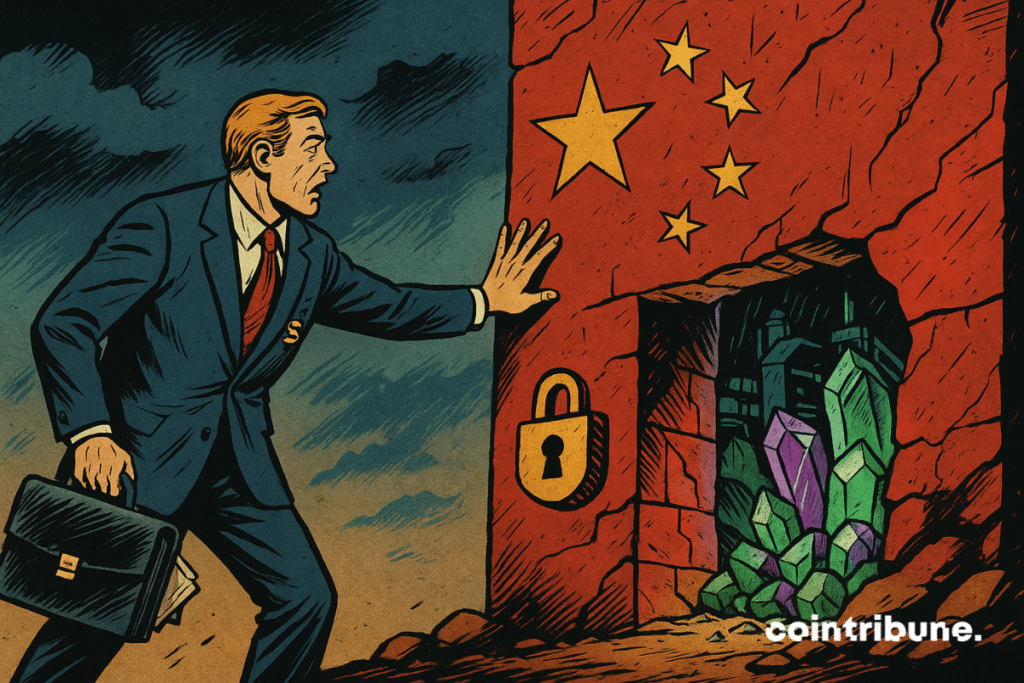

China Uses Minerals As Leverage In Dollar Showdown

In the Sino-American escalation, a subtle lever takes on an explosive dimension : rare earths. Essential in advanced technologies, these materials become the silent weapon of a strategic duel where industrial sovereignty and monetary confrontation intertwine.

In Brief

- China imposes restrictions on the export of rare earths, key resources for the American military and technological industry.

- According to analyst Luke Gromen, this decision directly threatens the global monetary balance dominated by the dollar.

- The United States respond with 100 % tariffs, revealing the escalation of economic tensions between Beijing and Washington.

- Bitcoin and gold appear as safe havens against monetary depreciation, according to several market experts.

Rare Earths : Beijing’s Geopolitical Lever Against the Dollar

In an interview on the podcast “Truth For The Commoner”, macroeconomic analyst Luke Gromen revealed a major geopolitical development: China has officially restricted the export of its rare earths, especially to the American military-industrial complex.

For Gromen, this decision is much more than a mere commercial act. It questions one of the invisible pillars of dollar dominance. “China now prohibits the sale of these critical minerals to the American military-industrial complex,” he said, adding that “if you touched the monetary aspect of the rule-based world order, the United States would send its army to crush you.”

According to him, this logic of military intervention to protect dollar hegemony has been at work in cases like Saddam Hussein or Muammar Gaddafi.

Here are the key facts to remember from this situation :

- China produces more than 90 % of the world’s rare earths, essential elements for manufacturing electronic components, batteries, semiconductors, and defense systems ;

- Beijing has officially restricted the export of these minerals to the United States, targeting particularly military applications ;

- In response, Donald Trump announced 100 % tariffs on Chinese products, illustrating the rise in trade tensions ;

- Luke Gromen believes this decision reveals a power asymmetry : “China has much more leverage than most Western commentators admit.”

These restrictions are not just another episode in the Sino-American economic war. They affect an international monetary system in flux. By putting pressure on one of the West’s most critical supply chains, China signals that it is ready to use its dominant position over strategic resources as an instrument of indirect monetary policy.

Bitcoin, Gold, and the Quest for Alternatives to a Declining Currency

While tensions escalate between the world’s two largest economies, some observers see a historic opportunity for so-called “hard money” assets, starting with bitcoin and gold.

For Luke Gromen, the diagnosis is unequivocal : “a monetary standard based on solid assets is the only solution to the United States’ current economic problems.” He believes that digital currencies pegged to the dollar, like stablecoins, are only temporary solutions incapable of addressing the fundamental structural problem: the accelerated depreciation of fiat currency.

The figures confirm this worrying trend. For The Kobeissi Letter, the Dollar Currency Index (DXY) is on track for its worst year since 1973, with a decline of over 10 % since January.

Worse still, the dollar has reportedly lost 40 % of its purchasing power since 2000. In this context, the appeal for bitcoin or gold is less about speculation and more about an instinct to preserve purchasing power, both among individuals and institutions. Gromen states that these assets will continue to rise as investors seek to protect their savings from inflation and devaluation.

This shift towards safe havens, whether digital or physical, inevitably raises the question of the future role of decentralized currencies in the global economy. If the dollar continues to lose its status as the dominant reserve currency, a new paradigm could emerge, based not on military power or Bretton Woods agreements, but on mechanisms of programmed scarcity, transparency, and individual sovereignty.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.