Bitcoin Shows Early Signs of a Buyer Comeback January 20, 2026

After a marked decline, Bitcoin has managed to stabilize and form a bullish structure still in development. Discover our complete technical analysis and the scenarios to watch for BTC.

In brief

- Technical analysis: The market consolidates after a bullish breakout, with a still positive structure but weakened short-term momentum.

- Technical levels: Prices move between major defense zones and key resistances, likely to generate volatility in case of breakout.

- Market sentiment: Sentiment shifts to fear, reflecting weakened confidence and a more cautious investor approach.

- Derivatives analysis: Derivatives indicators reflect an orderly and balanced market, without excessive leverage or marked directional pressure.

- Forecasts: The bias remains conditional, with a bullish structure preserved as long as major supports hold.

BTC/USD Technical Analysis

Bitcoin is trading around $93,000, recording a weekly increase of about 3%. This movement occurs in the context of a technical retracement after a bullish breakout from a range, reflecting a digestion phase of the previous move rather than a trend reversal. Weekly spot volumes reach about $25.5 billion, up 14%, signaling a moderate rise in participation without speculative excess.

The long-term trend remains clearly bullish, supported by a 200-period moving average still positively oriented. Mid-term momentum has neutralized after a pullback phase, indicating a progressive market stabilization. Short-term trend turns bullish again, suggesting an attempt at recovery after the recent retracement. Momentum now shows a technical rebound: oscillators, after declining substantially, signal a resumption of momentum, though it remains fragile and needs confirmation to be sustained.

Bitcoin (BTC) Technical Levels

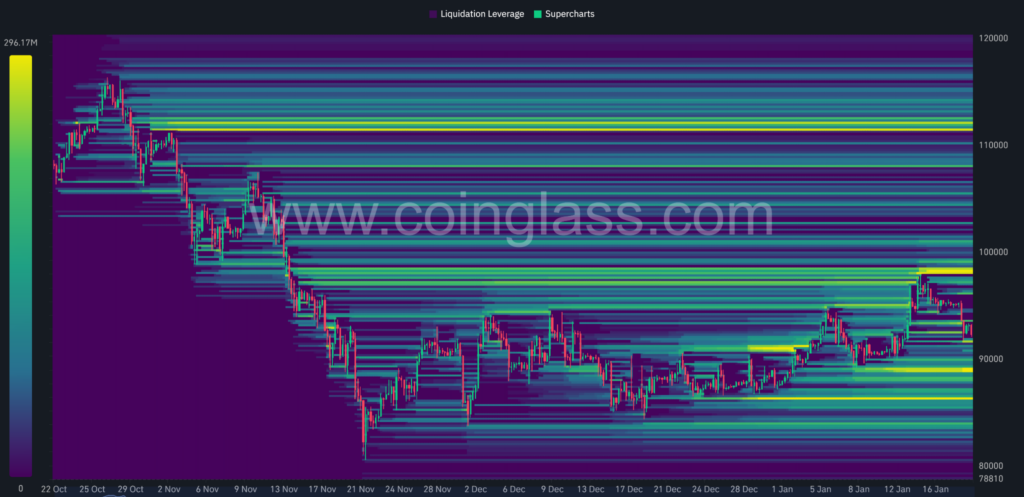

Bitcoin is currently trading below several major resistances located at $97,913, $107,461, and then $116,400, before the all-time high at $126,219. These levels are critical zones likely to act as distribution points if buying pressure weakens. On the downside, supports identified at $89,226, $83,496, and $80,619 represent major defensive levels historically associated with accumulation phases.

The last daily breakout above $95,000 marks crossing a resistance corresponding to the top of a range in place since November 2025, reinforcing the validity of the underlying bullish structure. The monthly pivot point at $88,686 remains below the current price and continues to serve as a key reference for the monthly momentum. The volume profile highlights a high value area around $111,000 and a low value area at $87,551, framing a market balance whose breakout could trigger directional acceleration.

Market Sentiment

Market sentiment now trades at the fear threshold, reflecting pessimistic confidence and increased caution among investors. This sentiment deterioration occurs despite still constructive technical structure, highlighting a divergence between perception and price momentum. Net flows into Bitcoin spot ETFs appear generally balanced, suggesting institutional actors adopt a reactive posture, following price movements rather than driving the current trend.

