcoin is exchanging hands at around $112,000 following a modest intraday uptick. Market participants are now looking to October—historically a strong month—to see whether consolidation gives way to renewed momentum.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.