Bitcoin Punishes Traders with $250 Million Liquidations in 24H

In just 24 hours, the Bitcoin market experienced a brutal purge, with more than 250 million dollars in liquidations. Yet, behind this volatility, technical and fundamental signals suggest a possible rebound. Analysis of the causes, market dynamics, and strategies to navigate this crypto storm.

In Brief

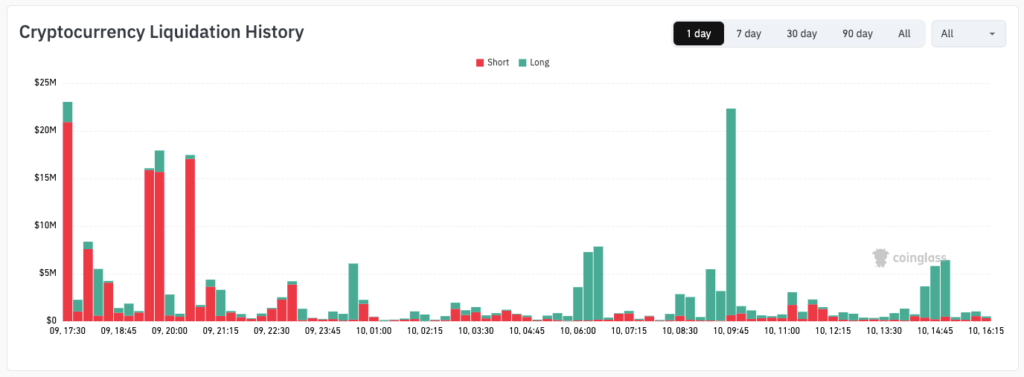

- $250 million of positions liquidated in 24 hours, mainly due to excessive leverage and bitcoin volatility.

- Heatmaps reveal liquidity concentrations between $66,000 and $72,000, making these levels vulnerable to brutal moves.

- Limit leverage, use stop-loss orders, and monitor technical indicators to anticipate market reversals.

Why Do Bitcoin Liquidations Punish Traders?

On February 10, 2026, Bitcoin experienced a wave of massive liquidations, mainly affecting traders using high leverage. Crypto exchanges recorded hundreds of millions of dollars of forcibly closed positions as the price oscillated around $68,000. These liquidations occur when the market reaches critical thresholds, triggering automatic position closures to cover losses.

Liquidation heatmaps reveal that the most vulnerable zones lie between $66,000 and $72,000. These levels act like magnets for the price since they concentrate a large number of leveraged positions. Experienced traders use this data to anticipate brutal moves and adjust their strategies.

Is BTC Ready to Rebound?

Despite the massive liquidations, some technical indicators suggest that Bitcoin could be in a rebound phase. The RSI is currently in oversold territory, a signal often interpreted as a precursor to a price increase. Moreover, bullish divergences observed on daily charts indicate a possible trend reversal, especially if the price manages to hold above $68,000.

On the fundamental side, data from CryptoQuant and Material Indicators show weakness in the market’s absorption of sales. Whales continue to sell, exerting additional pressure on BTC’s price. However, miners’ reserves remain stable, which could indicate discreet accumulation.

Bitcoin: How to Take Advantage of Opportunities in a Volatile Market?

In a market as volatile as Bitcoin’s, risk management is essential. Limiting leverage and using stop-loss orders help avoid forced liquidations and protect capital. Wise traders closely monitor support and resistance levels, such as $68,000 and $72,000, to anticipate price movements.

Diversification remains a key strategy. Rather than betting solely on BTC, investors can turn to promising altcoins or stablecoins to reduce their risk exposure. Technical analysis tools, like liquidation heatmaps or volume indicators, provide valuable insights to identify tension zones.

Bitcoin is currently going through a critical phase, marked by massive liquidations and extreme volatility. Yet, technical and fundamental signals hint at a possible rebound. In your opinion, is this BTC purge the prelude to a new drop or the opportunity for a lasting rebound?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.