Global 2023 Crypto Adoption Rankings

Chainalysis has published its annual ranking of countries based on their affinity for Bitcoin, stablecoins, and other cryptocurrencies.

A focus on mass adoption

The goal of Chainalysis’ ranking is simple:

“We combine data to measure which countries are leading in local cryptocurrency adoption. But this isn’t about which countries have the highest raw transaction volumes. It’s easy to guess that the biggest, wealthiest countries are far ahead. Our ranking instead highlights the countries where cryptocurrency adoption is the broadest among ordinary people. We designed the Global Crypto Adoption Index to bring out the countries where the largest number of people invest the largest share of their wealth in cryptocurrencies.”

Chainalysis has ranked 155 countries based on five key parameters, all weighted by purchasing power parity. What is “purchasing power parity” comparison?

Purchasing power parity is an economic method used to compare countries based on the real purchasing power of their national currencies, which a simple use of exchange rates cannot do. This method uses an exchange rate that equalizes the cost of living.

All ranking results are weighted according to the size of the population and their local real purchasing power. The ranking is then calculated by taking the geometric mean of the score obtained for each of the five parameters.

Parameters taken into account

- Amount of cryptocurrency received on centralized exchanges, weighted by purchasing power parity (PPP) per capita.

- In other words, if two countries receive equal amounts of cryptocurrency on their exchanges, the country with the lowest PPP per capita would rank highest.

- Amount of cryptocurrency received on centralized exchanges by small holders, weighted by PPP per capita.

- The purpose of this data is to assess the activity of individual non-professional users. Only amounts received in retail transactions are counted (transactions worth less than $10,000 in cryptocurrency).

- Peer-to-peer (P2P) volume, weighted by PPP per capita and the number of internet users.

P2P transaction volume represents a significant percentage of all cryptocurrency-related activity in emerging markets. The goal is to highlight countries where a larger part of their overall wealth is spent on P2P transactions.

The other two parameters are related to the amounts received by DeFi (Decentralized Finance).

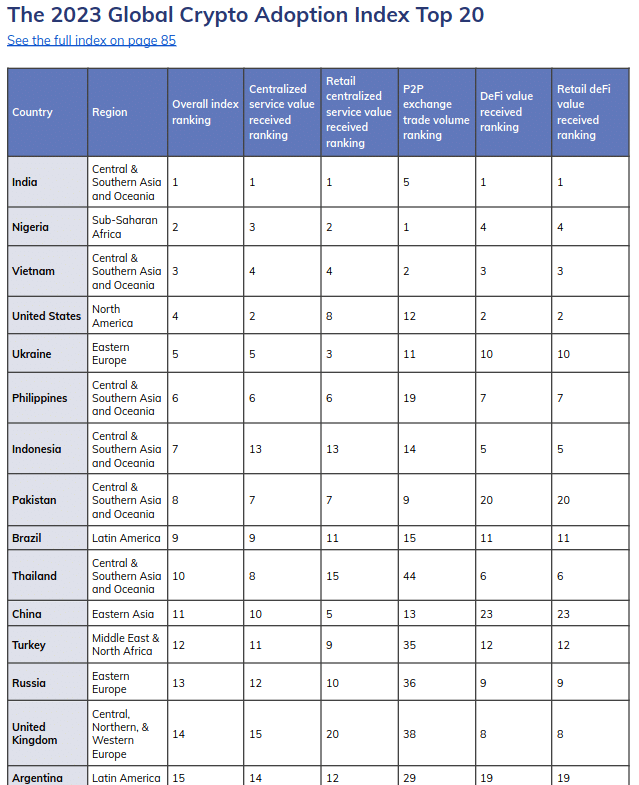

2023 Crypto Rankings

Chainalysis notes that mass adoption is still far from its historical highs. But this is not the case everywhere. Recovery is much stronger in lower middle-income countries (between $1,000 and $4,000 per year). That is, countries like Nigeria, India, Thailand, and Ukraine.

“This could be extremely promising as these are often booming countries with dynamic, growing industries and populations. And, perhaps most importantly, 40% of the world’s population lives in these countries,” the report says.

“This, combined with the fact that institutional adoption (mainly led by investment funds in high-income countries #ETF) continues to gain ground, makes us optimistic about the future.”

Other interesting information:

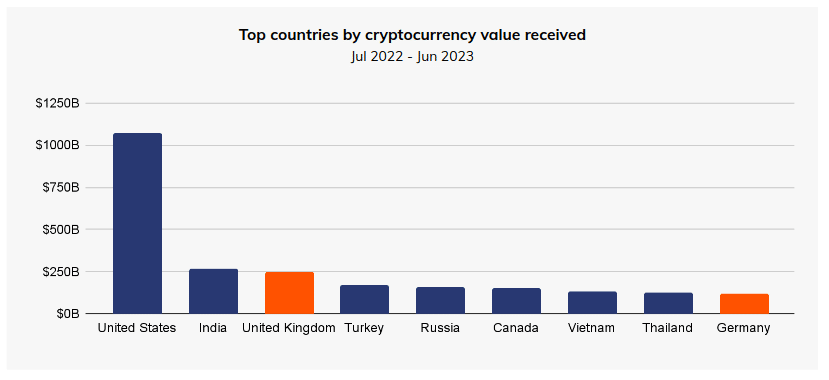

- A quarter of cryptocurrencies have been absorbed by North America between June 2022 and June 2023. This is equivalent to $1.2 trillion.

Latin America: 7% (mainly Argentina, Brazil, Mexico)

Western Europe: 18% (UK, Germany, Spain, France)

Eastern Europe: 9% (Russia, Ukraine, Poland, Czech Republic)

Central and South Asia and Oceania: 19% (India, Vietnam, Thailand)

East Asia: 9% (South Korea, Japan, China)

Middle East and North Africa: 7% (Turkey, UAE, Saudi Arabia)

Sub-Saharan Africa: 2% (Nigeria, South Africa, Kenya)

- Stablecoins have gone from 70% to 49% of on-chain transaction volume in North America.

- That being said, on a global scale, stablecoin remains the most widely used cryptocurrency. Half of all on-chain transaction volumes to or from exchanges took place in stablecoins. And over 90% of stablecoin activity takes place in stablecoins pegged to the dollar.

“Cryptocurrencies are commonplace in Argentina. About 5 million people [out of 46 million] use them,” says Lemon Cash Martel Seward, CEO of the Lemon Cash exchange.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Bitcoin, geopolitical, economic and energy journalist.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.