JPMorgan Denies Political Motive Behind Crypto Account Closure Tied to Trump

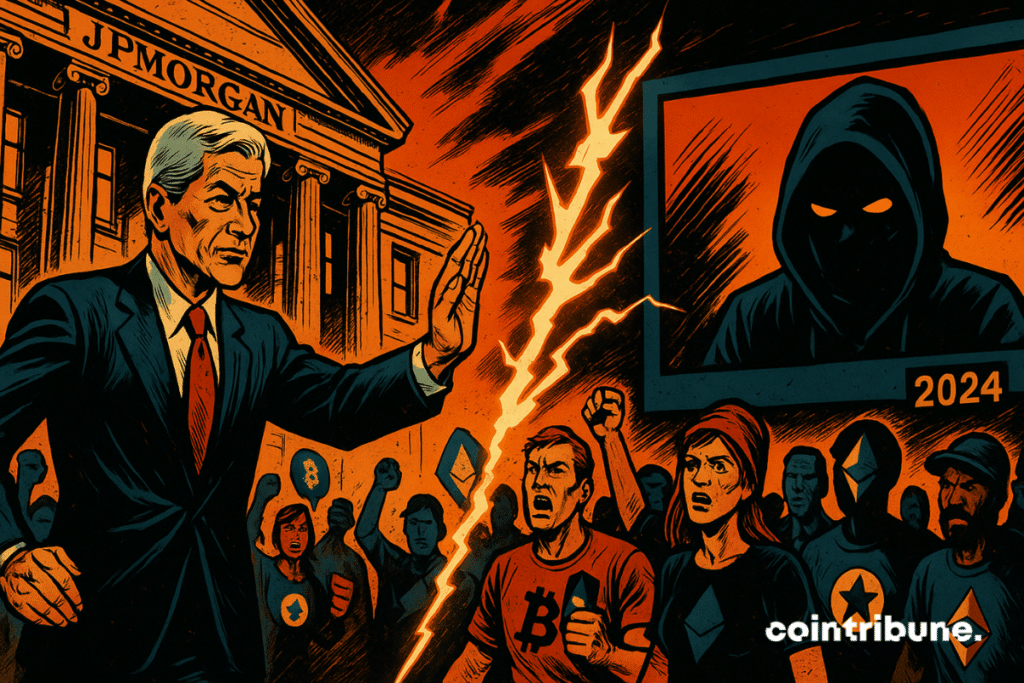

Crypto account closures reignite controversy between financial institutions and conservative figures. JPMorgan is indeed accused of targeting pro-Trump users. Its CEO, Jamie Dimon, firmly rejects this version.

In brief

- JPMorgan denies targeting crypto actors for political or ideological reasons.

- Jamie Dimon calls for reform of debanking rules deemed unclear and unfair.

Crypto and account closure: accusations rain down on JPMorgan

Several personalities in the crypto sector denounce the closure of their bank accounts by JPMorgan, without clear justification.

- The CEO of Strike Jack Mallers claims, for example, to have lost access to his personal funds.

- Trump Media, headed by Devin Nunes, mentions a similar blockage.

- The same scenario on the crypto platform ShapeShift.

These incidents revive fears of a new “Operation Chokepoint”. Some administrations use this controversial method to restrict access to crypto banking services.

Jamie Dimon, JPMorgan CEO, categorically rejects these allegations during an interview with Fox News.

The debate actually touches a sensitive point: the neutrality of banks in the face of the rise of digital assets. More precisely referring to the massive debanking that raises the question of possible financial censorship hidden behind vague compliance rules.

Crypto, Trump and regulation: Jamie Dimon’s strong defense

Jamie Dimon affirms he has been advocating for 15 years to reform the rules that push banks to close accounts on mere suspicion or media reporting. He thus calls for a clarification of the financial regulation standards imposed on banks.

Dimon reminds that JPMorgan never delivers information to authorities without a subpoena. However, he accuses the political climate of turning banks into easy targets. For him, the problem comes from the law (and not the intentions of the institution).

The crypto community therefore fears an abusive use of these procedures, seen as a barrier to decentralized finance. In a context where digital wallets are gaining popularity, each incident fuels distrust toward traditional actors.

In any case, the war between crypto supporters and traditional banks seems far from settled. Regulation will have to decide between control and innovation, before a real gap grows between two visions of finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.