Block Signals Potential 10% Job Cuts as Bitcoin Strategy Gains Priority

Payments firm Block Inc. has begun notifying hundreds of employees that their roles could be cut during annual performance reviews. As per reports, the move is part of a broader restructuring as the company adjusts its business focus. Workforce changes may affect up to one in ten staff members. Management is pushing to align teams with revised product priorities and cost targets.

In brief

- Up to 10% of staff may be affected as management enforces a long-standing 12,000-employee cap.

- Focus shifts to deeper integration of Cash App and Square to cut overlap and clarify product direction.

- Bitcoin investments continue across mining, self-custody, and payments, including Proto and merchant tools.

- Earnings approach with analysts forecasting $403M in Q4 profit as bitcoin remains a key revenue pillar.

Bitcoin Strategy Takes Center Stage as Block Plans Workforce Reductions

People familiar with the matter told Bloomberg that as much as 10% of Block’s workforce could be impacted. Headcount stood just under 11,000 in late November, according to an executive cited in the report. A staff cap of 12,000 introduced in 2023 remains in place, and leadership has reiterated its commitment to staying below that level.

The restructuring follows a reorganization launched in 2024 aimed at improving operational efficiency. Focus has shifted toward closer integration between Block’s peer-to-peer app, Cash App, and its merchant services arm, Square. Executives view tighter coordination as a way to reduce overlap and sharpen product direction.

Alongside internal changes, Block continues to invest in newer projects tied to Bitcoin and software development. Expansion plans include its mining division, Proto, and an internal artificial intelligence project known as Goose. Several Bitcoin-focused products also fall within the group, ranging from merchant payment tools to self-custody hardware and open-source development.

Key areas shaping Block’s current strategy include:

- Closer integration between Cash App and Square to simplify product offerings.

- Continued development of Bitcoin mining hardware and services through Proto.

- Support for self-custody and open-source Bitcoin tools via Bitkey and Spiral.

- Tighter control of staffing levels following the 2023 employee cap.

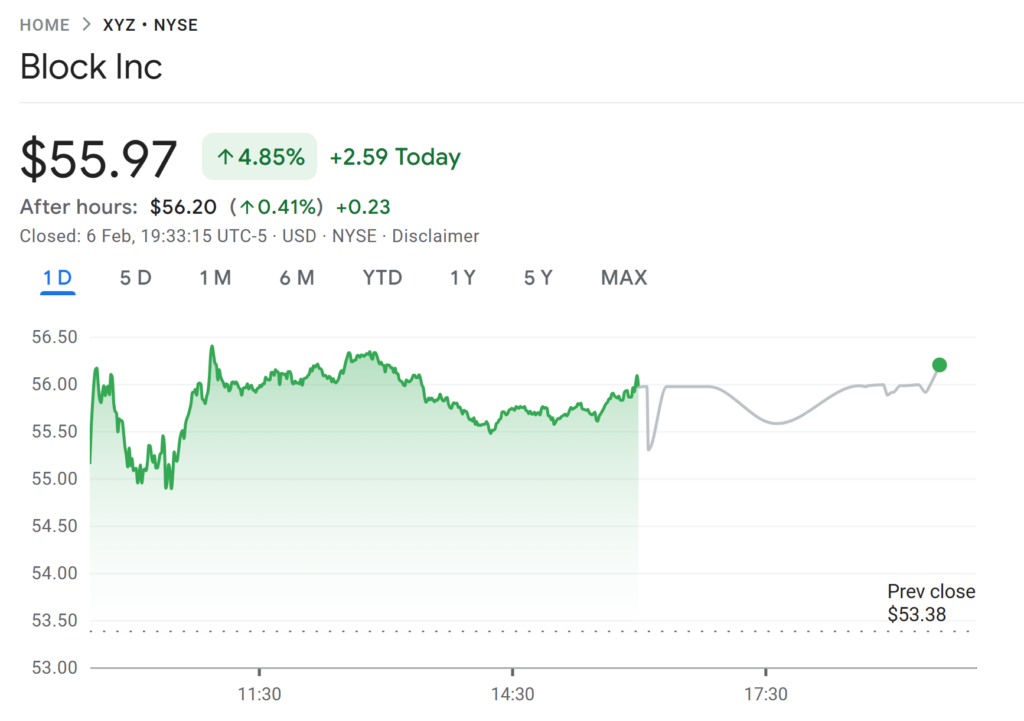

Market performance has remained under pressure during the transition. Shares have fallen about 14% so far this year, while the S&P 500 index rose roughly 1.3% over the same period. Losses deepened in 2025, with the stock down about 23%. Block joined the S&P 500 in July, a move that initially raised investor expectations.

Merchant Bitcoin Payments Expand as Earnings Come Into Focus

Block is scheduled to release fourth-quarter results on February 26, according to Bloomberg. Analysts expect adjusted profit of around $403 million, or 68 cents per share, on revenue close to $6.25 billion. Prior guidance suggested stable margins despite slower growth in some segments.

Third-quarter results showed net income of $461.5 million on $6.11 billion in revenue. Gross profit increased 18% from a year earlier, led by 24% growth at Cash App and 9% growth at Square.

Even so, shares fell after the release as several metrics missed Wall Street forecasts. Bitcoin-related revenue reached $1.97 billion for the quarter, down from $2.4 billion a year earlier, but still ranked as Block’s second-largest revenue source.

Square also expanded merchant Bitcoin payments in November, allowing sellers to accept BTC at checkout through point-of-sale terminals. Options include direct Bitcoin transfers or automatic conversion to fiat currency. More than four million sellers across eight countries use Square, giving Block a broad base as it continues reshaping its payments and Bitcoin businesses under founder Jack Dorsey.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.