The current technical analysis was conducted in collaboration with Elyfe, investors and market educators on cryptocurrencies.

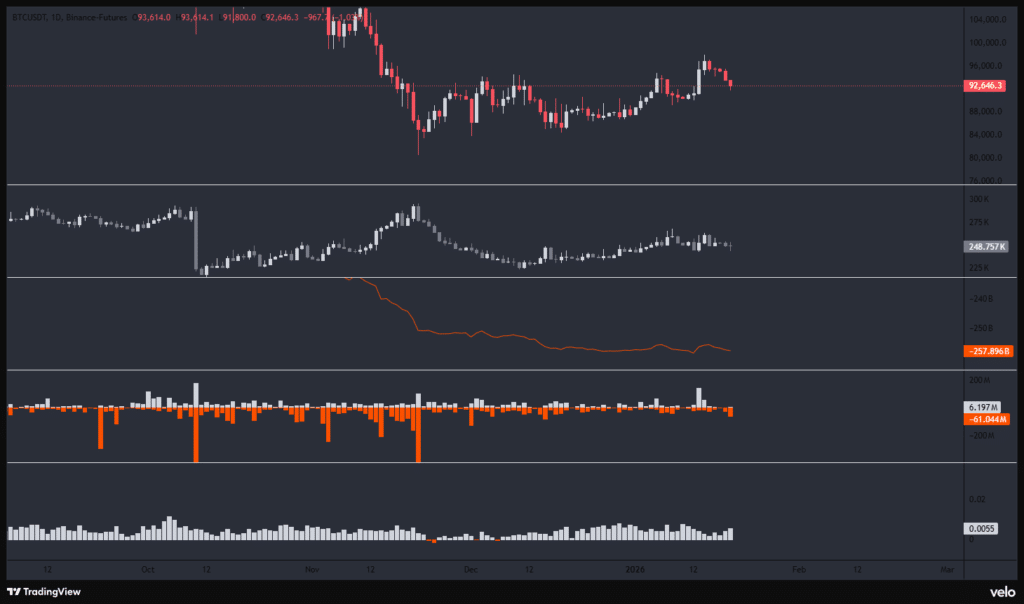

Derivatives Analysis (BTC/USDT)

Derivatives indicators depict a generally stable and orderly market. Open interest remains stable, indicating measured speculative positioning and no directional overcommitment. CVD flows remain balanced, though a slight selling dominance is observed, reflecting moderate pressure without marked imbalance. Liquidations stay low and unbiased, confirming a healthy market environment without major forced exits. The funding rate, slightly positive, reflects a moderate predominance of long positions without leverage excess.

The selling liquidation zone between $98,290 and $112,634 appears as a critical threshold: a breakout could strengthen bullish momentum, but it could also serve as a distribution zone if the market loses strength. Conversely, the buying zone between $84,000 and $89,000 remains vulnerable to a breakdown, potentially triggering bearish acceleration, while representing a potential interest point for strategic accumulation.

Bitcoin (BTC) Price Forecasts

Bullish scenario:

- Conditions: Stay above $89,226.

- Targets: $97,913, then $107,461, and $116,400.

- Potential: About 25% increase from current level.

Bearish scenario:

- Conditions: Breakdown of support at $89,226.

- Targets: $83,496, then $80,619.

- Potential: Approximately -13% decrease from current level.

Bitcoin is in a consolidation phase after a bullish breakout, with an underlying structure still positive but weakened market sentiment. Derivatives indicators confirm a balanced environment without speculative excess, while technical levels tightly frame price evolution. In this context, it will be essential to closely monitor price reaction at strategic levels to confirm or adjust current forecasts. Finally, remember that these analyses are based solely on technical criteria, and cryptocurrency prices can move quickly due to other more fundamental factors.

Could Bitcoin follow the trend of precious metals? Discover why gold and silver extend their rise.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Spécialiste en analyse technique, Elyfe décrypte les tendances graphiques des marchés des cryptomonnaies avec une approche rigoureuse et en constante évolution. À travers ses analyses détaillées, il apporte un regard éclairé sur la dynamique des prix, aidant les investisseurs et passionnés à mieux comprendre et anticiper les mouvements du marché.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more