Bots Fuel $15.6T Stablecoin Boom in Q3 2025 as Retail Use Hits Record Levels

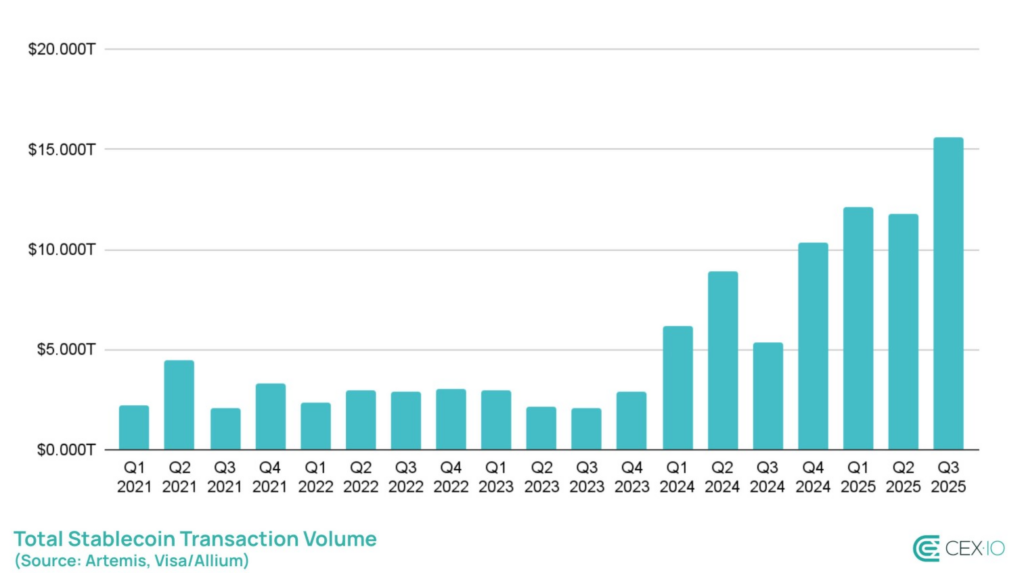

Stablecoins had their busiest quarter ever in Q3 2025, with transaction volumes hitting record highs. However, a new report reveals that much of this activity came from bots rather than individual users. At the same time, small retail transfers surged to unprecedented levels, highlighting stablecoins’ dual role as a trading tool and an emerging option for everyday payments.

In brief

- Bots drove 71% of stablecoin transfers, fueling record $15.6T activity in Q3 2025.

- Non-bot transfers surged too, highlighting stablecoins’ growing role in payments.

- Retail transfers under $250 reached all-time highs, led by trading and remittances.

- USDT and USDC led stablecoin inflows, pushing market cap to $292.6B this quarter.

Over 70% of Stablecoin Transfers Tied to Bots, CEX.io Reports

Much of the third-quarter growth in stablecoin activity was driven by automated bots rather than individual users. According to new research from crypto exchange CEX.io, more than 70% of all stablecoin transfers during the quarter were tied to bots, underscoring the need to separate speculative flows from real-world adoption.

CEX.io reported that stablecoin transfers surged to a record $15.6 trillion in Q3, marking the strongest quarter to date for the asset class. Illya Otychenko, a market research analyst at the exchange, described the period as the “most active” in the history of stablecoins.

The analysis found that automated trading bots accounted for roughly 71% of total transfers during the quarter. Non-bot transactions accounted for roughly 20%, while the remaining 9% stemmed from internal smart contract operations and intra-exchange transactions.

Regulators Weigh Systemic Risks as Stablecoin Market Surges to $292B

Otychenko emphasized that this distinction will be critical for regulators and policymakers assessing systemic risks and adoption trends. He noted that the 71% figure included both high-frequency trading bots and manipulative practices, such as wash trading. Many of these bots were “unlabeled,” processing over 1,000 transfers a month and moving more than $10 million in volume.

He added that bots designed for maximal extractable value (MEV) and those active on decentralized finance (DeFi) protocols represented less than half of total stablecoin activity.

This highlights that while bots drive liquidity and activity, a significant portion may not reflect meaningful economic usage

Illya Otychenko

Stablecoin growth has also been fueled by the recently approved GENIUS Act, which offers regulatory clarity for fiat-pegged assets. The total market capitalization of stablecoins now stands at $292.62 billion, according to recent data.

Retail Transfers Hit Record High in 2025

Despite the dominance of bots, the report highlighted a surge in retail-sized stablecoin transfers under $250. Activity in this category climbed to record levels in both September and the broader third quarter, setting 2025 on track to become the most active year ever for small-scale stablecoin usage.

The report projects retail transfers will surpass $60 billion by year’s end. Trading remains the largest driver, accounting for nearly 88% of sub-$250 transfers, but an increasing share is tied to remittances, payments, and fiat cash-outs.

CEX.io noted that non-trading retail stablecoin activity grew more than 15% this year, pointing to increasing adoption in everyday transactions. According to the platform, both trends show stablecoins are increasingly used for payments, remittances, and cashing out.

USDT and USDC Lead Quarterly Inflows

In addition to transaction activity, fiat-pegged coins also saw a sharp rise in net inflows—the difference between tokens minted and redeemed—during Q3. Data from RWA.xyz revealed that stablecoins recorded over $46 billion in net inflows for the quarter.

Tether’s USDT led with nearly $20 billion in inflows, solidifying its position as the market leader. Circle’s USDC followed with $12.3 billion, while synthetic stablecoin Ethena USDe (USDe) recorded $9 billion in new inflows.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

James Godstime is a crypto journalist and market analyst with over three years of experience in crypto, Web3, and finance. He simplifies complex and technical ideas to engage readers. Outside of work, he enjoys football and tennis, which he follows passionately.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.