Bitcoin Shows Strength as Altcoins Lose Significant Ground

Bitcoin has pulled back in recent months but continues to outperform most altcoins. Data from Glassnode shows capital rotating toward BTC, while Ether, AI tokens, and memecoins have suffered much deeper losses.

In brief

- Bitcoin continues to outperform most altcoins as capital rotates toward BTC in a risk-averse market.

- Altcoins such as Ethereum, AI tokens, and memecoins have suffered significantly deeper losses.

- Persistent capital concentration around Bitcoin could keep altcoins under pressure going forward.

Bitcoin Gains Strength as Capital Rotates Away From Altcoins

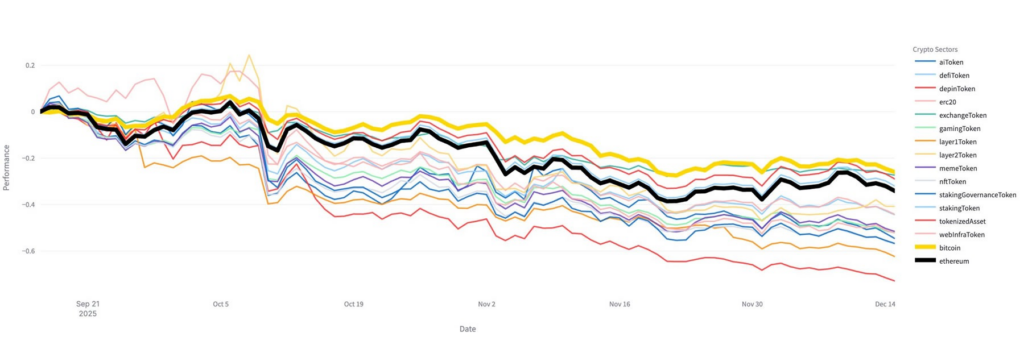

According to Glassnode, Bitcoin has outperformed most altcoins over the past three months. The data shows that average returns across nearly all altcoin segments lagged behind Bitcoin, pointing to a market environment shaped by caution and risk aversion.

This trend suggests that investors are increasingly concentrating capital in Bitcoin rather than spreading exposure across higher-risk assets. In uncertain conditions, BTC remains the primary destination for liquidity.

While some analysts have argued that Bitcoin’s dominance weakened in the second half of the year, the broader market has failed to establish a new leader. Attempts at recovery following the deleverage event have lost momentum, leaving the market without a clear anchor.

Altcoins underperform Bitcoin across key sectors

Price data supports Glassnode’s assessment. Bitcoin declined by roughly 26% over the past three months and currently trades near $86,000. This performance is slightly better than the broader crypto market, which saw total market capitalization fall by about 27.5% over the same period.

Ethereum recorded steeper losses. Since mid-September, ETH has dropped around 36% and is now trading below the $3,000 level. Other altcoin categories experienced even heavier drawdowns.

AI-related tokens declined by approximately 48%. The memecoin market suffered one of the sharpest drops, with total market capitalization falling by around 56%. Real-world asset tokens were down about 46%, while DeFi tokens lost roughly 38%.

Bitcoin remains the preferred safe haven in crypto

Nick Ruck, Director at LVRG Research, agreed with Glassnode’s findings. He said recent data shows that capital inflows continue to favor bitcoin, reflecting investor preference for BTC’s relative stability. Ruck added that Bitcoin’s dominant position leaves many altcoins struggling to stay relevant.

He also pointed to BTC’s established reputation and growing institutional interest as key drivers behind its continued appeal. In volatile conditions, BTC is increasingly viewed as a safer haven within the crypto market.

Bitcoin continues to stand out as market confidence fades

Despite the recent pullback, Bitcoin remains more resilient than most altcoins. The data shows a clear rotation of capital toward BTC as investors reduce exposure to higher-risk assets. Until broader market confidence improves, Bitcoin is likely to maintain its leading role.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Louis Blümlein has been analyzing the crypto market for several years. His focus is on trading strategies, market trends, and economic developments to identify and take advantage of market opportunities at an early stage.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.