Bitcoin Reaches New Heights, But Google Searches Plummet To An Unprecedented Level

Bitcoin is flirting with $104,000, but retail investor enthusiasm is collapsing. Google searches and trading app downloads are hitting an unprecedented low. This contrast reveals a worrying paradox: where have retail investors gone in this historic bull cycle?

Retail interest dormant despite Bitcoin’s rise

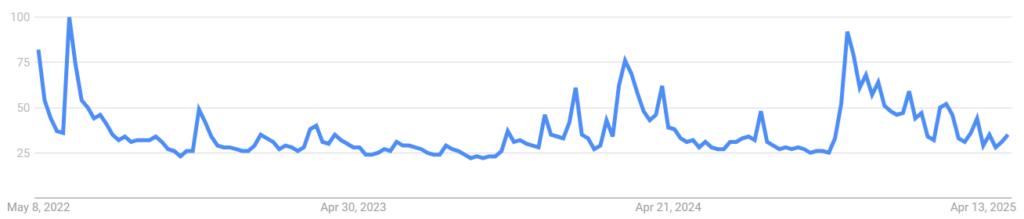

Market indicators reveal a notable weakness in retail investor interest. Google searches for the term “Bitcoin” have returned to levels seen in June 2024, when BTC was trading around $66,000.

Similarly, the Coinbase app, a classic barometer of retail demand, fell to 15th place in the finance category of the U.S. app store, close to its ranking mid-last year. This low activity contrasts with Bitcoin’s bullish movements, suggesting retail investors are waiting for a clearer signal or a clear breakthrough of a record to return strongly.

Retail investors net sellers in 2025

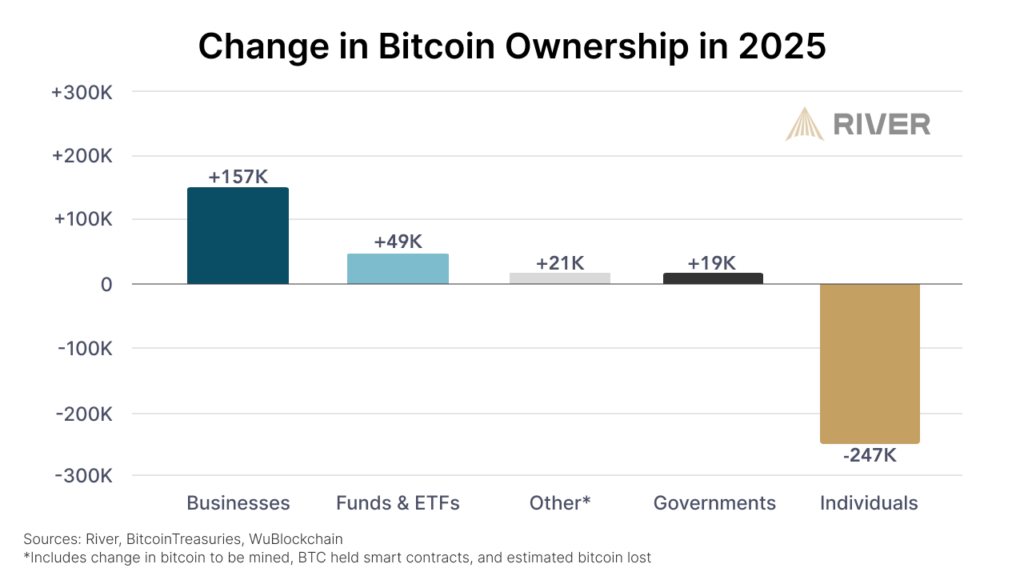

In 2025, data shows that small Bitcoin investors were overall net sellers. Estimates suggest they sold 247,000 BTC, roughly $23 billion at the period’s average price. Meanwhile, companies have taken over, representing the majority of Bitcoin purchases, with acquisition strategies like Michael Saylor’s concentrating 77% of the 157,000 BTC bought by professional entities.

This movement highlights a gradual transfer of BTC market control towards more experienced players, reducing the active share of retail investors in price formation.

Bitcoin: risks related to late buying by retail investors

Late entry by retail investors into the Bitcoin market exposes them to several risks, including losing most of the gains. Historically, retail investors tend to react about a week after a historic peak is surpassed. This delay often leads to:

- Entering positions after a significant rise has already occurred, limiting profit potential;

- Increased exposure to volatility, with more pronounced fluctuations at this stage of the cycle;

- A risk of rapid correction, as market euphoria may fade.

Spikes observed in November 2024 and March 2025 confirm this pattern where the retail investor often buys BTC too late, reducing the effectiveness of their investment strategy.

Search and app data as behavioral barometers

Tracking Google searches and trading app rankings provides a valuable tool to anticipate retail investor behaviors. These leading indicators reveal not only the current demand but also predict the emergence of renewed interest. For example:

- Retail interest has historically peaked about a week after Bitcoin surpassed a record;

- The current trend suggests interest could increase after BTC crosses the $109,350 threshold;

- App rankings like Coinbase directly illustrate small investor engagement.

This monitoring method provides an additional analytical window complementary to financial data, essential for understanding retail investor psychology.

The Bitcoin market remains dominated by institutions, while retail investor interest collapses, as confirmed by sharply declining Google searches. Does this retail disengagement signal healthy consolidation or does it prepare for a prolonged stagnation phase? The future of the bull cycle remains uncertain, especially as experts consider several scenarios for altseason 2025 that could influence the overall market dynamics.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.