Jordi Visser (@jvisserlabs) joins this week to discuss bitcoin outlook for rest of the year, interest rate cuts, how to evaluate AI acceleration, Nvidia’s $100 billion deal with OpenAI, and what metrics investors should keep an eye on.@JohnPompliano did a great job filling in… pic.twitter.com/ihbJV8JR8m

— Anthony Pompliano 🌪 (@APompliano) September 27, 2025

A

A

Bitcoin’s Fate Tied To Future Catalysts

Mon 29 Sep 2025 ▪

5

min read ▪ by

Getting informed

▪

Bitcoin (BTC)

Summarize this article with:

While bitcoin is going through a consolidation phase around 110,000 dollars, the prevailing euphoria clashes with signals of caution. Analysts believe that the trajectory toward a new ATH will not be linear. Corrections, volatility, and regulatory uncertainty could mark the path. In a market dominated by optimism, some remind that peaks must be earned, and pullbacks are part of the journey.

In Brief

- Bitcoin holds around $110,000, but the path to a new ATH appears more volatile than expected.

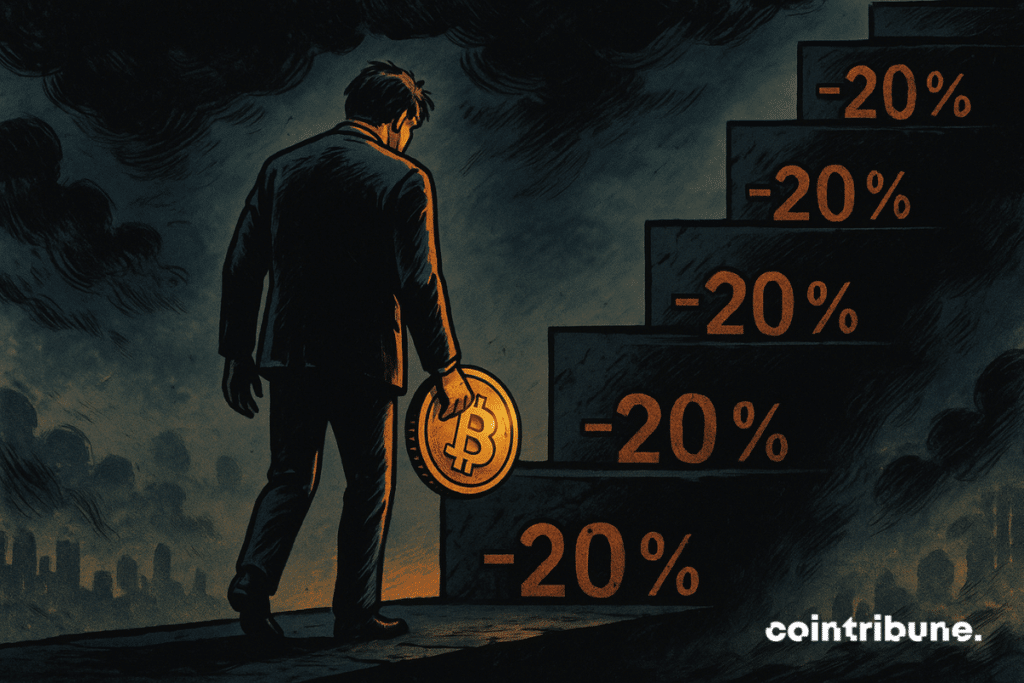

- Analyst Jordi Visser compares BTC’s behavior to Nvidia, highlighting similar corrections to expect.

- Since 2022, Nvidia has experienced five drops of over 20% before reaching its highs, a dynamic bitcoin might replicate.

- These corrections do not question the upward trend but reflect a natural consolidation phase.

Necessary Corrections Within an Upward Trajectory

While the 110,000 dollar zone becomes a key threshold, Jordi Visser, investor and market analyst, states in a post on social platform X : “bitcoin will do exactly the same as Nvidia”.

He points out that despite Nvidia’s valuation explosion, now the first publicly traded company in the world to reach 4 trillion dollars, the stock’s path was far from linear.

“During this period, you had five 20 % or more corrections at Nvidia before it returned to its historic highs. Bitcoin will do the same.” For Visser, bitcoin is now part of what he calls the “AI trade”, an investment strategy focused on assets exposed to the rise of artificial intelligence.

This comparison is based on a common dynamic between the two assets, which Visser considers structural rather than cyclical. Here are the main points of his analysis :

- Bitcoin, like Nvidia, is driven by the AI revolution : both attract investors looking to position themselves on the major upcoming technological transformations ;

- Corrections are an integral part of the bull cycle : five major pullbacks of over 20 % have punctuated Nvidia’s rise since 2022, without questioning its upward trend ;

- Bitcoin will experience similar declines before reaching new all-time highs, according to Visser. He particularly anticipates such movements during the fourth quarter, a period usually favorable to cryptos ;

- The parallel is not coincidental : Nvidia has become the symbol of industrial digital transformation, while BTC could embody the digital era’s store of value.

This reading suggests that upcoming correction phases should not be interpreted as market reversal signals but as logical steps within a general bull cycle.

Regulatory Inertia and Doubts About Future Catalysts

Besides technical correction forecasts, other analysts question the current stagnation of the bitcoin price, which remains around 110,000 dollars, roughly 11 % below its all-time high set at just over 123,000 dollars.

This relative inertia contrasts with the dynamics observed in other markets, where gold and some stock indices have recorded new highs. Such a contrast fuels debate among investors : does bitcoin’s recent correction herald a lasting trend reversal, or is it just a pause before a new jump to 140,000 dollars, a target some observers anticipate by year-end ?

One often highlighted explanation for this situation is the absence of a strategic commitment by the United States. Several analysts had anticipated that the US government might initiate a BTC purchase program intended to build a national strategic reserve.

This hypothesis, which could have been a powerful market catalyst, has not materialized. Meanwhile, regulatory uncertainties and the caution of major institutional investors continue to weigh on overall sentiment. For some, the optimism surrounding BTC is premature as long as these structural barriers remain.

In the medium term, this situation opens the way to several divergent scenarios. On one hand, if current uncertainties dissipate, for example through regulatory clarification or the adoption of a purchase policy by a major state, BTC could quickly resume its upward march. On the other hand, a lack of catalyst could prolong consolidation or even trigger a more pronounced correction toward 60,000 dollars, as some market players fear.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.