Bitcoin Santa Rally: Does It Start at $89K?

Bitcoin enters a decisive phase as the price holds above 90,000 dollars ahead of the final Fed meeting of the year. Market structure tightens while traders watch the 89,000 to 95,000 dollar zone for signals. Sentiment remains cautious, yet seasonal patterns and strong underlying demand keep the Santa rally narrative alive. Lower leverage and muted activity in derivatives also shape this week’s setup.

In brief

- Bitcoin holds above 90,000 dollars after a volatile weekend, keeping the 89,000–95,000 dollar zone in focus.

- Traders watch key levels as the Fed prepares its final rate decision, with a 25 bp cut widely expected.

- Low leverage, falling open interest and seasonal patterns keep a year-end rally possible if Powell signals stability.

Bitcoin Tests Key Levels Ahead of Fed Week

Bitcoin continues to show strong volatility as the price pushed back above 90,000 dollars on Sunday and has managed to hold this level so far. The weekend rebound highlights how quickly momentum shifts, with traders reacting to each move inside the wide 87,000 to 90,000 dollar range. Several well-known analysts are watching this structure closely, as noted in a recent market analysis that outlined key trader expectations for the current range.

Trader CrypNuevo expects the price to move toward the 50-day EMA near 95,500 dollars, where a major liquidity cluster stands. He still sees no clear long setup, as a retest of the low 80,000s remains possible if Bitcoin fails to build a stronger base. Michaël van de Poppe notes strong buying pressure near recent lows and believes a move above 92,000 dollars would support a bullish continuation.

Daan Crypto Trades highlights the importance of the 84,000-dollar Fibonacci area. It acted as support earlier this month, and losing it would break the higher-timeframe structure and expose the April lows as the next target.

Fed Decision Takes Center Stage This Week

This week brings few macroeconomic data releases, allowing the FOMC meeting to take full focus. Markets expect a 0.25 percent rate cut, supported by weakening US labor data. Nonfarm payrolls have declined in five of the last seven months, which The Kobeissi Letter describes as the weakest streak in at least five years.

Despite this, Mosaic Asset Company sees a constructive backdrop. Inflation remains above target, yet the overall economy appears steady and the S&P 500 trades near all-time highs. According to Mosaic, this mix creates a favorable setup for risk assets if the Fed continues easing. Jerome Powell’s press conference will be crucial, as markets look for clues on the policy path for 2026. His communication may determine how both stocks and Bitcoin react to the decision.

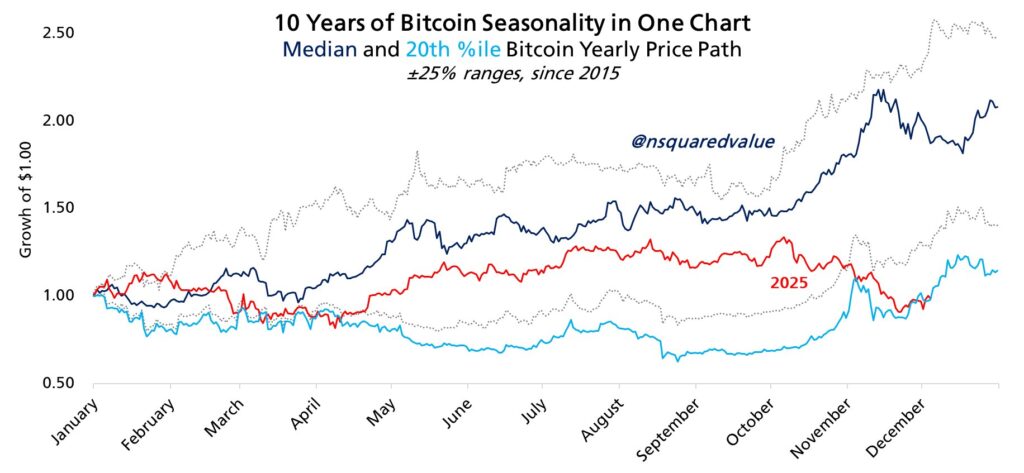

Bitcoin Santa Rally Depends on Market Reaction and Seasonality

Bitcoin has underperformed stocks throughout Q4, while major indices trade close to new highs. Still, seasonal patterns have kept the Santa rally narrative alive. Analyst Timothy Peterson sees strong similarities between the current cycle and the 2022–2023 period.

