Bitcoin Approaches $110K as Whales Dump Billions in BTC

While Bitcoin is flirting with the $110,000 mark, new data shows whale supply has dropped to its lowest point since 2019, signaling a wave of profit-taking that could threaten the rally’s momentum.

In brief

- Bitcoin whales sold over 40,000 BTC this week, worth $4.3 billion, pushing whale supply to its lowest level since 2019.

- Long-term holders are also selling, signaling weaker confidence and adding pressure on Bitcoin’s recent price rally.

- BTC is struggling to hold $108,000 as support, with resistance at $109,476. Failure could trigger a drop to $105K or lower.

Whales offload over 40,000 BTC

Addresses holding between 1,000 and 10,000 BTC, or whales, have sold more than 40,000 BTC in the past week alone, worth over $4.3 billion. This heavy sell-off comes as Bitcoin’s price surged 7% in 24 hours, reaching $108,145.

Whale exits often precede periods of volatility. When large holders offload coins at scale, it floods the market with supply, adding bearish pressure that can stunt price growth—or reverse it entirely.

Long-term holders also exit

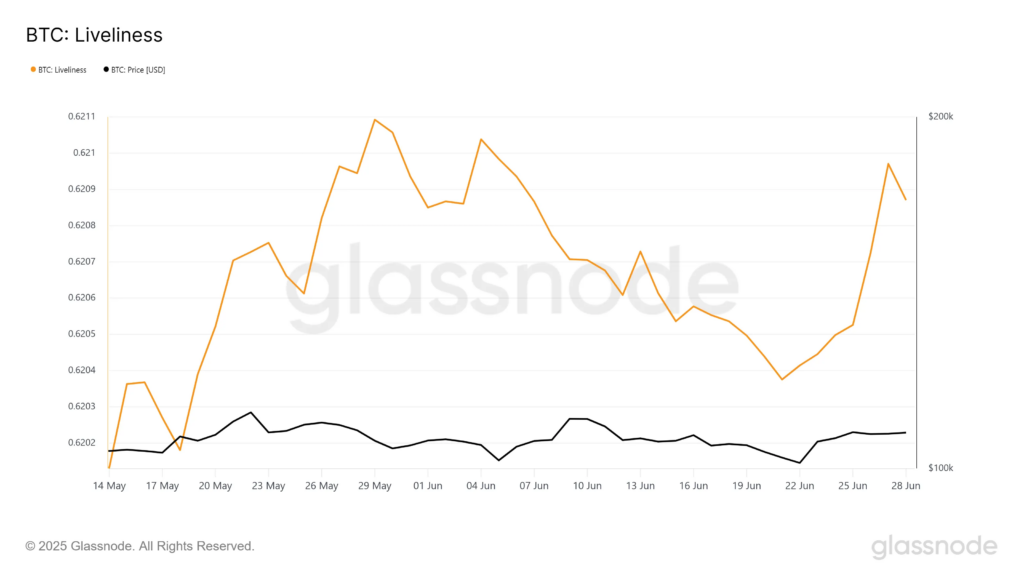

It’s not just whales. Long-term holders are also starting to move their assets. The Liveliness metric, which tracks the ratio of holding vs. spending, spiked this week, suggesting many older wallets are choosing to sell instead of accumulate.

That’s a concerning signal for bulls. Long-term holders are often seen as the backbone of market stability, and their decision to sell could compound volatility and reinforce resistance at key price levels.

$110K in sight

Bitcoin is currently testing $108,000 as a support level, with a key resistance level at $109,476. If bulls break past it, the path to $110,000 opens. But if whale and long-term holder selling continues, support could fail, sending BTC back to $105,622 or even $102,734.

With whale supply now at a six-year low, the question isn’t just whether Bitcoin can rally higher, but whether it can do so without its biggest holders behind it.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

I've been passionate about crypto for nearly a decade, ever since I was young and first became curious about investing. That early spark led me to years of research, writing, and exploring the future of decentralized tech.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.