The Bitcoin Boom Triggers an Unprecedented Wave of Liquidations

The rapid rise of Bitcoin has not only been a windfall for optimistic investors. It has also triggered an unexpected wave of liquidations, hitting hard traders who had bet on a drop in the digital currency. A true earthquake in the volatile world of crypto, where nothing is ever truly predictable.

The Rapid Rise of Bitcoin: Glimmer of Hope and Shadow

There’s no denying that the recent surge of Bitcoin has created many winners. Trading at $34,120, up nearly 20% in a week, Bitcoin seems to have reclaimed its crown in the crypto arena.

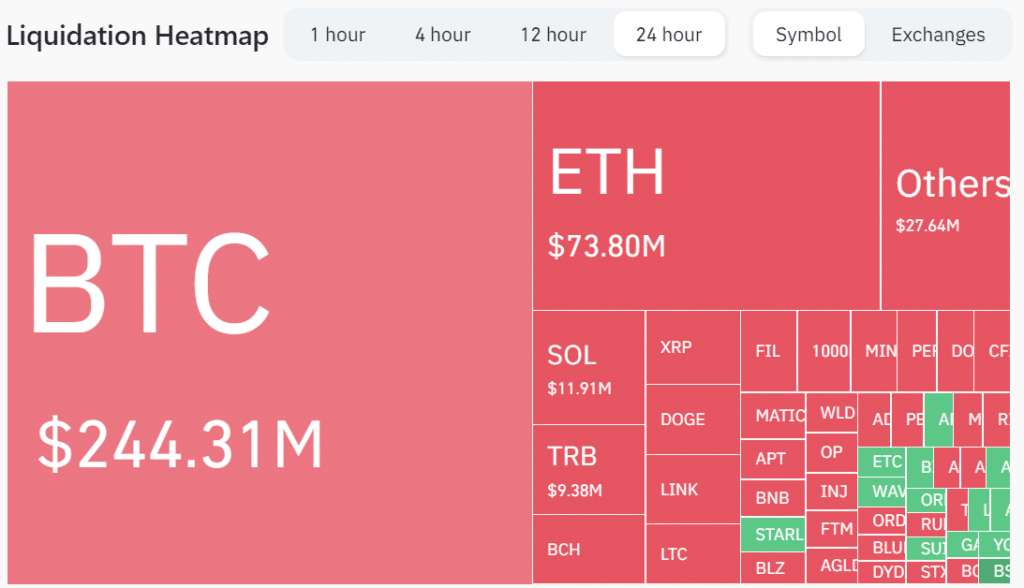

However, with this surge came a wave of liquidations. In just 24 hours, nearly 94,168 traders saw their positions liquidated, showcasing the massive impact of this increase on the market.

The cryptocurrency market’s surge revealed its dark side. While Bitcoin was rising, those who had bet against it found themselves caught off guard. Data from CoinGlass highlights this turbulence, with liquidations totaling $244 million for Bitcoin alone.

But what caused such a shockwave? The answer is simple: a majority of short positions. These bearish bets, made in the hope of buying back Bitcoin at a lower price, were annihilated by this unforeseen surge.

Catalysts for the Surge?

Beyond mere market movements, it is worth examining the underlying causes of this surge. Anticipation around Bitcoin exchange-traded funds (ETFs) appears to be a key factor.

The potential approval of the first US physically-backed Bitcoin ETFs promises increased demand for the token. Two giants, BlackRock Inc. and Fidelity Investments, are already vying to offer these products.

Their confidence in crypto could bolster its legitimacy and presence in the market.

Volatility remains Bitcoin’s constant companion, offering both opportunities and challenges for traders.

While this recent surge has been a windfall for some, it has been a knockout blow for others. In this ever-changing financial landscape, one thing is certain: the crypto sector will continue to surprise, delight, and sometimes confound. Only the future will tell if Bitcoin will continue its ascent or experience another fall. But for now, traders around the world have their eyes fixed on this unpredictable giant.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.