His view that “89,000 dollars is the new 16,000 dollars” reflects the idea that Bitcoin may be forming a longer-term bottom or consolidation floor.

Timothy Peterson

Joao Wedson expects Bitcoin to end the year sideways, noting that the asset has already recorded more negative trading days than its historical average. In his view, any deeper correction would likely occur in 2026, not in the final weeks of 2025. These contrasting views highlight how much the next move depends on macro events, especially the Fed’s decision.

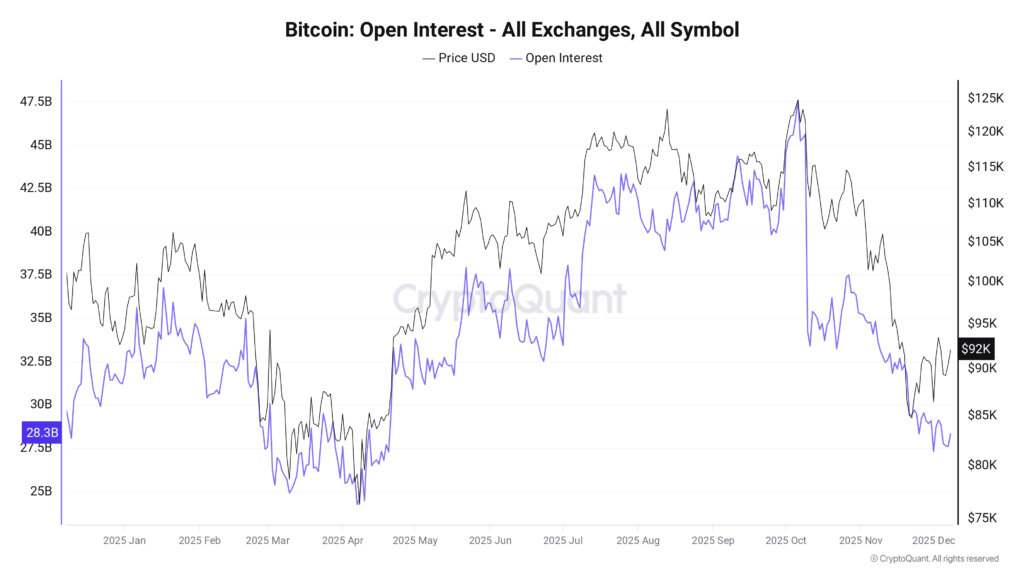

Market signals from derivatives support this cautious tone. New data from CryptoQuant shows that open interest across major exchanges has fallen to its lowest level since April. Analyst Coindream explains that such declines often indicate investor apathy or mild capitulation, both of which have historically created buy-the-dip opportunities. Leverage ratios have also dropped sharply since mid-November, reducing structural pressure and creating a healthier market setup.

Even after the rebound from 80,500 dollars, traders have not added significant leverage, suggesting that the market has already absorbed its correction and is now waiting for a macro trigger to define the next move. Together, seasonality, reduced leverage and a tightening market structure create the conditions for a potential Santa rally but the reaction to the Fed decision will be the deciding factor.

Bitcoin Outlook for the Coming Weeks

Bitcoin enters a decisive phase as the price holds above 90,000 dollars while volatility remains high. The range between 89,000 and 95,000 dollars acts as the key zone before the Fed’s final rate decision of the year. If the Fed cuts rates and Powell delivers a stable outlook, Bitcoin could gain the momentum needed to break the upper boundary of this range. Seasonal patterns, reduced leverage and steady demand support the idea that a Santa rally remains possible. The next major move will depend on how markets interpret the Fed’s message and whether buyers can reclaim control above key resistance levels.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Louis Blümlein has been analyzing the crypto market for several years. His focus is on trading strategies, market trends, and economic developments to identify and take advantage of market opportunities at an early stage.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.