Bitcoin passes $109,000 again but Ethereum captures most of the institutional flows

No matter what happens now, these two cryptocurrencies are etched in the marble of time. Bitcoin has already charmed the general public, from the student stacking some satoshis to the sovereign wealth fund making it an alternative reserve. Ethereum, meanwhile, finds itself in the vault of the institutional giants. One plays the role of symbol, the other attracts the money of the powerful. The recent figures from CoinShares leave no doubt: the duel between BTC and ETH has never been so sharp.

In Brief

- Bitcoin recovered $109,000, despite a weekly market decline of 2%.

- Ethereum recorded $3.95 billion in institutional inflows in August, versus -$301 million for BTC.

- The United States led flows with $2.29 billion, followed by Switzerland and Germany.

- Bitcoin dominance remains at 58%, but could swing between 53% and 63%.

ETH attracts capital, BTC holds the throne

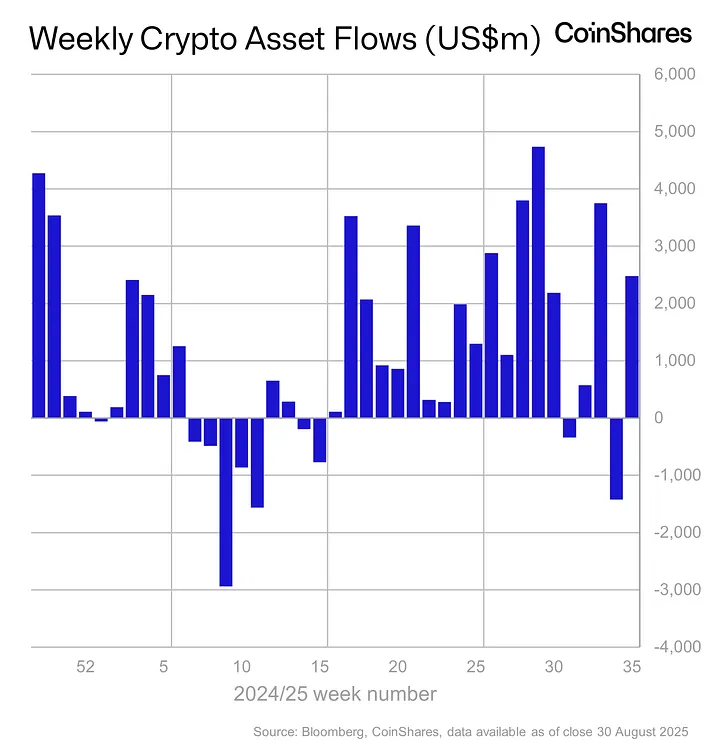

Ethereum has established itself as the star of institutional funds. Just last week, $1.42 billion flowed into ether-linked products, versus $748 million for bitcoin. And in August, the difference is vast: $3.95 billion inflows for ETH against $301 million outflows for BTC.

James Butterfill, head of research at CoinShares, summarized it: “Ethereum continues to dominate Bitcoin… Flows remained strong throughout the week before flipping on Friday after the Core PCE release. The data did not confirm the hope of a Fed rate cut in September, which disappointed digital asset investors”

However, ether did not perform better in the market: -4.3% over the week, versus -2% for bitcoin. Institutional investors are betting on ETH despite its volatility, proof that the battle between adoption and valuation is far from settled.

Bitcoin, Ethereum and the fragile balance of dominance

The question of supremacy remains hot. Bitcoin dominance hovers around 58%. Myriad Markets traders admit: it’s almost a coin toss. BTC dominance could rise to 63% or drop to 53%, it will all depend on the momentum in the coming days.

Meanwhile, other altcoins like Solana ($177M inflows) and XRP ($134M) benefit from optimism surrounding American crypto ETFs. This context reminds us that the visible part of institutional flows hides a complex game where every macro announcement or product launch can move billions.

Some key figures

- $4.37 billion in institutional flows in August;

- $2.29 billion from the United States in one week;

- $109,494 for bitcoin and $4,420 for Ethereum at the time of writing;

- $500 million in liquidations last Friday, after a general correction.

BTC remains the safe haven, ETH becomes the locomotive of investment products. The market oscillates between caution and conviction.

Corrections are an integral part of bitcoin’s story. As Anthony Scaramucci reminds us, they can be violent: the drop can reach 40% before bitcoin’s price hits $500,000. A warning that clearly illustrates market reality: between rapid ascent and brutal shocks, the road is long.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.