Bitcoin Rallies After Weekend Drop Below $100K

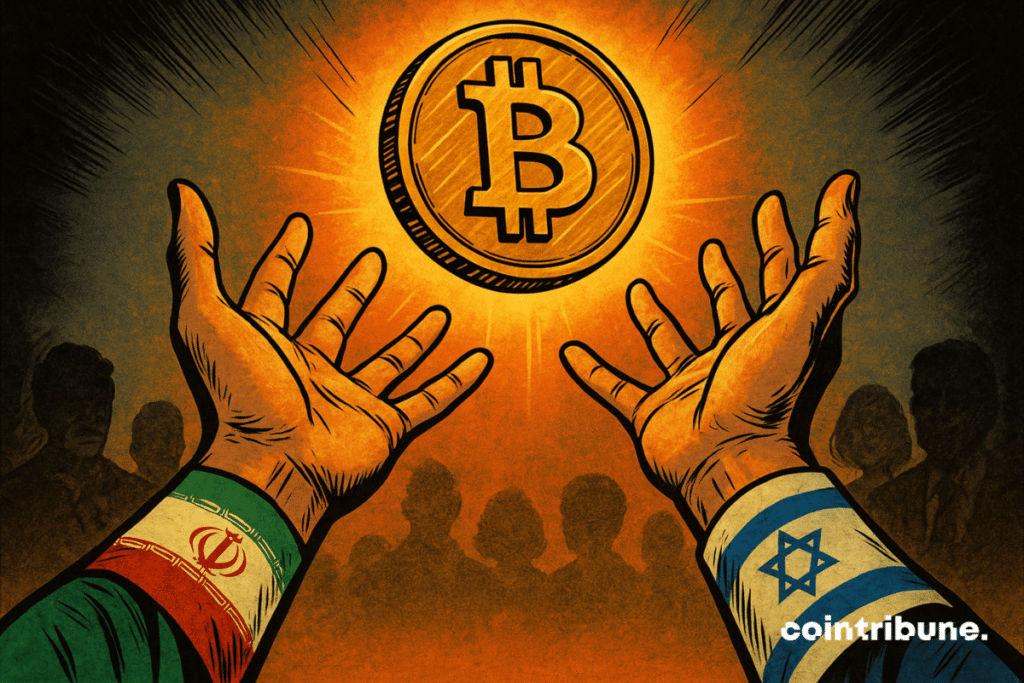

Like any financial asset, bitcoin is heavily dependent on the geopolitical situation, and the start of the war between Israel and Iran this weekend caused its price to drop below 100,000 dollars. The announcement of a ceasefire between the two countries yesterday had the opposite effect, not only for bitcoin, which surpassed 109,000 dollars today but also for other financial assets.

In brief

- Bitcoin takes off again after the end of hostilities.

- New growth outlook for Wall Street ?

Bitcoin takes off again after the end of hostilities

For several weeks, bitcoin has been struggling to maintain support at 100,000 dollars, achieved with Donald Trump’s electoral victory and then lost for the first time this winter. This time, geopolitical uncertainties in the Middle East have created a downward trend in recent days. In fact, during the mutual missile launches between Iran and Israel, bitcoin dropped below the symbolic 100,000 dollar mark, dragging down the rest of the cryptocurrency market.

Fortunately, a ceasefire between the two countries began yesterday. Clearly, that was enough to reassure the markets and restart a bullish trend. Bitcoin quickly surpassed 105,000 dollars and reached 109,000 dollars a few hours ago. This upward trend is also reflected in bitcoin ETF purchases. On June 24, American spot bitcoin ETFs received inflows of 588.5 million dollars.

In the top 10 cryptocurrencies, most assets regained their value from before last weekend or even benefited from the return to calm to rise over 7 days, like XRP. Conversely, ETH and ADA remain down weekly despite a slight rebound early in the week, which shows the uncertainties surrounding these two cryptocurrencies.

New growth outlook for Wall Street ?

This increase in bitcoin is not an isolated case, as the entire market reacted positively to the ceasefire. The S&P 500 rose 1.1% and recovered the very psychological support of 6000 points.

Beyond the ceasefire between Israel and Iran, several indicators show that American finance could regain a bullish trend. The tariffs imposed by Donald Trump may have led to short-term inflation but could increasingly favor American companies.

Moreover, Jerome Powell has announced that an interest rate cut may be considered in the coming months if the American economy continues on this path. We know that Donald Trump is very critical of the Fed chairman and considers that maintaining high interest rates does not allow his economic policy to have its full effect. However, if this cut happens soon and the geopolitical situation in the Middle East eases, a strong bullish recovery can be expected across different markets.

Bitcoin could benefit from this general momentum and increasingly more companies could follow the example of Strategy and Microplanet by creating bitcoin reserves as a hedge against inflation.

Structural drivers – state reserves, adoption by companies, and ETF flows – appear resilient to macroeconomic difficulties and reinforce our confidence in the prospect of continuous growth.

Timothy Misrir, Research Director at BRN

This institutional demand, increasingly favored by the easing of regulatory frameworks, could be the engine of a new BTC bullish rally.

After the anxiety the markets experienced this weekend, the return to a calmer geopolitical situation allowed several assets to resume a bullish trend. This is the case for bitcoin, which has attracted more and more institutions and companies in recent months. This weekend’s drop was therefore only a temporary episode that does not erase all the progress of recent weeks.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par l’histoire du Web3, je m’efforce de rendre cette nouvelle ère numérique plus compréhensible grâce à mes articles et à ma thèse de doctorat en cours sur le sujet.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.